The Have-Not Enoughs

We hear a lot of talk about the haves and the have-nots. For a lot of us, thinking in extremes is far simpler than sliding scales. The rich, the poor, the left, the right, the smart, the dumb and so on. What we don’t often realize, is that the vast majority of us fall somewhere in the middle. Most of us aren’t extreme right or left and while I wouldn’t consider myself dumb, if you’re looking for someone to perform your brain surgery, I’m certainly not your girl. The same goes for income. We talk a lot about income inequality and the top 1% and the injustice; the haves and the have-nots. But what about the have-not-enoughs?

In 2019 51% of households in the United States were considered to be middle class (Pew Research 2020). This is households of 3 making $40,100-120,400 before taxes. Now, some of you look at that and think, “gosh that’s a huge range,” and you’re right. A family making $40,000 is in a far different situation than a family making $120,000, not to mention the importance of geographical location. While this category represents a wide array of different financial situations, they all have one thing in common, they are being squeezed out.

The qualifications for middle class (typically 2/3 to double the national median income) haven’t changed in many years, but what has changed is the overall quality of life within the class. It may not only be that the middle class is shrinking, but also being in the middle class no longer means what it once did.

There are many factors that play into this idea of having-not-enough…

- The cost of housing: Well, this one has certainly changed a lot in the past year. If you’re local to Montana, like myself, you know first-hand what housing has done over the past year. Every week we hear a new story from a client or colleague about accepting one of a dozen over-asking offers on a house that sat on the market for 10 hours. With a clear shortage in housing that roots back to the 2008 housing crisis, a 37% increase in housing starts over March of 2020 has shot the cost of building materials up rapidly (MarketWatch). Unfortunately, we experienced this first hand in April when the cost of this simple shower/tub increased by over 30% from the prior quote we had received a mere 10 month ago.

Housing is hot and the middle-class buyer is being squeezed out by cash offers made far above asking and contractors booked solid for new builds.

- The cost of education: This is my hill. If you’ve followed the blog for awhile, you know how I feel about the cost of higher education. I am certainly no believer in free education, but with the annual increase of tuition more than double what standard inflation is historically, something isn’t right. From 1964 to 2016, after adjusting for inflation, the average annual cost at a four-year public university increased by 164% (aarp.org). It is largely believed that to break into the middle class, college education is the key, and a lot of statistics back that belief. The struggle comes in paying for that education. According to enrollment statistics, in 2015, college enrollment amongst the middle 60% of income earners (by family) dropped below the bottom 20% for the first time (Forbes, Preston Cooper). With federal student aid eligibility linked to Expected Family Contribution (EFC), many middle-class students find themselves ineligible for aid but without the family’s ability to contribute what it is said they “should.” This leads to students being forced to take on unsustainable debt in hopes of a life in the middle-class where that cycle can continue.

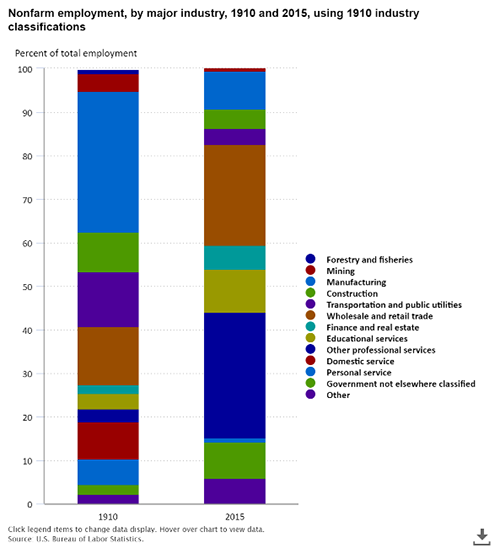

- Technological advances: Three years ago, I attended a conference and had the pleasure of hearing from the now very popular Cathie Wood. At the time, her investment management firm, Ark Invest, was fairly small, what we would call a boutique. We listened as she schooled a room full of investment professionals on disruptive technology. If I know one thing about Cathie Wood it’s that she’s brilliant. One of the aspects of technology that Cathie spoke on was 3D printing and how it would revolutionize manufacturing. She gave an example of support structures, one created with traditional manufacturing through molds and larger block pieces, and one created with a 3D printer. Each structure could support the same weight, but the 3D printed piece was 75% lighter and 50% smaller than the traditionally manufactured one. This is just one small example of areas we do and will continue to see technology overtaking traditional manufacturing and thus disrupting the workforce. In 1910, manufacturing was 32% of our workforce, in 2015 it was down to only 8% (bls.gov). Now, some of this is certainly a result of globalization and trade, but innovation has also claimed its fair share of jobs.

It’s story we’ve all heard before, you likely just didn’t know it. In 1910, one third of the United States 92 million citizens worked on farms. In 2010 farmers were only 2% of the workforce. Why the rapid decline? In 1890, John Froelich introduced the first gas powered tractor. In 1907, Henry Ford produced the “automobile plow,” their version of the tractor. What once took many men and horse could now be done with a single man and a gas-powered plow. Technological advances are today’s tractor.

- The Joneses: While the previous three were all very numeric and measurable, this fourth factor could potentially have the largest, most painful impact on the middle class. The cost of maintaining the middle-class facade. If you’re a Dave Ramsey follower, you’ve likely heard dozens of callers paint the picture of their desperate attempts to create a life that they couldn’t afford. Mounds and mounds of crippling debt only to give the appearance of wealth and the achievement of the American dream. For every person who calls in seeking guidance, I’d venture to guess there are dozens if not hundreds in the same boat who don’t call. We’ve created a society so centered around consumerism that the average middle-class family, that may have previously been able to live quite comfortably, is being told they must have newer vehicles, bigger homes, fancier vacations and prettier things. With the constant pressure of expensive school sports, RVs/cabins, elective body treatments and name brand clothes, the middle class has stretched themselves so thin, they slip perfectly in between the haves and the have-nots, as our have-not-enoughs.

While it is certainly hard to argue that technological advances and rising home values are all bad, the middle class is experiencing first-hand the painful collateral damage they cause. The perceived (and somewhat data driven) necessity of higher education starts the middle-class cycle of debt that is only fueled by the constant pressure to keep up with the Joneses. It’s hard to say if the American middle class is truly shrinking or if being in the middle class no longer affords you the life it once did. Policy makers obsess over the disparity between the haves and the have-nots, but often times forget about the growing group of have-not-enoughs squished in the middle. Only time will tell of the fate of our working middle-class, but constant negative pressures lead to grim outlooks.

Any opinions are those of Molly VanBinsbergen and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete.