October 1987

I remember clearly October 19, 1987, when the Dow Jones Industrial Average closed down 22% in one day, a drop of 508 points from 2246 to 1738. As a frame of reference, a 22% drop today would be a drop of 9200 points.

It was a scary day, and I had no idea how to respond to a drop of that magnitude in just one day. I do remember clearly my instinct was to panic and get the heck out. And back then, I had some clients who used margin to buy stocks, meaning they borrowed money from my firm (Smith Barney) and as the value of their stocks (which was the collateral for the loan) dropped, I had the fun phone call telling them they needed to add money or sell some stocks to reduce the amount of their margin loan.

Not a fun day. But was memorable in more than one way.

But the call I remember the most was to my father-in-law whose account had been with the firm for a long time, but his advisor retired, and I became his “advisor”.

My father-in-law (FIL) was a Greek immigrant who came here in the early 1920’s at 14 years old. And like many Greek immigrants, he had been in the restaurant business all his life in the U.S. And as a restaurant owner, he had noticed good times or bad times, his customers almost always ordered a Coke with their hot dogs and hamburgers.

So in the early 1970’s, he invested a significant amount of his savings into Coca-Cola stock, and it had been a very good investment for him. Well, that day I watched Coke stock drop from the low 40’s to the high 30’s, the mid 30’s, the low 30s, the high 20’s and was trading around the mid 20’s when I picked up a very heavy feeling phone to call him.

This was before the days of CNBC and other networks informing investors non-stop of what is happening in the market. I think he was watching Days of Our Lives with my mother-in-law when I called him. I said hello and asked how he was doing, then holding my breath I told him that a big chunk of his portfolio had dropped about 50% that day.

I was thinking he should sell it before the stock became a teenager. But he paused for a moment then asked, “Are they still paying their dividend?” I remember thinking who cares because the world is coming to an end. But I answered, “yes sir”. His next comment would not pass compliance as something I can put in this letter verbatim, but he calmly said “Blank ‘em”. He didn’t even think of selling it.

What I learned later in talking to his retired advisor who had worked with him for many years explained a lot. My FIL had himself been on margin in the mid 70’s when the market had a huge drop and was also hit with a margin call. He sold some Coke stock to cover the margin call, then watched it subsequently bounce back in a big way. He also had noticed that the dividend was never cut but was increased, that the stock price was much more volatile than the business itself, and he never used margin again. And Coke did bounce back and did great for him for many years.

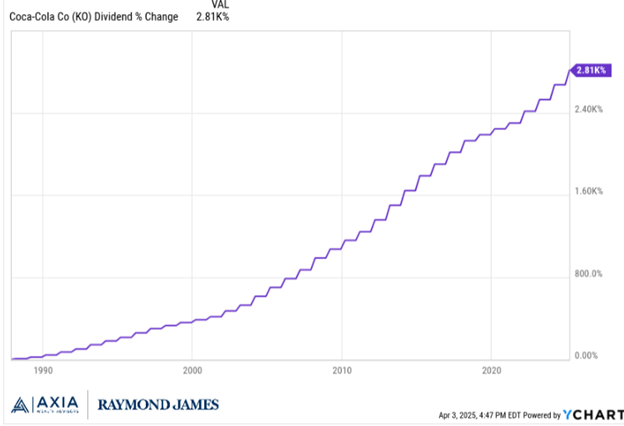

The chart below shows the dividend of coke since September 30, 1987. It increased 2,800%.

Not every situation is the same. We are not looking at the same factors as the crash of 1987. But some things stay generally true. Such as businesses are not nearly as volatile as their stocks that trade every day, often with prices driven by the daily emotions of investors. That dividend income, reflective of the underlying businesses, is not nearly as volatile as the daily fluctuations of their share prices. And that panicking out of good solid companies, whether owned individually or via mutual funds, is not a recipe for investment success.

Thanks for your time reading this. I hope you find these emails of value. We feel it is very important to stay in touch with our clients, and especially so as the markets test us as they do sometimes.

Thank you for your trust and confidence in us.

Beach

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Beach Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. If you no longer wish to receive these emails, please reply “unsubscribe.