Dealing With Market Volatility

Although we’ve all experienced volatility in the past, 2022 has shaped up to be one of the most volatile starts to a year for the stock market in a while. In fact, it has been the worst start to a year for the S&P 500 in at least 25 years. The initial volatility in January was pushed aside due to the fact that we had not seen a 10% pullback in two years. There is now a laundry list of reasons for this volatility that includes Russia’s invasion of Ukraine, surging oil prices, high inflation, and fears of China’s zero-COVID policy slowing global growth…to name a few. Here are a few of my favorite pieces to look at during times like this.

It Ain’t Easy

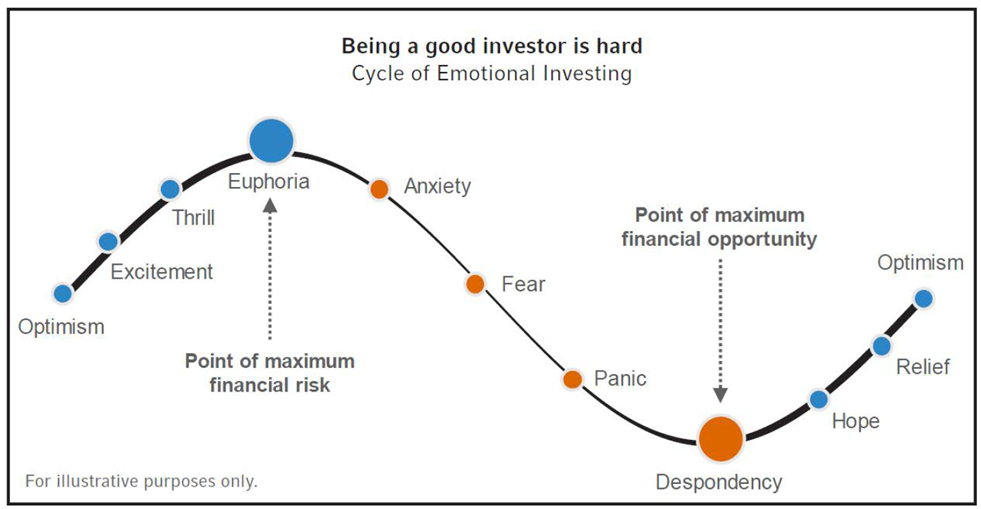

Euphoria: A feeling or state of intense excitement and happiness.

Being a good investor is hard. This illustration shows the emotional cycles that investors go through. When you first invest in the stock market, you’re optimistic about the future. As you see your account grow in value, you grow more and more excited. The men and women reporting on the stock market news outlets are yelling “Buy! Buy! Buy!” Your self confidence is on the moon and it appears you have been blessed with the Midas touch. But then…

Despondency: A state of low spirits caused by loss of hope or courage.

You see your account slowly begin to drop…-5%... -10%... -20%! The news media starts sounding the alarm on the next big (insert current event here). People start using words like “collapse” and “plunge.” You start to lose faith in your investments and question yourself. Should I sell? Should I put it all into (insert investing fad here) that my brother-in-law told me about at Christmas?

It’s clear to see that being an investor is not strictly about the numbers. There is a significant amount of emotions that go into each and every investment you put your hard earned dollars into.

What Is Normal?

This chart shows the average declines of the S&P 500 from 1952 to December of 2021. You can see that a decline of 5% happens on average around 3 times per year, a decline of 10% happens about once per year, a decline of 15% happens about once every 3 years, and a decline of 20% or more happens about once every 6 years. What’s going on in the world right now may not be normal, but the fact that the market is being volatile is normal. You shouldn’t use this data as a way to time the market, but rather as a way to calm your nerves when looking at your investment account declining in value. Think back to why you chose to invest in the stock market in the first place. Maybe you looked at your local banks CD rate. Perhaps you looked at the interest rate you were earning on your savings account. Little to no risk, but also little to no reward.

Fortune Favors The…Long Term Investor?

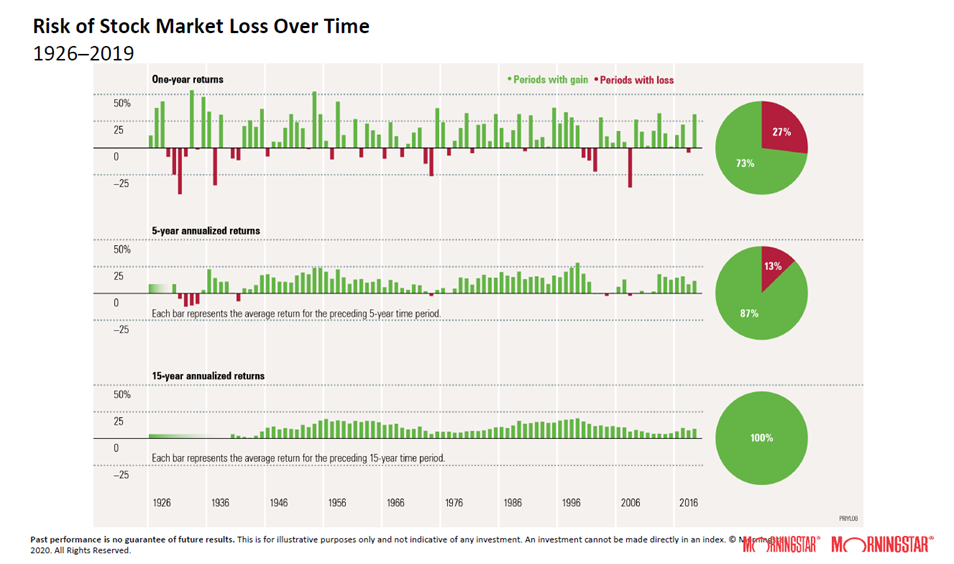

This chart shows how large cap stocks that are represented by the Ibbotson Large Company Stock Index have done the longer you own them. You can see that during any one year period from 1926 to 2019, you had a 73% chance of having a gain. In any 5 year period, your odds of a gain increase to 87%. And in any 15 year period, your chances of having a positive gain was 100%. You can see how beneficial it can be to stay invested for the long term, as opposed to trying to time the market in the short term. The chart also makes the point that money you will need in the next year should probably go into a more stable investment like cash.

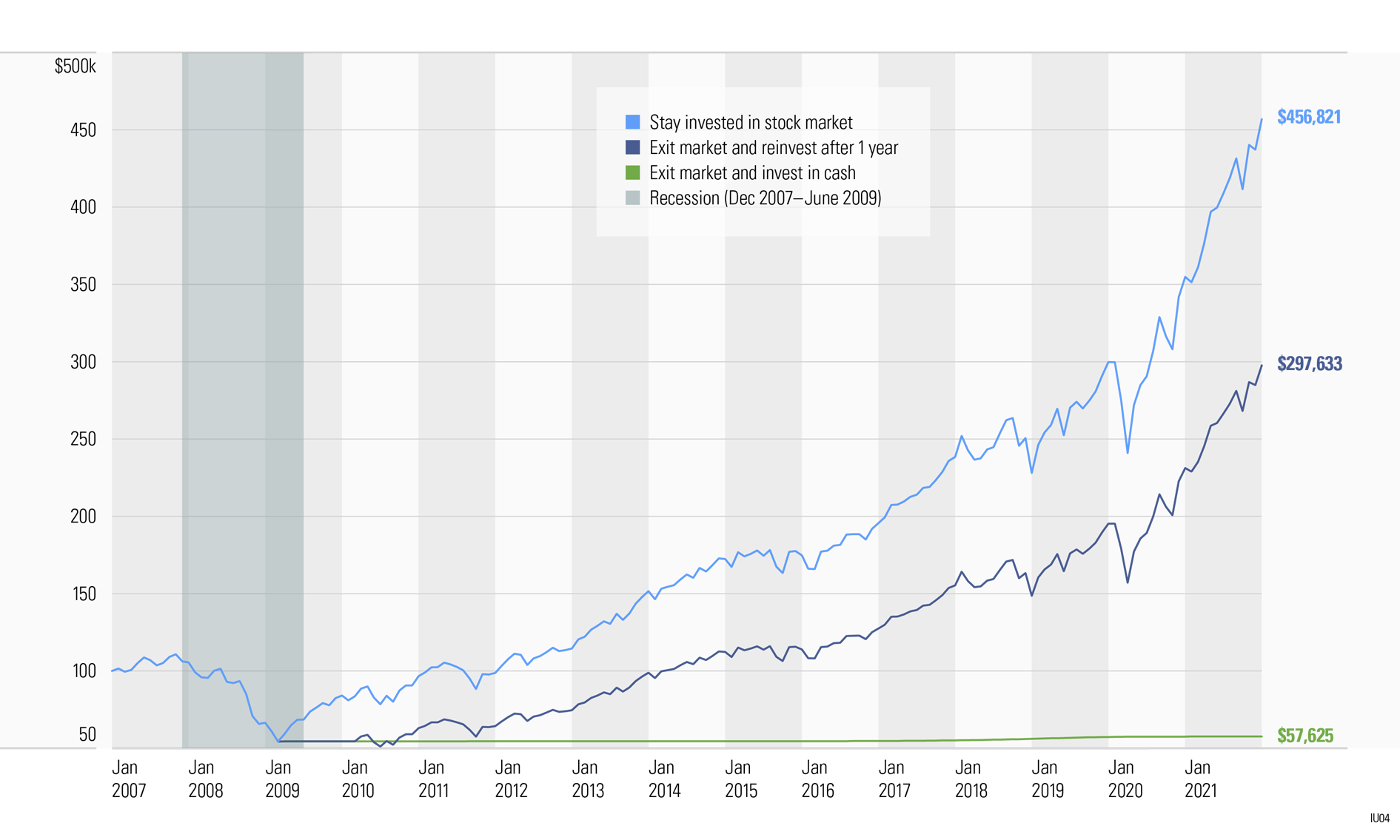

Timing? *Time In

This image illustrates the value of a $100,000 investment in the stock market during the 2007–2021 period, which is represented by the Ibbotson Large Company Stock Index. The value of the investment dropped to $54,381 by February 2009 (the trough date), following a severe market decline. If an investor remained invested in the stock market over the next twelve years, however, the ending value of the investment would have been $456,821. If the same investor exited the market at the bottom, invested in cash for a year, and then reinvested in the market, the ending value of the investment would have been $297,633. An all-cash investment at the bottom of the market would have yielded only $57,625.

The continuous stock market investment recovered its initial value over the next three years and provided a higher ending value than the other two strategies. While all recoveries may not yield the same results, we advise investor to stick with a long-term approach to investing. Investors who attempt to time the market run the risk of missing periods of exceptional returns, leading to significant adverse effects on the ending value of a portfolio. This can bring about financial issues like: pushing back retirement, not helping fund your grandchild’s college, not being able to travel as much as you’d like during retirement…you get my point.

There’s No “I” In “Team”

Keep in mind that headlines and market volatility can be a little easier to handle with a date specific, dollar specific financial plan along with an investment strategy to fit your risk tolerance. At Goff Wealth Management, we’ve been helping guide clients to their dream retirement since 1978. Click the “Contact Us” tab to schedule a no cost, no obligation conversation with our team of advisors. If you’d like to be added to our free monthly and quarterly market update emails with research from our investment experts at Raymond James, send an email to markus.goff@raymondjames.com and he will add you to our list.

Mark Goff, CRPC® is the branch manager of Goff Wealth Management and has more than 35 years of experience in the financial services business. Mark and his team work with individuals who are in financial transition as a result of the loss of a spouse, inheritance, retirement or sale of a business. You can reach out to him at mark.goff@raymondjames.com.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete nor is it a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice.