The Week In Review 6/20/2023

“It’s no wonder that truth is stranger than fiction. Fiction has to make sense.” ~ Mark Twain

Good Morning ,

Last week we continued to enjoy Bullish sentiment among investors.

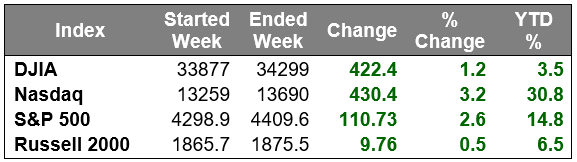

The major indices all logged decent gains, which had the S&P 500 close above 4,400 for its fifth straight winning week. The Nasdaq enjoyed its eighth straight week of gains. Things got started on an upbeat note after Goldman Sachs raised its 2023 year-end S&P 500 price target to 4,500 from 4,000.

Mega caps were in a leadership role this week, which saw Apple and Microsoft each hit new all-time highs. Small and mid-caps stocks, meanwhile, trailed their larger peers after a big run recently. The Russell 2000 logged the slimmest gain among the major indices this week, up 0.5%, but shows the largest gain so far this month (+7.2%).

Semiconductor stocks were a pocket of strength in the market. The PHLX Semiconductor Index (SOX) rose 4.2% despite recording losses on Thursday and Friday.

This week's broad advance saw ten of the 11 S&P 500 sectors enjoy gains on the week. Energy (-0.7%) was the lone laggard in negative territory while the information technology (+4.4%), materials (+3.3%), and consumer discretionary (+3.2%) sectors saw the largest gains.

The rally really picked up steam with the release of the May Consumer Price Index (CPI) on Tuesday followed by the May Producer Price Index (PPI), FOMC decision, and Fed Chair Powell's press conference on Wednesday. The CPI and PPI reports went the market's way in terms of feeling better about the inflation trend.

In response to those reports, stock market action reflected a belief that the Fed may not over-tighten and precipitate a worse economic outcome than is necessary to get inflation back down to its 2.0% target. This was in spite of Fed Chair Powell's commentary that indicated more rate hikes may be needed.

The FOMC voted unanimously to keep the target range for the fed funds rate unchanged at 5.00-5.25%. The latest dot-plot showed an upward thrust in the median projection for the fed funds rate in 2023 to 5.60% from 5.10%. In other words, the median view calls for at least two more rate hikes in 2023. Also, the median policy rate projection for 2024 was revised to 4.60% from 4.30% and the median projection for 2025 was revised to 3.40% from 3.10%, which supports a "higher for longer" policy rate outlook.

Fed Chair Powell said in his press conference that the July meeting is a "live" meeting (for looking at a possible policy change), but one that isn't being pre-determined.

Regardless, the price action still reflected a growing belief that the Fed may be done, or close to done, raising rates. The sizable gains logged on Thursday likely triggered a flat squeeze as investors employed cash from the sidelines due to a fear of missing out on further gains.

Following the FOMC decision, the ECB announced a 25 basis points increase in its three key policy rates, as expected, while the Bank of Japan left its interest on excess reserves (-0.10%) and yield curve control unchanged. Also, the People's Bank of China announced a 10 basis points cut in the one-year medium-term lending facility rate to 2.65%. This followed China's weaker than expected retail sales, industrial production, and fixed asset investment data for May.

We have a holiday shortened week this week… have a great week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.