Headlines: “Ukraine and Russia”, “Fed Raising Rates”

Many people, myself included, are surprised to know that there are over 50 ongoing wars and conflicts in the world. We are mostly unaware of them due to our geographic location and the fact that we are not economically impacted. Russia, on the other hand, is a nuclear superpower and has a little more of an impact on the world with its energy and mineral resources.

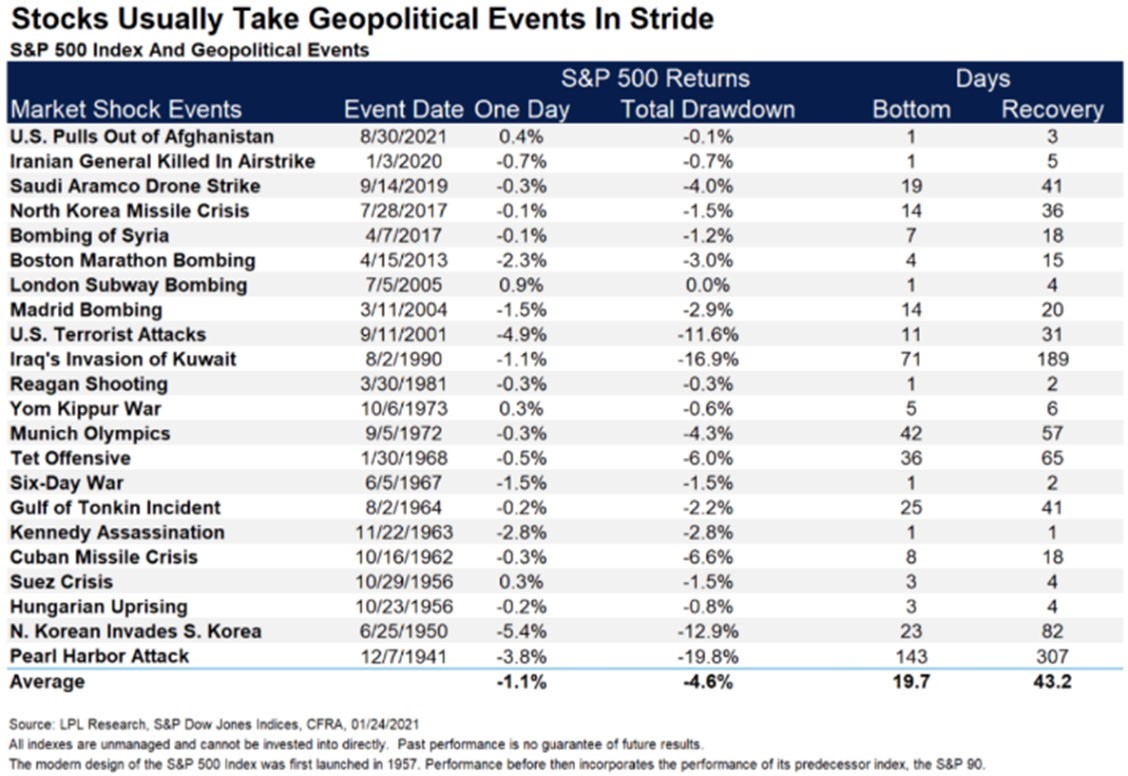

Past and Present Geopolitical Tension

LPL Financial did a study that shows how past geopolitical tension has affected the stock market dating back to Pearl Harbor in 1941. Out of the 22 geopolitical events that include, the Cuban Missile Crisis, The Kennedy Assassination, and the North Korea Missile Crisis, on average, the event caused a 1.1% decline in one day, and a total drawdown of 4.6% in the S&P 500. It then took the S&P 500 an average of 19.7 days to bottom, and 43.2

days to recover. News headlines can make it seem like civilization is going to end, causing investors to make emotional decision that hurt their financial goals. But this report shows just how resilient the markets are, even when faced with extreme adversity.

Although this report does not predict any future outcome in Ukraine, it’s important to realize that we have been in difficult situations before and pushed through them. From terrorist attacks to assassinations, the stock market has recovered and climbed to new highs.

Fed Raising Interest Rates

Before official news of Russia invading Ukraine, investors primary focus regarding the market was the federal reserve raising interest rates. As a reminder, the Fed is considered the central bank of the United States. The main responsibilities of the Fed are to set interest rates, manage the money supply and regulate the financial markets. When they decide that inflation is high (like 7% high) or growth is low, the fed can make the decision to increase the interest rate. When they do this, the cost of borrowing increases and consumers along with companies are much more cautious with their spending. So if you are invested in a company that relies on using a large amount of debt in their business, they could potentially be affected by these rate increases.

After inflation increased by 7% in December 2021, the highest annual increase in 40 years, we were bound to see the fed react. The Fed chair, Jerome Powell, recently came out and said that he is leaning towards a quarter‐point rate hike as opposed to a half point hike which was being discussed in prior months. That’s not to say future rate hikes won’t be higher than this, but that this is likely to be the

starting point. We would not be surprised if more volatility in the markets occur based on news headlines about the feds decisions on future interest rate increases.

Facts, Not Headlines

Although we don’t encourage focusing on news headlines when it comes to making investment decisions, we do think that keeping our clients well informed during times of volatility is important. If you’d like to be added to our email list to stay up to date on current market events, send an email to markus.goff@raymondjames.com and he will add you to our list. If you’d like to stress test your current portfolio to see how recent events and future events could affect your financial goals, please reach out to any one of our team members to see what the next steps are.

Mark Goff, CRPC® is the branch manager of Goff Wealth Management and has more than 35 years of experience in the financial services business. Mark and his team work with individuals who are in financial transition as a result of the loss of a spouse, inheritance, retirement or sale of a business. You can reach out to him at mark.goff@raymondjames.com.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete nor is it a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice.