The Week in Review 7/17/2023

“What we know is a drop, what we don't know is an ocean.” - Isaac Newton

Good Morning ,

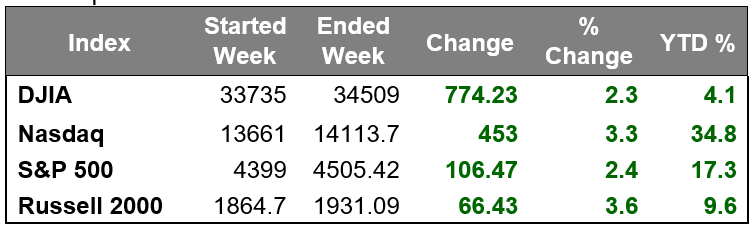

We enjoyed another very good week last week, trading volume at the NYSE was on the a bit on the light side but not so at the Nasdaq, where saw heavier-than-average volume most days.

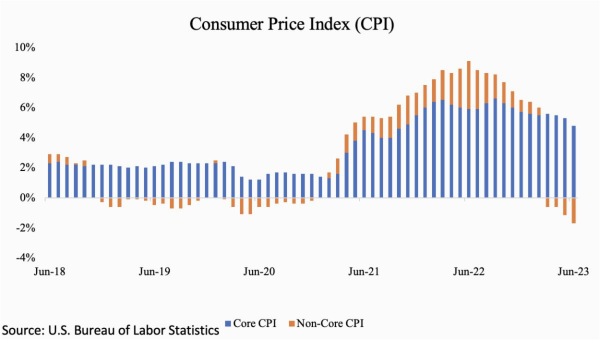

A “soft landing” was our theme and that the Fed is close to being done raising interest rates. This was corroborated by some key economic data including the June CPI, PPI, and Import-Export Price Index, all of which showed inflation trending in a market-friendly direction, and another weekly initial claims report that was well below recession-like levels.

The CPI report was the headliner of the week. It was released before Wednesday's open, and it showed a smaller-than-expected 0.2% increase in total CPI and a 0.2% increase in core CPI, which excludes food and energy. On a year-over-year basis, total CPI was up just 3.0%, versus 4.0% in May, which was the smallest increase since March 2021, and core CPI was up 4.8% versus 5.3% in May.

Treasury yields dropped lower after the report and stock prices advanced, following the trajectory Fundstrat's Tom Lee said before Monday's open that they would likely take if core CPI came in at 0.2% or less.

Specifically, Mr. Lee said the S&P 500 could add as many as 100 points if the CPI report lived up to his expectations. When he made that call, the S&P 500 stood at 4,398.95. At its high on Friday, the S&P 500 hit 4,527.76.

The move from last Friday's closing level to this Friday's high was fueled by broadbased buying interest and a sizable drop in market rates. The 2-yr note yield declined 21 basis points this week to 4.73% while the 10-yr note yield dropped 23 basis points to 3.82%.

The Russell 2000 was up 4.6% for the week entering Friday's trade and settled the week up 3.6%.

The broader market overcame a weak start for the mega cap stocks on Monday, which coincided with the Nasdaq's announcement after last Friday's close that there will be a special rebalancing of the Nasdaq 100 on July 24 to address the overconcentration in the index that has resulted from gains in the "Magnificent Seven." It will be the first special rebalancing of the Nasdaq 100 since May 2011.

The mega-cap stocks, however, overcame their slow start to the week and finished strong, ultimately outperforming the S&P 500 as a group.

All 11 S&P 500 sectors saw gains this week that ranged from 0.6% (energy) to 3.4% (communication services). Those gains were logged as the Q2 earnings reporting period got underway, featuring reports from Delta Air Lines, PepsiCo, JPMorgan Chase, Wells Fargo, Citigroup, and UnitedHealth, all of which exceeded consensus earnings expectations.

Speaking of expectations, the fed funds futures market was emboldened by the friendly CPI report on Wednesday and effectively put a lid on the prospect of any additional rate hikes after the July meeting.

The fed funds futures market has priced in a 96.1% probability of a 25-basis points rate hike at the July meeting, yet the probability of a second rate hike at the September, November, or December meetings sits at just 15.4%, 29.0%, and 25.2%, respectively, according to the CME FedWatch Tool.

Several Fed officials, however, don't seem ready to close the door on a second rate hike, preferring to wait for more data to draw their conclusions.

Be that as it may, the fed funds futures market and the stock market are embracing the one-and-done view.

That perspective placed some added pressure on the dollar this week, as other central banks, namely the ECB and Bank of England, are seen as having further to go with their rate-hike campaigns.

The U.S. Dollar Index dropped a hefty 2.4% this week to 99.96.

That move, and the soft-landing view, led to a pickup in many commodity prices this week, including oil (+1.9%) and copper (+3.8%), which rose despite some weak data out of China that, naturally, sparked calls for more policy stimulus.

Market Snapshot…

- Oil Prices – Oil prices fell but traders booked profits from a strong rally. West Texas Intermediate crude (WTI) fell $1.47, or 1.9%, to settle at $75.42 a barrel. Brent crude futures fell $1.49, or 1.8%, to settle at $79.87 a barrel.

- Gold – Gold notched its biggest weekly gain after signs of cooling inflation. Spot Gold was up 1.65% at $1,964.04 per ounce. Silver finished the week at $25.194.

- S. Dollar – The dollar made a modest comeback after falling sharply the last few days. The dollar rose 0.6% to 138.87, while the dollar index edged 0.22% higher at 99.93. Euro/US$ exchange rate is now 1.126.

- S. Treasury Rates – The 10-year Treasury note added 5 basis points to

3.811%. The rise in 10-year Treasury was the result of investors reacting to the June producer price index.

- Asian shares were down in overnight trading.

- European markets are trading in the red.

- Domestic markets are trading lower this morning.

As we get into the heart of earnings season, we expect volatility in individual names as they either beat or fall short of expectations in their reports. But overall, the market appears to want to move higher.

On the economic front, we will receive June’s Retails Sales, Industrial Production, Manufacturing Production, and Business Inventories reports.

Consumer spending is still strong, as evidenced by another record Amazon Prime Day, which totaled $12.7 billion in total sales, a 6% increase over last year’s event. Retails sales should also reveal a healthy consumer and the production to support that.

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.