How Long Do Bull and Bear Markets Typically Last

Investing often comes with uncertainty, but history provides helpful perspective.

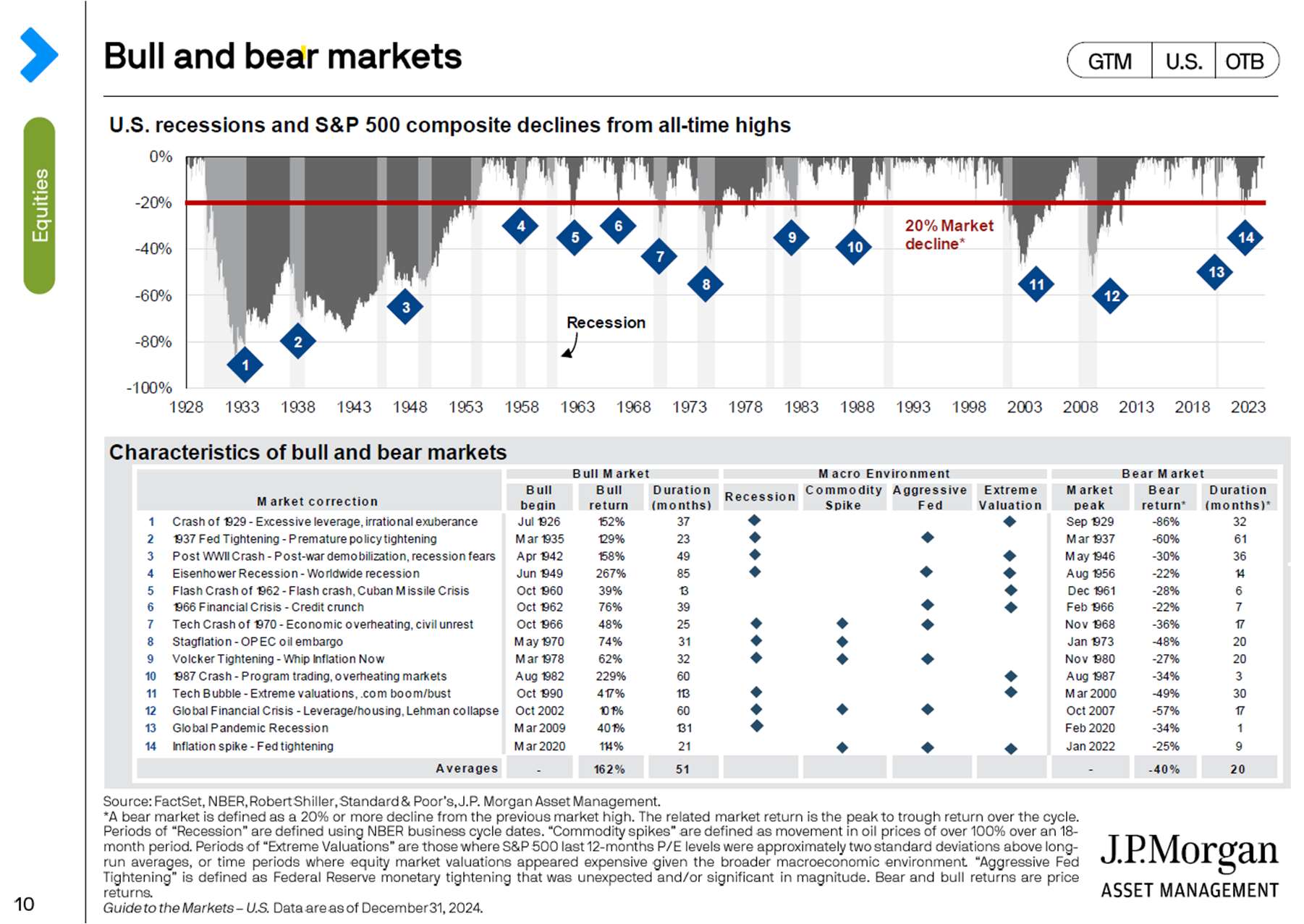

- Bull Markets (periods when stock prices rise 20% or more from previous lows):

- Average Length: 51 months

- Average Return: +162%

- Bear Markets (periods when stock prices decline 20% or more from previous highs):

- Average Length: 20 months

- Average Return: -40%

Key Insight: Bull markets tend to last 2.5 times longer and deliver returns nearly 4 times greater than bear markets. This historical trend reinforces the value of staying invested and focused on long term goals, especially during market downturns.

Are you prepared to weather the next bear market and capitalize on the next bull?

Let’s talk about how your portfolio can be aligned with your long-term goals—send me a message or schedule a quick call to start the conversation.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Every investor's situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Michael Fitzgerald and not necessarily those of Raymond James.