Utilizing Private Equity as a Wealth Planning Tool

By Christopher J. Wagner | June 2025

Introduction

For many business owners, the sale of their company is the single largest financial event of their lifetime. Choosing the right exit strategy isn’t just about valuation — it’s about protecting your legacy, maximizing after-tax proceeds, and setting up your personal financial future. It can also be one of the most effective ways to unlock the potential of a business, through both the injection of capital and the institutionalized focus on growth. This makes Private Equity a potentially attractive option for business owners that are looking to both grow and/or exit.

Private equity offers a distinctive, flexible, and tax-efficient path to achieve these goals.

This white paper explores private equity and how it can be thoughtfully integrated into wealth planning strategies to address tax efficiency, estate planning, business succession, and legacy objectives.

What is Private Equity?

Private Equity Groups (PEGs) are firms that have raised capital to make minority and majority ownership in companies. There are two types of PEGs, Funded and Unfunded. And typical PEG investment strategies are as follows:

Let’s first talk about Funded Groups.

- Funded PEGs comprise the majority of all PEGs

- The fund managers (General Partners) raise committed capital from investors (Limited Partners) to acquire (“buyout”) businesses.

- Funds sizes range widely from a few million to several billion dollars

- Typical investors include pension funds, endowments, insurance companies, high-net-worth families and other institutional investors

- PEGs often manage multiple committed funds simultaneously

- For example, XYZ Capital is actively investing in Fund VI, while simultaneously managing and exiting Fund V investments.

Second, we can talk about Unfunded Groups.

- Unfunded PEGs do not have access to committed capital

- The number of unfunded PEGs has increased as a direct result of the difficulties inherent in raising a fund with committed capital

- Approach to deal financing varies by unfunded PEG structure. There are 3 types of structures:

- Pledge Fund: Investors cover expenses in exchange for first right of refusal on new deals – investors decide typically, to invest on a deal-by-deal basis.

- Search Fund: Like a pledge fund in structure but fund managers typically want to take an active role in management of acquired business.

- Fundless Sponsor: Typically, do not have affiliated investors and cover own expenses while searching for a deal – seek to lockup business under LOI and then subsequently arrange financing.

Estate Planning Leverage

Private equity interests can be transferred to trusts, family partnerships, or charitable entities at discounted valuations, making them highly effective for:

- Wealth transfer minimization

- Generation-skipping transfer (GST) planning

- Charitable remainder trust (CRT) funding

- Donor Advised Funds (DAF’s)

Business Succession Planning

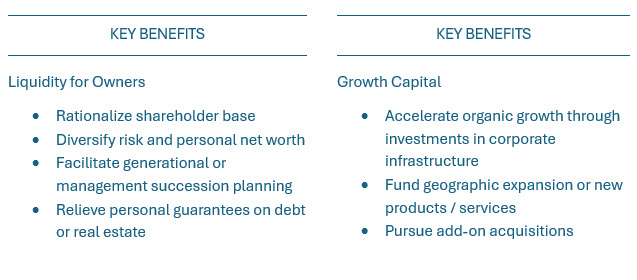

For business owners considering liquidity events or succession strategies, private equity provides opportunities to recapitalize, retain partial ownership, or transition leadership while monetizing business value. So, what are some key benefits of a partnership with a PEG?

Key Wealth Planning Benefits of Selling to Private Equity

Liquidity with Continued Upside:

- Sell a majority stake while retaining partial ownership

- Benefit from a future “second bite at the apple” when the business is resold

- Monetize a portion of your business now while participating in its future growth

- Identify a Private Equity partner that you feel can meaningfully contribute to the growth of your business (industry experience, acquisition strategies, etc.)

Tax Optimization Opportunities:

- Pre-sale gifting of ownership interests to family trusts or charitable entities at discounted valuations

- Potential for deferring capital gains across multiple liquidity events

- Implement estate freeze strategies to limit taxable estate value while passing future growth to heirs

Preserve Your Business & Protect Your Legacy:

- PE buyers often keep the company’s brand, leadership, and workforce intact

- Flexible deal structures allow for continued involvement, if desired

- Support future growth and employee opportunity while exiting on your terms

Diversify Personal Wealth:

- Convert illiquid business equity into a diversified, investable portfolio

- Reduce personal financial risk concentrated in a single asset

- Secure multi-generational financial independence

Access Growth Capital & Professional Resources:

- Fuel expansion, acquisitions, or product launches

- Partner with experienced operators and financial experts

- Scale the business faster than you could independently

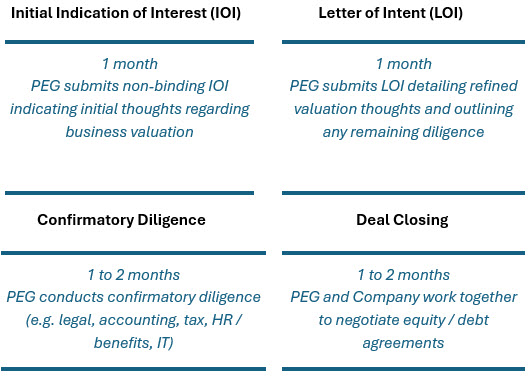

While every deal is different, PEGs can typically evaluate and close a transaction in four to six months.

During these four phases of the transaction process there are some key diligence items that will typically be addressed.

IOI Phase – Evaluate threshold items, which will vary by PEG but typically include:

- Business Model

- Competitive position

- End markets / industry

- Financial profile: size, growth, margins and free cash flow

- Customer / vendor diversity

- Near-term growth opportunities

LOI Phase– Onsite / In-person business diligence meeting with Company management team to discuss:

- Company history / key milestones

- Industry / competitor trends

- Competitive differentiation

- Sales and Marketing

- Operations structure and key trends

- Key financial trends

- Key growth opportunities

Diligence Phase – Onsite meeting with management to discuss PEGs analysis of key business trends and go forward strategic growth plan:

- Third-party diligence about Market

- Industry, accounting and tax issues

- Your technology

- HR & Benefits and Legal.

Closing Phase – Management to meet in-person with potential lenders to facilitate PEGs selection of lender and finalization of debt financing package:

- PEG to receive final third-party confirmatory diligence reports

- PEG and Company to finalize negotiation of equity and debt agreements

Is a Private Equity Sale Right for You?

Deciding whether to sell your business to private equity is about more than just numbers — it’s about aligning your financial future, personal values, and business legacy. If you’re seeking liquidity, diversification, and a tax-efficient way to transition wealth, while maintaining a stake in your company’s continued growth, a private equity transaction may be an ideal fit. It’s a flexible, strategic option that can help you protect what you’ve built, unlock long-term value, and secure financial independence for yourself and future generations. As with any major decision, it’s essential to evaluate your personal goals, risk tolerance, and legacy priorities with a trusted wealth advisor and transaction team before moving forward.

Ideal for owners who:

- Want to get rid of personal guarantees

- Seek significant liquidity and estate planning opportunities

- Want to preserve their company’s culture and workforce

- Are open to retaining a minority interest or advisory role

- Have a business with growth potential and strategic value

- Private equity isn’t just a transaction — it’s a wealth strategy.

- It can help you achieve liquidity, tax efficiency, and legacy continuity while opening new opportunities for your company and family.

At Lamington Private Wealth Advisors of Raymond James & Associates, we understand that selling your business is one of the most significant financial and personal decisions you’ll ever make. Our role is to serve as your strategic partner throughout the process — helping you not just complete a transaction, but structure it in a way that supports your long-term financial goals, preserves your legacy, and minimizes tax exposure. We recommend this should start 3 to 5 years before a transaction so that all available pre-transaction planning steps are covered.

A good way to identify the right private equity partner is by leveraging our team’s established relationships with experienced investment banking professionals who specialize in representing privately owned businesses in complex negotiations.

We work closely with you and help structure your deal team to evaluate private equity offers, identify the wealth planning opportunities a sale creates, and design a personalized strategy for what comes next. From pre-sale estate and tax planning to post-sale investment management, liquidity diversification, and multi-generational wealth transfer, we guide you through each stage with clarity and confidence. Through our relationship with Raymond James Financial and access to specialized resources, we can also facilitate introductions to private equity groups, transaction advisors, and legal counsel, ensuring you have the right experts at the table.

Ultimately, our mission is to help you turn a business sale into a strategic wealth event — one that secures your financial future, honors your hard work, and supports the people and causes you care about most.