The Week in Review 8/28/2023

It’s a funny thing, the more I practice, the luckier I get.” – Nolan Ryan

Good Morning,

Overall, we saw a decent week in the markets for the mega-cap names, but a relatively lackluster week for the broader market.

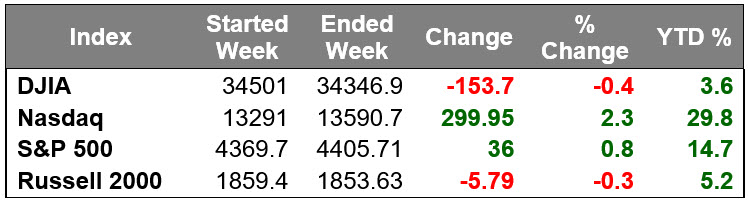

The S&P 500 rose 0.8% last week while the broad market gave us a mixed return. The Russell 2000 was down 0.3% for the week and the S&P Midcap 400 Index was flat. The Nasdaq Composite gained 2.3% and the Dow Jones Industrial Average declined 0.4%.

With their gains this week the S&P 500 and Nasdaq Composite broke a three-week losing streak.

There wasn't a lot of consistency in the trading action last week, which gave us a somewhat volatile week accented with light volume and big news items that included the July Existing Home Sales and New Home Sales reports, the preliminary Manufacturing and Services PMI readings for August, NVIDIA's earnings report, results from a large and diverse batch of retailers, and of course Fed Chair Powell's policy-oriented speech at the Jackson Hole Symposium.

Much news to digest…

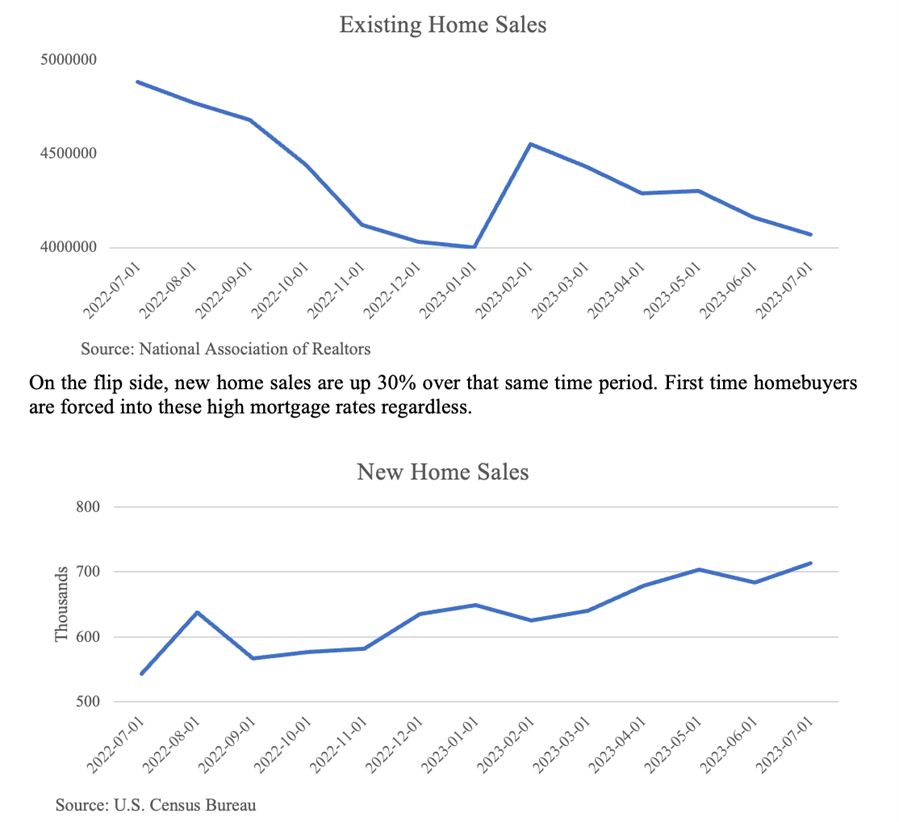

- Existing home sales were slightly weaker than expected, impeded yet again by limited supply and affordability pressures from high mortgage rates.

- New home sales were slightly stronger than expected, driven by sales of more moderately priced homes as higher building costs crimped the supply of lower-priced homes while higher mortgage rates contributed to affordability pressures across the spectrum.

- The preliminary Manufacturing and Services PMI readings showed a deceleration in activity from July and an ongoing contraction in the manufacturing sector.

- NVIDIA delivered another blowout earnings report, with much stronger than expected guidance, yet the stock struggled to hold its gains after the report.

- The results from the retailers were a mixed bag but comments from Macy's about weakening consumer credit trends, and disappointing results and/or guidance from Dick's Sporting Goods, Dollar Tree Stores and Foot Locker that were attributed in part to inventory shrink (i.e., theft), overshadowed good news from other reporters.

- Fed Chair Powell stuck by the Fed's 2.0% inflation target; he reiterated that the process of getting inflation back down to 2.0% still has a long way to go; and he acknowledged that the Fed will raise rates again if it is appropriate. Nothing he hasn't said before. What he didn't say is that the Fed is thinking about cutting rates, yet that omission wasn't a surprise either.

The best-performing sectors this week were information technology (+2.6%), consumer discretionary (+1.1%), and communication services (+1.0%). The commonality is that they all include mega-cap stocks. The energy sector (-1.4%) was the biggest decliner last week with oil prices fading some on continued concerns about China's weakening economy.

That weakening prompted the PBOC to cut its one-year loan prime rate by 10 basis points to 3.45% on Monday and officials to urge financial institutions to assist in stabilizing the stock market. On a related note, Reuters reported Friday that China is planning to lower the duty on stock trading by 50%. China's Shanghai Composite declined 0.6% on Friday and lost 2.2% for the week.

The Treasury market had its own gyrations last week. The 2-yr note yield saw a trading range that spanned from 4.92% to 5.10%. It settled the week at 5.05%, up 14 basis points for the week. The 10-yr note yield saw a trading range that spanned from 4.18% to 4.35%. It settled the week at 4.24%, down one basis point for the week.

Market Snapshot…

- Oil Prices – Oil prices rose about 1% on Friday on signs of slowing U.S. output. West Texas Intermediate crude (WTI) gained 78 cents, or 1.0%, to settle at $79.83/barrel. Brent crude futures were trading at $84.48/barrel, up $1.12 or 1.3%.

- Gold– Gold prices fell, snapping a four-session streak of gains. Spot gold fell 0.21% to $1,913.364 per ounce, while U.S. gold futures settled 0.4% lower at $1,939.90. Silver closed out the week at $24.234.

- U.S. Dollar– The dollar index gained 0.21% at 104.20 buoyed by Fed chief Powell’s speech at the Jackson Hole symposium. Euro/US$ exchange rate is now 1.082.

- U.S. Treasury Rates– The yield on the 10-year Treasury note rose less than 1 basis point to 4.233%.

- Asian shares were up in overnight trading.

- European markets are trading higher.

- Domestic markets are trading slightly higher this morning.

This week will feature the release of the Home Price Index on Tuesday and August’s jobs report on Friday. After two solid, if not stellar, jobs reports in June and July, the Fed will be looking for cooling in this area to assess the effect of its policy changes. Current estimates call for an increase of 187K jobs for the month.

We have a long weekend coming… the markets will closed next Monday for Labor Day.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.