Why the uptick in inflation isn't the start of a new trend

- 04.12.24

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- March CPI data came in hotter than expected

- A cooling economy/labor market should ease inflation

- We continue to expect the Fed to cut three times in 2024

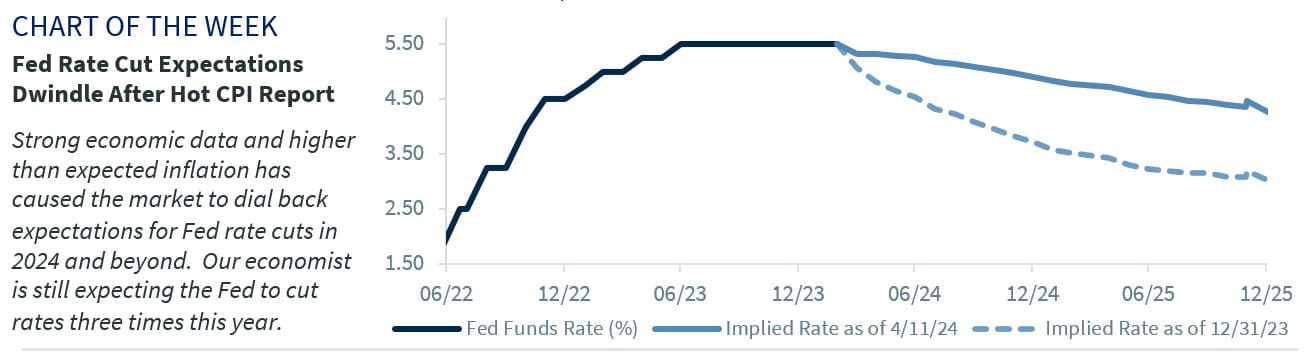

Growth and inflation have remained remarkably resilient since the start of the year, causing the market to once again rethink the Fed’s rate path. As a result, the odds of a June rate cut have collapsed, with the market pricing in less than a 20% probability of a rate move – down sharply from over 50% last week. The number of expected interest rate cuts has dwindled from six at the start of the year to fewer than two today. And with Treasury yields soaring to year-to-date highs, the equity market is starting to notice. To be sure, the latest data does not increase the Fed’s confidence that inflation is moving sustainably down to its 2% target; however, there are four reasons the current uptick in inflation is not the start of a new trend:

- Economic growth should start to simmer down | While the economy has managed to avoid a recession (thus far), we do expect growth to slow from last year’s strong pace. Why? First, small business optimism has fallen to its lowest level since 2012, and more importantly, the percentage of businesses reporting poor sales (one of our favored indicators) has climbed to its highest level in nearly three years. Second, with the latest back up in rates, borrowing costs are soaring again – mortgage rates have climbed back above 7.0%, credit card rates are hovering near record levels (above 22.0%) and the average interest rate on short-term loans for business shot up over 1% from 8.7% last month to 9.8%. High borrowing costs should dampen spending. This, plus a softening labor market, dwindling savings, high credit card balances and rising delinquencies suggest the momentum in consumer spending should start to slow, but not collapse. This should lead to GDP falling below 1% in the next two quarters.

- Labor conditions will gradually ease | The job market looks solid, as evidenced by the 303k jobs added last month and an unemployment rate that has been at or below 4% for 28 consecutive months. However, there are cracks forming that point to weaker labor conditions ahead. For example, the employment subsectors in both the ISM Manufacturing and ISM Services Indices have moved into contractionary territory. Small businesses have started dialing back their hiring plans in recent months. In fact, in the latest NFIB survey, small business hiring plans fell to the weakest level since May 2020. Temporary help services, viewed as a leading indicator of a softening labor market, have been trending lower for well over a year. While significant job losses are unlikely, these indicators suggest the labor market is likely to soften, keeping a lid on wages and dampening consumption.

- Forward-looking metrics point to more downside | While inflation has remained stubbornly high, more forward-looking metrics suggest the downward inflation trend remains intact. First, while services prices have been sticky (+5.4% YoY), the prices paid subsector within the ISM Services Index declined to the lowest level since March 2020 – suggesting that services prices should decelerate over coming months. Second, goods prices are likely to remain depressed as supply chains continue to normalize (the NY Fed Supply Chain Index fell to the lowest level since October) and the % of manufacturers reporting their inventory levels are “too high” rose to a 13-month high. This, combined with additional Amazon ‘selling events’ and slowing demand for motor vehicles point to further discounting in the goods space and leaves us confident that a material acceleration is unlikely.

- Discrepancies with real-time metrics | The official government metrics within the CPI remain disconnected from the more ‘real-time’ metrics reported from third party sources. For example, rent prices (the largest component of the CPI) have risen ~6% YoY, whereas Apartment List (which tracks rental prices on public listing feeds) is down 1% YoY. Also, used vehicle prices in the CPI are down 2% YoY, while Manheim (which tracks ~5 million cars in auction per year) reports prices are down ~15% YoY. Third, food prices are up 2.2% within the CPI, while the UN Food Price Index reflects that food prices are down 10.5% YoY. Lastly in more niche categories, the CPI measure reports that wine and watch prices are up ~4% and down a paltry 1% respectively, whereas the real-time metrics suggest wine and watch prices are down more significantly, falling ~15% YoY and 7.4% YoY, respectively. If we replaced these components in the CPI with the real-time metrics, CPI would be less than 2% on a YoY basis! The point is: there should be plenty of disinflation in the pipeline as CPI converges with some of these more real-time metrics.

Bottom line | Hotter than expected inflation has reduced market hopes for rate cuts, as expectations for 2024 rate cuts have fallen from six at the start of the year to around two today. However, it is important to remember that the Fed’s preferred measure of inflation is PCE, and much of the upward pressures on CPI (e.g., shelter, auto insurance) are not weighted as heavily within PCE. This should lead to continued downward pressure in the PCE; the Cleveland Fed expected core PCE to moderate to 2.6% YoY by April (which would be the slowest pace since March 2021). As we expect economic activity to moderate, the labor market to normalize and the downward trend in inflation to continue, we expect the Fed to cut rates three times in 2024.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.