Early signs of economic weakness are starting to emerge

- 06.13.25

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- The Fed will likely hold rates steady at the FOMC meeting next week

- Future decisions will get more challenging as growth slows and prices rise

- Early signs of economic weakness are starting to emerge

The calm before the storm is here – and the Fed knows it won’t last. Next week’s Fed meeting is expected to be relatively straightforward. With the economy showing solid momentum, policymakers are likely to stick with their current ‘wait and see’ approach – something many Fed officials have already telegraphed. There’s little urgency to cut rates just yet. But the calm may not last. As the effects of tariffs begin to ripple through the economy, the Fed’s job could get trickier. Slower growth and a temporary bump in inflation could complicate future decisions. While the updated Summary of Economic Projections – covering forecasts for growth, inflation, the unemployment rate, and the Fed funds rate – may shed additional insights, markets are unlikely to be swayed in either direction until the economic impact confirms the trend. Here’s how we see it unfolding:

- Next Week’s FOMC Decision Will Be Easy | Aside from a few minor tweaks to its economic forecasts, we don’t expect next week’s (June 17– 18) FOMC meeting to be a major market mover, as the Fed is likely to keep interest rates unchanged. With both sides of the Fed’s dual mandate—maximum employment and stable inflation—relatively balanced in today’s economic environment, the decision should be easy.

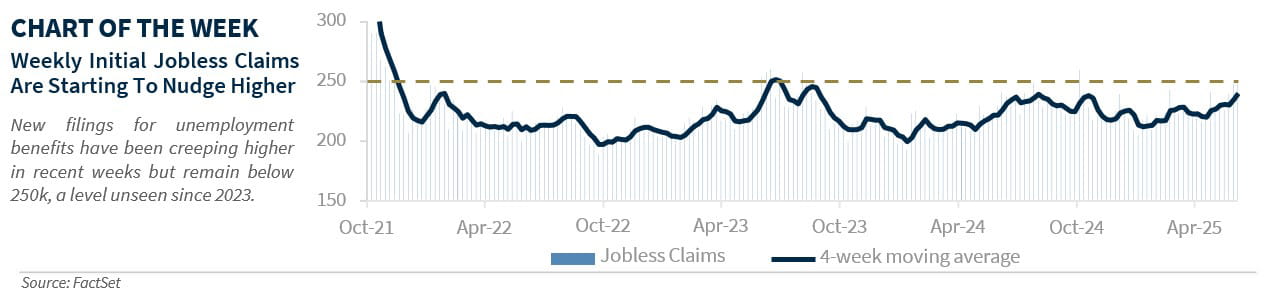

- Resilient Economic Activity—So far, the economy is holding up well, nowhere near the worst-case fears of a tariff-driven recession or what some surveys have suggested. Once again, we’re seeing that what consumers say doesn’t always match what they do. Our ‘Fab Five’ economic indicators—which track metrics like tax withholdings, credit card spending, airport traffic, and restaurant bookings— show that people are still spending. With the economy adding an average of 135,000 jobs over the past three months and jobless claims staying below 250,000, the overall consumer remains in good shape. Recession worries have eased, especially with the Atlanta Fed’s GDPNow model projecting a strong 3.8% rebound in second-quarter growth.

- Inflation Cooler Than Expected—Despite concerns that tariffs would drive inflation sharply higher, price increases have remained more moderate than many expected. The Producer Price Index (PPI)—often the first place inflation shows up—rose just 0.1% in May and 2.6% over the past year. Similarly, the Consumer Price Index (CPI) also increased by 0.1% in May and 2.4% YoY. While the earlier disinflation trend has paused, and inflation is running above the Fed’s 2% target, it’s still well below the 3.5% to 4% range that would raise serious concerns about runaway inflation.

- But Future Decisions Will Get More Challenging | As uncertainty lingers around the scale and timing of tariffs, the Fed’s job is about to get more complex. Much of the current economic data and corporate earnings were reported before the latest tariffs took effect, meaning the full impact has yet to be felt. Since tariffs tend to slow growth while pushing prices higher, Fed policymakers could soon face tough trade-offs between supporting the economy and keeping inflation in check. On top of that, they’ll need to consider the potential effects of the proposed ‘One, Big Beautiful Bill Act,’ which could include new stimulus measures like tax cuts—with more projected national debt possibly putting upward pressure on interest rates. And with Chair Powell’s term ending in May 2026, any behind-the-scenes maneuvering for his replacement could add another layer of complexity. Here’s what else could make the Fed’s decisions even more challenging:

- Economic Cracks—Some early signs of economic strain are emerging. Both the ISM manufacturing and services indices have recently dipped into contraction, auto sales have softened, and the latest Beige Book points to a slowdown in growth. Small business hiring plans are also becoming more cautious. At the industry level, companies are noting pressure on lower-income consumers—evidenced by weaker performance in fast food compared to upscale dining, stronger demand for premium airline seats over economy, and freight activity that has stabilized but hasn’t fully rebounded. In a consumer-driven economy, the key metric for the Fed to watch will be job growth. If monthly job gains consistently fall below 100,000, the Fed may consider stepping in to support the economy.

- Inflation Outlook Becomes Murkier—The inflation outlook is uncertain for two main reasons. First, comparisons to last year’s low inflation numbers will naturally push year-over-year figures higher, regardless of the impact from tariffs. Second, the impact of tariffs may take time to show up, as businesses work through existing inventory. Companies like Walmart (the world’s largest retailer), Best Buy, and Procter & Gamble have already signaled upcoming price increases due to tariffs. While a slowing economy and price-sensitive consumers may help ease some of this pressure, the Fed may still be concerned about a short-term inflation bump. The key challenge for the Fed will be determining how prolonged and widespread the tariff effects will be. Our economist still expects two cuts this year.

Bottom Line | Next week’s FOMC meeting is likely to be relatively uneventful, aside from some modest updates to the Fed’s economic projections and Chairman Powell’s press conference. However, as new forward-looking data begins to reflect the impact of tariffs, our outlook for a slowing economy and a temporary uptick in inflation could complicate the Fed’s decision-making in the months ahead.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.