The Week in Review 5/12/25

“You can’t predict, [but] you can prepare.” ~ Howard Marks

Good Morning ,

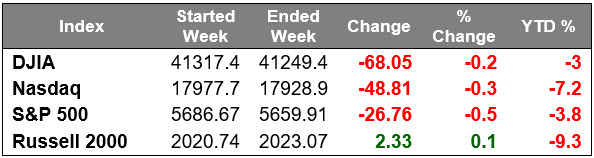

Our markets were quiet last week, which continued in a consolidation pattern following the huge run up from the April 7 lows.The S&P 500 has recovered 14% from the April lows… in just over a month of trading.

A nine-session win streak for the S&P 500 was broken on Monday, serving as a precursor to a week where outsized moves were reserved for individual stocks with news.

Dow component Walt Disney, which impressed with Q1 results and better-than-expected guidance for the full year, and Alphabet, which struggled on concerns about AI challenges to its search business.

It was a huge week of earnings reporting, yet most of the market's focus was on the macro picture that included the following highlights…

- OPEC+ agreeing to raise its production output in June by 411K barrels per day.

- The U.S. trade deficit hitting a record $140.5 billion, as imports surged in a tariff frontrunning move.

- India launching attacks on nine sites in Pakistan, and Pakistan vowing a response to those attacks.

- An indication that Treasury Secretary Bessent and U.S. Trade Representative Greer will meet China's Vice Premier He Lifeng in Switzerland over the weekend with an aim of de-escalating the tariff/trade situation.

- The People's Bank of China lowering its 7-day reverse repurchase rate by 10 basis points to 1.40% and the required reserve ratio by 50 basis points to 9.00%.

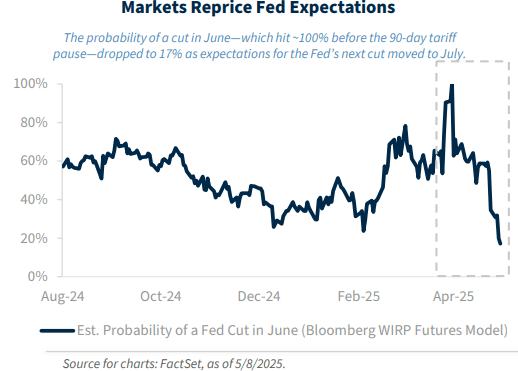

- The FOMC voting to leave the target range for the fed funds rate unchanged at 4.25-4.50%, and Fed Chair Powell declaring that the Fed will be patient before making any policy moves as it needs to see more data to understand better how the new administration's policies are affecting economic activity.

- The Bank of England lowering its cash rate by 25 basis points to 4.25%, as expected.

- President Trump announcing the first trade deal with the UK, which will involve keeping the baseline 10% tariff rate; and noting that several other trade deals should be following soon.

- President Trump touting the reconciliation bill and suggesting one should buy stocks now.

The best-performing sectors last week were the industrials (+1.1%), consumer discretionary (+0.8%), and utilities (+0.5%) sectors.

The worst-performing sectors were the health care (-4.3%), communication services (-2.4%), and consumer staples (-1.1%) sectors.

Tech continues to struggle… especially the beloved ”Magnificent 7”.

Earnings are impressive…

According to FactSet with about 90% of the S&P 500 reporting, profits are projected to climb 13.6% from a year ago. What’s not to like?

Interest rates are gently rising… the 2-yr Treasury note yield increased four basis points on the week to 3.88%, while the 10-yr note yield added six basis points to 4.38%.

The Fed’s reluctance to lower rates, when most of the global players are lowering is causing some friction in the bond markets… and with the White House.

The CME FedWatch Tool now predicts only a 17.3% probability now for a rate cut in June. We are still seeing a 50.4% probability of a ¼ point cut in July.

The U.S. Dollar Index jumped 0.4% to 100.42, garnering some support from the market's expectations for the next rate cut getting pushed out to the July FOMC meeting.

Have a wonderful week!!

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.