Our Mission

We strive to draw on our collective experience to address our clients’ individual goals and to implement time-tested wealth management strategies. It is important that we prioritize our clients and their financial well-being in all phases of life and partner with them to pursue their financial goals. We use our sophisticated planning resources and integrated technology solutions to help enhance how we serve our clients while helping preserve and manage their wealth.

Our Approach

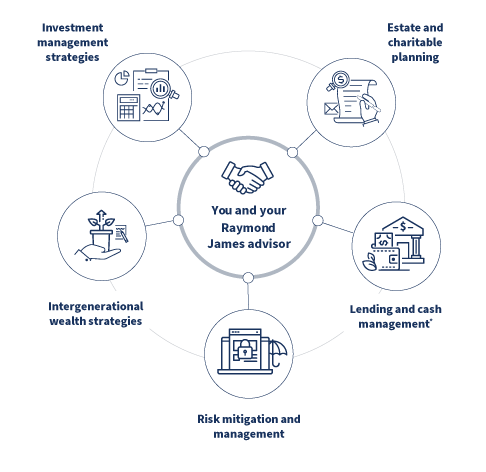

The private wealth solutions offered by Raymond James encompass:

- Services tailored to clients’ objectives

- Comprehensive advice considering all facets of clients’ lives and goals

- Broad capabilities through our platform and partner networks

*Banking and lending services provided by Raymond James Bank, member FDIC, affiliated with Raymond James Financial Services.

Executive Benefits Services

We partner with organizations to help simplify the busy and complicated financial lives of their employees. Through our Advanced Financial Planning approach, we can assist employees in better understanding their financial situation, and work with them to create a road-map forward - reducing the stress that financial ambiguity can breed. These services are intended to assist HR leaders and compensation committees with additional resources that can aid in attracting and retaining top talent in a competitive market.

-

- 401(k) fee assessment

- Business transition and exit planning

- Buy-Sell review

- Charitable giving strategies

- Corporate structure and document review

- Employee stock ownership plan

(ESOP) review - Executive transactions planning

- Key-man/buy-sell agreement review

- Long-term incentive plans (LTIP)

- Tax-mitigation strategies

- Retirement plan review and fee assessment

- Review of investment policy statement

- Risk management

-

- Advanced financial planning

- Cashless stock option strategies

- Rule 144 planning

- 10b5-1 planning

- Concentrated equity positions risk reduction

strategies - Charitable giving strategies

- Education cost planning

- Estate planning review

- Insurance needs analysis

- Longevity planning

- Private wealth consulting

- Tax planning

Quote provided after initial consultation, based on planning needs.

The Financial Planning or Consulting services listed are generally those offered under the Wealth Advisory Services Agreement. However, fees and services are customized with each client agreement. For a complete list of fees and available services, please consult the most current Form ADV Part 2A and the Wealth Advisory Services Agreement that you may obtain from your Investment Adviser Representative.

To download our flier, please click here.

If you are interested in learning more, contact us.