The Week in Review 6/26/2023

“You can’t build a reputation on what you are going to do” ~ Henry Ford

Good Morning ,

The Fed is not the only thing that seems to be pausing…

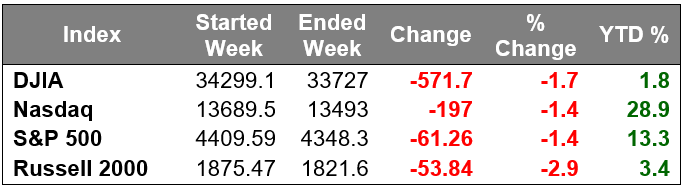

A holiday-shortened week of trading saw the S&P 500 and Nasdaq break five-week and eight-week winning streaks, respectively. There was a growing feeling that the market was due for a pullback, so losses were driven largely by normal profit taking activity after a big run.

Mega cap stocks were still the relative outperformers last week. One might have expected consolidation efforts to be focused more on mega caps, which have been leading all year but selling was more pronounced in non-tech related stocks.

By the end of the week, concerns about global growth and the lag effect of rate hikes by central banks had entered the market narrative.

Fed Chair Powell said in his semiannual monetary policy testimony before the House Financial Services Committee on Wednesday that there could be two more rate hikes by the Fed before the end of the year if the economy performs as expected.

This was followed by Fed Governor Michelle Bowman (FOMC voter) saying in a speech that "additional policy rate increases will be necessary to bring inflation down."

Fed Chair Powell continued his monetary policy testimony before the Senate Banking Committee on Thursday. He didn't provide any new surprises in terms of monetary policy views, yet there was consternation among committee members regarding capital requirements for banks.

That understanding undercut the bank stocks this week. Weak regional bank components, along with the growth concerns, led to the underperformance of the Russell 2000, down 2.9%.

Several central banks announced increases in their policy rates, including the Bank of England (+50 bps to 5.00%), Norges Bank (+50 bps to 3.75%), Swiss National Bank (+25 bps to 1.75%), and Central Bank of Turkey (+650 bps to 15.0%).

Those moves stoked concerns about global inflation and the lag effects of rate hikes potentially impacting global growth.

Piling onto the growth concern narrative, preliminary June manufacturing PMIs for Japan, Germany, the UK, the eurozone, and the U.S. all came in below 50 (i.e. the dividing line between expansion and contraction).

Some economic data for the U.S. was also on the weaker side last week. Existing home sales declined 20.4% year-over-year in May while the Leading Economic Index declined for the 14th consecutive month. Also, weekly initial jobless claims remain elevated above 260,000.

Housing starts, though, came in quite strong, relative to expectations. Total starts surged 21.7% month-over-month to a seasonally adjusted annual rate of 1.631 million units -- the highest since April 2022 -- while total building permits rose 5.2% month-over-month to a seasonally adjusted annual rate of 1.491 million, aided by a 4.8% increase in single-unit permits. In response, homebuilders outperformed last week.

Only one of the S&P 500 sectors logged a gain this week -- health care (+0.2%) -- while the real estate (-4.0%), energy (-3.5%), and utilities (-2.6%) sectors saw the largest declines.

Separately, trading volume was extremely heavy on Friday due to the reconstitution of the Russell Indexes

Market Snapshot…

- Oil Prices – Oil prices fell on Friday as traders worried interest rate hikes could hurt demand. U.S. West Texas Intermediate (WTI) crude futures fell 0.50%, or 35 cents, at $69.16 a barrel. Brent crude settled down 0.39%, or 29 cents, at $73.85 barrel.

- Gold– Gold notched its biggest weekly percentage fall in over four months. Spot Gold was up 0.3% to $1,918.79 per ounce, after rising as much as 1.2% on a retreat in U.S. bond yields and closed 2.1% lower for the week. U.S. gold futures gained 0.3% to $1,928.90. Sliver closed out the week at $22.354.

- U.S. Dollar– The U.S. dollar was higher on a safety bid as data spurred growth worries. The dollar index rose 0.49% to 102.89. Euro/US$ exchange rate is now 1.093.

- U.S. Treasury Rates– Treasury yields fell Friday as investors digested remarks from Federal Reserve officials about the outlook for interest rates and the latest economic data. The 10-year Treasury was down by 6 basis points at 3.735%.

- Asian shares were mixed in overnight trading.

- European markets are trading mostly lower.

- Domestic markets are mixed this morning.

The Fed and its monetary policy are still driving markets as we wait for a hard or soft landing to occur. The Fed isn't done fighting inflation. Chairman Powell indicated in his testimony last week that more rate hikes would likely be appropriate in 2023.

The futures market expects one additional rate hike in July, but, beyond that, is indecisive. Future rate hikes will be data dependent. Many experts believe the Fed is close to being done with rate hikes.

Chairman Powell will speak later this week two additional times, on Wednesday and Thursday as he appears before the Senate Banking Committee. Given the extensiveness of his testimony, it’s unclear what new comments he may have, especially without significant economic news beforehand. Friday will feature May’s PCE report.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.