The Week in Review 7/24/2023

Good Morning ,

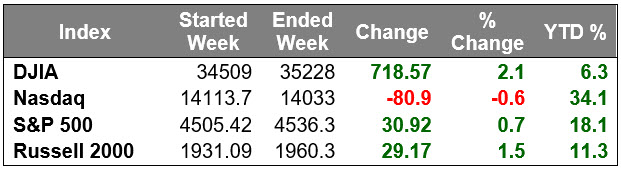

We were treated to yet another winning week last week!

The Dow Jones Industrial Average extended its winning streak to ten straight sessions highlighted by a sizable gain on Thursday, which was led by Johnson & Johnson, IBM, and Travelers following their earnings reports.

This week's trading featured a broadening out of buying interest. Mega caps were relative underperformers due to profit-taking activity and valuation angst ahead of a big week of mega-cap earnings that will feature results from Alphabet and Microsoft on Tuesday, and Meta Platforms on Wednesday.

Tesla and Netflix were top laggards, experiencing some consolidation following their better-than-expected Q2 earnings results. Taiwan Semiconductor Manufacturing Co. was another losing standout after warning about customers' continued inventory adjustment due to dampening end market demand. TSM also reported better than expected earnings and revenue.

Elsewhere, bank stocks outperformed following a slate of earnings news and commentary that did not imply any meaningful concerns about a recession. Starting with strong gains in Bank of America on Tuesday, Northern Trust, M&T Bank, Western Alliance, and U.S. Bancorp all logged nice gains after their earnings reports.

Regional bank stocks also rose across the board.

By and large, market participants continue to trade off the notion that the U.S. economy will avoid a hard landing, that the Fed is close to done raising interest rates, and that earnings growth will return in the second half of the year.

The soft-landing view was corroborated by this week's economic releases. Weekly initial jobless claims came in at the lowest level (228,000) since Mid-May, which was good news regarding the state of the labor market. The retail sales report, meanwhile, looked weak at first with total sales declining 0.2%. Control group sales, which factor into the computation for personal spending in the GDP report, were up a solid 0.6%.

Housing data was soft, but still didn't contain anything alarming. Total housing starts declined 8.0% month-over-month to a seasonally adjusted annual rate of 1.434 million and building permits decreased 3.7% month-over-month to a seasonally adjusted annual rate of 1.440 million.

With the soft-landing narrative still intact, market participants were inclined to fade mega caps and buy non-tech and value stocks. There is less valuation angst among those stocks, which led to the preferential treatment this week.

The S&P 500 health care sector (+3.5%), boosted by Johnson & Johnson and Abbott Labs, and energy sector (+3.5%) saw the biggest gains. The communication services sector, meanwhile, was the top laggard by a decent margin, falling 3.0%.

There was an uptick in Treasury yields this week, yet the bond market is still respecting a multi-month trading ranging. The 2-yr note yield rose 13 basis points to 4.85% and the 10-yr note yield rose three basis points to 3.85%.

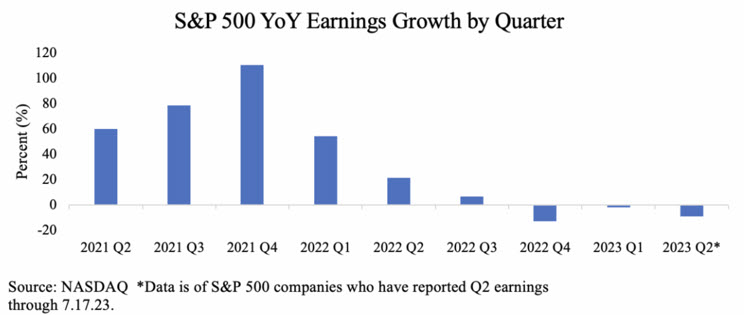

Earnings are holding up because of low expectations…

Last week was another week of companies overcoming low bars. So far, S&P 500 companies are reporting a year-over-year earnings decline of -9.0%, the lowest since Q2 2020.

Market Snapshot…

- Oil Prices – Oil prices fell but traders booked profits from a strong rally. West Texas Intermediate crude (WTI) fell $1.47, or 1.9%, to settle at $75.42 a barrel. Brent crude futures fell $1.49, or 1.8%, to settle at $79.87 a barrel.

- Gold– Gold notched its biggest weekly gain after signs of cooling inflation. Spot Gold was up 1.65% at $1,964.04 per ounce. Sliver closed out the week at $24.385.

- U.S. Dollar– The dollar made a modest comeback after falling sharply in the last few days. The dollar rose 0.6% to 138.87, while the dollar index edged 0.22% higher at 99.93. Euro/US$ exchange rate is now 1.111.

- U.S. Treasury Rates– The 10-year Treasury note added 5 basis points to 3.811%. The rise in the 10-year Treasury was the result of investors reacting to the June producer price index.

- Asian shares were mixed in overnight trading.

- European markets are trading mostly lower.

- Domestic markets are trading higher this morning.

Coming up this week…

This week’s focus will be the Fed’s meeting and interest rate decision on Wednesday most expect them to announce a 0.25% increase. We'll be looking for clues about the Fed’s future decisions from Chairman Powell’s comments regarding the interest rate path for the rest of the year.

On Thursday, we'll receive the preliminary Q2 GDP report and Friday will feature June’s PCE report.

With a plethora of earnings and economic reports looming, this week could prove to be an eventful one.

Have a fantastic week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.