The Week in Review 8/21/2023

“There are no gains, without pains.” – Benjamin Franklin

Good Morning,

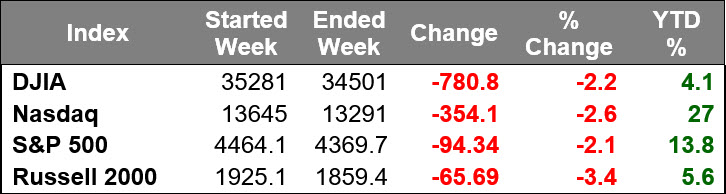

Last week was another sloppy week… with rising interest rates and carryover downside momentum after the persistent selling in August. Volume continues to be below average… it is summertime.

Last week's selling led the S&P 500 to breach support at its 50-day moving average for the first time since March and take out support at the 4,400 level. We continue to see profit taking after the impressive moves of 2H23.

Treasuries were one of the biggest catalysts for selling interest in the stock market as yields rose. The 10-yr note yield, which settled at its highest level since November 2007 on Thursday (4.31%), rose eight basis points this week to 4.25%.

The 10-yr note yield is now up 29 basis points for the month with investors weighing on supply matters and incoming data. That continues to validate the soft landing/no landing scenario that presumably will keep inflation above the Fed's 2.0% goal and the Fed itself in a higher-for-longer mindset. This also includes a consideration of raising rates yet again. The economy is a double-edged sword… we don’t want it to be too strong or the Fed will remain an adversary, but we also don’t want it to fail. Can you say Goldilocks?

Participants received the FOMC Minutes from the July 25-26 meeting this week, which induced some volatility in the immediate aftermath of the release. The knee-jerk selling was in response to some hawkish sounding headlines from the minutes.

For example, "most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy." That view wasn't exactly surprising, however, considering remarks made by Fed Chair Powell after the meeting.

Global growth worries, especially related to China, also kept stocks under pressure last week. China reported a batch of weaker than expected retail sales, industrial production, and fixed asset investment data for July, along with another decline in home prices. In addition, property developer Evergrande filed for Chapter 15 bankruptcy protection in the U.S.

The People's Bank of China, in response to weakening economic activity, lowered its one-year medium-term lending facility rate to 2.50% from 2.65% and lowered the seven-day reverse repurchase rate by ten basis points to 1.80%. The PBOC also reportedly instructed state banks to intensify their interventions in the foreign exchange market to support the yuan.

Bank stocks were a weak pocket in the market after a warning from Fitch Ratings that it might be forced to downgrade the ratings of dozens of additional banks. The warning came just a week after Moody's cut the ratings of ten small to mid-sized U.S. banks.

On the earnings front… Dow components Home Depot and Cisco were met with positive reactions to their reports while fellow Dow component Walmart saw a decline after its earnings report.

Target and TJX Cos. were also among the standout winners, along with Applied Materials.

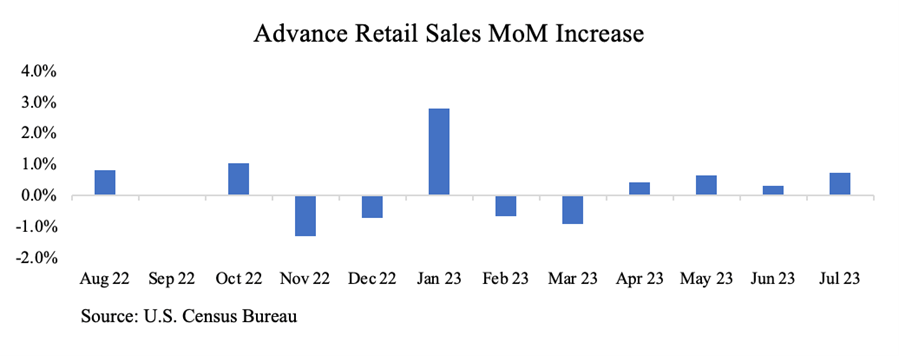

We saw Retail Sales come in strong for July, with May & June also being revised upward… the consumer continues to spend.

Amazon had another record Amazon Prime Day… and it shouldn’t surprise anyone that online retailers led the pack, up 1.9% for the month.

Market Snapshot…

- Oil Prices – Oil prices rose about 1% on Friday on signs of slowing U.S. output. West Texas Intermediate crude (WTI) gained 86 cents, or 1.1%, to settle at $81.25/barrel. Brent crude futures rose 68 cents, or 0.8%, to settle at $84.80/barrel.

- Gold– Gold prices were little changed but bullion was headed for its third straight weekly dip. Spot Gold was steady at $1,887.79 per ounce, down 1.4%. U.S. gold futures settled 0.1% higher to $1,916.5. Silver finished the week at $22.733.

- U.S. Dollar– The dollar was set for a fifth consecutive week of gains in the longest winning streak for 15 months. The dollar index edged 0.1% higher at 103.53 buoyed by demand for safer assets on worries over China’s economy. Euro/US$ exchange rate is now 1.091.

- U.S. Treasury Rates– The yield on the 10-year Treasury was down more than 5 basis points at 4.253% as investors considered the economic outlook, especially inflation.

- Asian shares were mixed in overnight trading.

- European markets are trading higher.

- Domestic markets are indicated to open in the green this morning.

Although earnings season is ending, we will still hear from several prominent companies. Among them are Zoom, Lowe’s, Dick’s Sporting Goods, Nvidia, Intuit and Dollar Tree.

This week will be rather Fed-centric as well. The Kansas City Fed’s Jackson Hole Symposium will be held August 24-26th. The annual event is attended by central bankers, economists, financial market participants and academics from across the globe. Chairman Powell will also be in attendance. This year’s title will be “Structural Shifts in the Global Economy.”

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.