The Week in Review 05/19/25

“An economist is someone who sees something happen, and then wonders if it would work in theory.” ~ Ronald Reagan, 40th US President

Good Morning ,

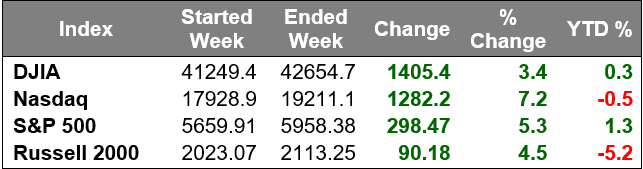

It was another BIG winning week for stocks.

The S&P 500 and Dow Jones Industrial Average turned positive again for the year, sitting on a 1.3% and 0.3% gain, respectively in 2025 after this week's moves.

The market was enthused by a notable easing in the trade war with China.

Both the U.S. and China agreed to a 90-day reduction in tariffs, which went into effect on Wednesday. The U.S. dropped tariffs on China from 145% to 30% and China dropping tariffs on the U.S. from 125% to 10%.

The good news for the market is that the reductions were larger than expected. The less than good news for the market is that the reductions expire in 90 days if both sides can't reach a more permanent trade deal.

Our markets focused on the positive takeaway, fueling an everything-rally. Moves were helped by short-covering activity and a fear of missing out on further gains.

Also, there was an emerging view that stocks were due for a period of consolidation after a big run since the April lows, but that didn't materialize in a meaningful way. The continued resilience acted as an additional upside catalyst for stocks.

The S&P 500 was down 17.8% for the year and down 21.4% from the all-time high it reached on February 19 at its April 7 low (4,835.04).With Friday's close, the benchmark index is 23.2% higher than its April low and 3.2% below its all-time high.

Increased attention to mega caps and large-cap tech stocks had an outsized impact on the major equity indices. NVIDIA surged 16% and Apple was up 6.4% from last Friday.

On the flip side, UnitedHealth was a huge laggard, dropping 23.3%.

It's one of the most influential names in the price-weighted Dow Jones Industrial Average, sinking following the news that CEO Andrew Witty is stepping down for personal reasons and that the company is suspending its 2025 outlook as it grapples with higher-than-expected medical costs.

Market participants were also weighing a big slate of economic news, including an April Consumer Price Index that lacked any tariff inflation shock, and a cool Producer Price Index report for April.

The calendar also included April reports for retail sales, and industrial production; weekly initial and continuing jobless claims; and May reports for the Philadelphia Fed Index, Empire State Manufacturing Survey, and NAHB Housing Market Index that, collectively, all were mixed relative to expectations.

Treasury yields moved noticeably higher, but that didn't deter stocks.

The 10-yr yield rose above 4.50% at its high this week before settling at 4.44%, which is six basis points higher than last Friday. The 2-yr yield jumped ten basis points from last week to 3.98%.

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.