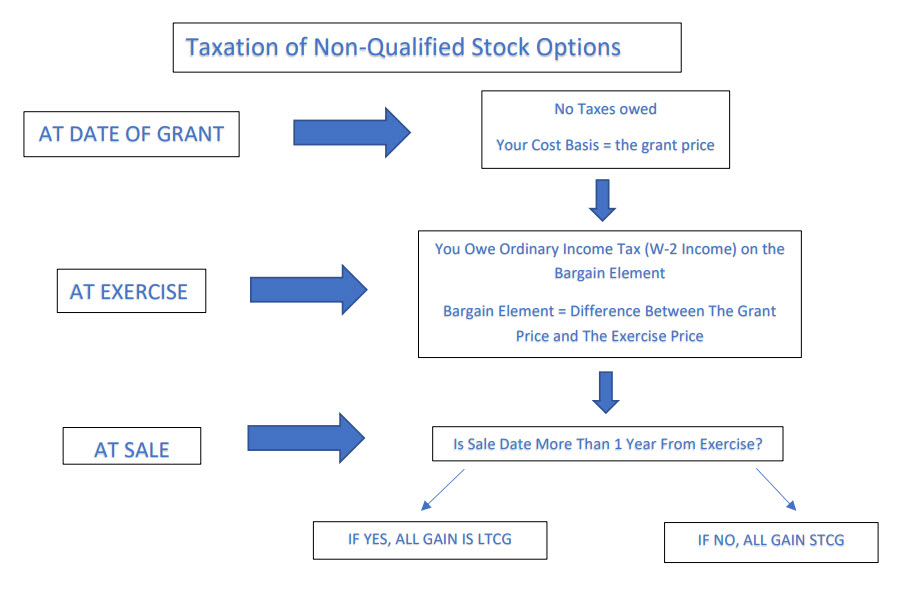

Now could be a great time to exercise your stock options. Why? Taxes. When you exercise stock that is down in value, the value of the “Bargain Element” is down also. With Non-Qualified Stock Options, you owe ordinary income tax on the bargain element when you exercise.

Your initial cost basis is the grant price. This is the price at which the company “Grants” you the shares of stock. Since these are stock options, you have the option to purchase them, not the obligation.

Assuming you take advantage of the options, your next step is to purchase the stocks, aka exercise the options. On the date of exercise, you owe ordinary income tax on the difference between the grant price and the exercise price. The exercise price is the price of the stock on the date that you purchase them. Basically, the value of the bargain element will be added to your W-2 at the end of the year. Now since you own the shares outright, your new cost basis is the fair market value of the stock on the day of exercise (exercise price). From that point forward, you can do whatever you like with the stock. Normal holding periods apply from this point forward for tax purposes.

There are many factors to consider before exercising stock options. A lower stock price is an important factor, but not the only one. Other factors apply such as risk tolerance, personal circumstances, or your current outlook of the stock to name a few.

Here is a chart to make it easier to grasp.

Written by Andrew Spears, CFP®. Please note - Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.