There’s Always a Reason to Sell Stocks

Recent tariff announcements have given investors plenty of reasons to worry—concerns about a potential recession, shrinking corporate profits, or even the weakening global influence of the U.S. economy and dollar. It’s no surprise that markets dropped 19% from their peak on February 19, 2025, and are currently down 5.07% year-to-date (as of the April 29 market close).

These periods of uncertainty are often when the best long-term investment opportunities arise. The key is staying patient and focused on the bigger picture.

You might be thinking, “But isn’t this time different?” Of course it is—just like the COVID-19 pandemic was different, and so was Russia’s invasion of Ukraine. Whenever major disruptions hit, markets become volatile as everyone scrambles to understand what’s happening. That’s exactly the phase we’re in today.

But one thing I wouldn’t bet against is the resilience of American businesses and consumers.

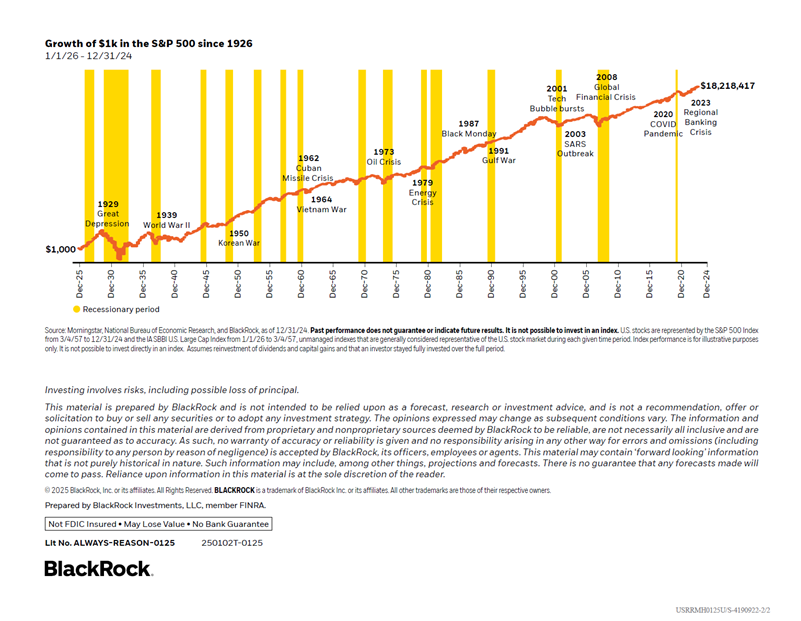

The chart below illustrates over 100 years of U.S. companies navigating wars, recessions, crises, and pandemics—and yet, here we are. Not only have we survived, we've grown stronger.

The S&P 500 is a dynamic group of America’s 500 best companies, led by its most capable CEOs. The S&P 500 is designed to evolve. Great companies rise to the top, and struggling ones get replaced.

Take Enron, for example. It collapsed in 2001 and was removed from the index on November 28th of that year. Its replacement? Nvidia—which is now worth $2.6 trillion.

So yes, there’s always a reason to sell. But history shows there are even more reasons to stay invested.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Every investor's situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Michael Fitzgerald and not necessarily those of Raymond James.