Intelligently countering market fluctuation with portfolio flexibility.

Intelligently countering market fluctuation with portfolio flexibility.

Call our investment approach what you will. Technical. Tactical. Non-traditional. What we call it is a well-reasoned approach for attempting to mitigate market risk and reducing downside exposure, while still pursuing market-like returns.

Granted, this takes much technical knowledge and due diligence, but we believe that in today's world, managing wealth requires managing the risks it faces – and we are thoroughly prepared to accomplish this crucial objective on behalf of our clients.

We utilize and implement individual mutual funds, individual fixed income securities, structured products, alternative investments and annuities. We may consider separately managed accounts or individual stock selections if it makes sense, but they typically present more risk.

-

Over the past 20 years, asset allocation has increasingly become the foundation of individual as well as institutional investment portfolios. Yet, while many people are familiar with the concept, not all fully understand what it means to them and their investments.

Asset allocation entails exchanging the potential to reap a higher return – and the risk of taking an equally dramatic loss – for the likelihood of generating a more consistent, positive return over the long term.

The general idea is that instead of devoting the bulk of your assets to a particular sector or even one specific investment, you choose different types of investments. Underlying this decision is the assumption that each asset class will react somewhat differently to a given event. For example, if interest rates rise, some asset classes should, as a whole, increase in value. Conversely, the value of some of your investments will tend to decline in the same environment – but should flourish when rates drop.

Basic Asset Classes

Depending on your appetite for risk, the economic environment, your specific investment objectives and other factors, your portfolio might include some or all of the following:

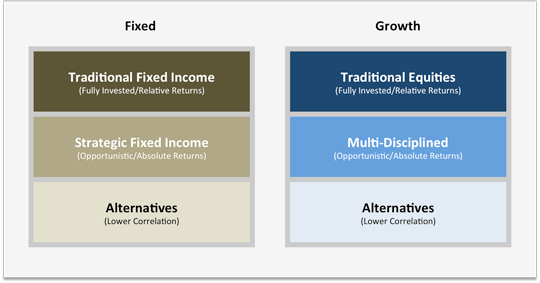

Depending on your appetite for risk, the economic environment, your specific investment objectives and other factors, your portfolio might include some or all of the following:- Cash and cash alternatives

- Fixed income

- Traditional equities (U.S. and Non-U.S.)

- Multidisciplined (tactical and balanced)

- Alternative investments

There is no assurance that any investment strategy will be successful. Asset allocation does not guarantee a profit nor protect against loss. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability.

-

Our proprietary portfolio construction methodology incorporates multidisciplined and investment alternatives alongside traditional long-only equity and fixed income asset classes for the purposes of providing additional diversification, lowering correlations and potentially reducing volatility.

-

We conduct extensive quantitative and qualitative investment manager research and due diligence in order to identify and select quality money managers and help maximize opportunities in each asset class.

We have a particular interest in managers who have the flexibility to invest across asset classes and who can get defensive when conditions permit. Our efforts here support our steadfast goal to attempt to mitigate long-term risk and capture less downside in the market.

Qualitative

Investment Thesis

Process

Experience

AccessQuantitative

Performance

Risk & Volatility

Market Capture

Correlation

Alternative investments involve substantial risks that may be greater than those associated with traditional investments and may be offered only to clients who meet specific suitability requirements, including minimum net worth tests. These risks include but are not limited to: limited or no liquidity, tax considerations, incentive fee structures, speculative investment strategies, and different regulatory and reporting requirements. There is no assurance that any investment will meet its investment objectives or that substantial losses will be avoided.