What's Really Behind Your Numbers? A Practical Guide to Quality of Earnings Reports for Business Owners

Introduction

If you’re a business owner, you probably have a good sense of how well your company is doing. You know your sales, your expenses, and your bottom line. But if you’ve ever thought about selling your business, bringing in investors, or applying for a loan, you’ll quickly find that others don’t just want to see your financial statements — they want to know what’s really behind your numbers.

That’s where a Quality of Earnings (QoE) report comes in. It’s a tool that helps explain how much of your profits are steady and dependable, and how much might be from one-time or unusual events. This white paper will explain what a QoE report is, why it matters to you, and how it can help you protect your business’s value.

What Is a Quality of Earnings Report?

Simply put, a Quality of Earnings report takes a close look at your business’s profits and adjusts for anything unusual, temporary, or non-business-related.

For example:

- Did you sell a piece of equipment for a big gain this year?

- Did you get a one-time legal settlement?

- Do you run some personal expenses through the business?

A QoE report helps separate these kinds of one-offs from the profits your business earns through its regular day-to-day operations. That way, buyers, lenders, or investors — and you — can get a clear picture of what the business really makes year after year.

Why Should Business Owners Care?

Not all profits are created equal.

And when it comes time for someone else to evaluate your business — whether it’s a buyer, a bank, or a partner — they’ll want to know which profits they can count on moving forward.

Here’s why a QoE report matters:

- It shows the real, steady profits of your business.

- It helps avoid surprises in a deal or financing process.

- It allows you to fix problems or risks before others find them.

It gives you the tools to defend your asking price and negotiate from a stronger position.

When Would You Need One?

A QoE report is especially valuable when:

- You’re thinking of selling your business in the next three to five years,

- You’re bringing in new investors or partners,

- You’re applying for a bank loan or line of credit,

- You’re starting to plan your retirement or exit strategy,

- You simply want a clear, honest financial check-up.

Even if you’re not planning a transaction today, knowing what truly drives your profits and where risks might be hiding can help you run a better business.

What Does a Quality of Earnings Report Look At?

A QoE report reviews your business’s financial activity and focuses on:

- Where your revenue comes from — and whether it’s consistent or seasonal

- Which expenses are normal business costs and which aren’t

- One-time income or unusual transactions that won’t happen again

- How much working capital your business really needs to stay running

- Any hidden liabilities or financial risks that might affect future profits

The goal is to paint an honest, accurate picture of how your business performs in a typical year.

Methodology: How a QoE Report is Prepared

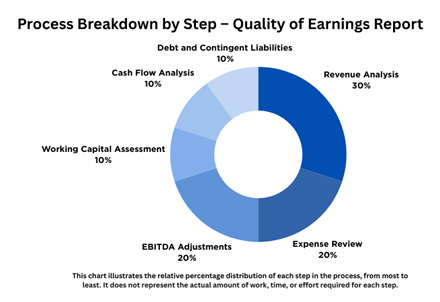

A thorough QoE report typically includes the following components:

- Revenue Analysis:

- Identification of revenue streams

- Recognition policies

- Seasonality and trends

- Customer concentration analysis

- Expense Review:

- One-time or unusual expenses

- Owner discretionary expenses

- Normalization of ongoing operating costs

- EBITDA Adjustments:

- Adjusting reported EBITDA to reflect sustainable, recurring earnings

- Working Capital Assessment:

- Determining normalized working capital needs to support operations

- Cash Flow Analysis:

- Understanding cash conversion cycles and non-operating cash flows

- Debt and Contingent Liabilities:

- Identifying off-balance sheet risks and debt-like items

A Simple Example

Let’s say Greenleaf Landscaping, Inc. reports $4.2 million in profits this year.

But when the numbers are reviewed:

- $500,000 came from a one-time legal settlement

- $200,000 came from selling old trucks

- $150,000 was personal expenses paid through the business

When those are taken out, the real ongoing profit is $3.6 million.

This matters because a buyer or lender would base their offer or loan terms on the lower, recurring number — not the inflated total. By knowing this ahead of time, the business owner can plan better, adjust expectations, and avoid surprises.

Conclusion

In an environment where financial clarity is paramount, a Quality of Earnings report provides a critical, reliable assessment of a company’s earnings power.

Your financial statements tell a story, but sometimes that story includes extra chapters — one-time events, owner perks, or unexpected windfalls — that don’t reflect your business’s steady earnings. A Quality of Earnings report helps you separate the steady from the temporary, giving you a clearer view of what your business is truly worth.

Whether you’re preparing for a sale, seeking financing, or just want a better handle on your financial health, a QoE report is a smart investment in your business’s future. As deal volumes grow and transactions become more complex, the demand for QoE reports will continue to rise — solidifying their role as an indispensable tool in modern financial due diligence.