A lesson from recent history

Drew O’Neil discusses fixed income market conditions and offers insight for bond investors.

It has been over six months since the FOMC has made a change to the Fed Funds rate. While the debate continues as to when the next cut will be, market consensus (per Bloomberg calculations) is currently for a 25 basis point cut in September. Past that, markets are somewhat split between an additional 25 to 50 basis points in cuts from September through the end of the year. As much of the interest rate headlines and market commentary that we all hear on a daily basis are focused on the Fed Funds rate, it is important to keep in mind what the Fed Funds rate is and what the downstream effects of changes to the rate mean for fixed income investors.

The Fed Funds rate is an overnight rate. It can be thought of as the shortest maturity on the yield curve. When the FOMC is “cutting rates,” it does not mean that they are cutting rates across the entire yield curve. As they cut the overnight rate, the effects tend to be felt most strongly on the short-end of the curve. Longer maturity yields generally take their direction from the longer-term macroeconomic outlook and trends (longer-term views on inflation, growth, employment, etc.). So, the FOMC cutting, or potentially cutting rates, does not mean intermediate and long-term yields will necessarily move by the same margin, or even in the same direction. A recent and stark example of this can be seen by looking at what yields have done since last September, when the FOMC started the current rate cutting cycle.

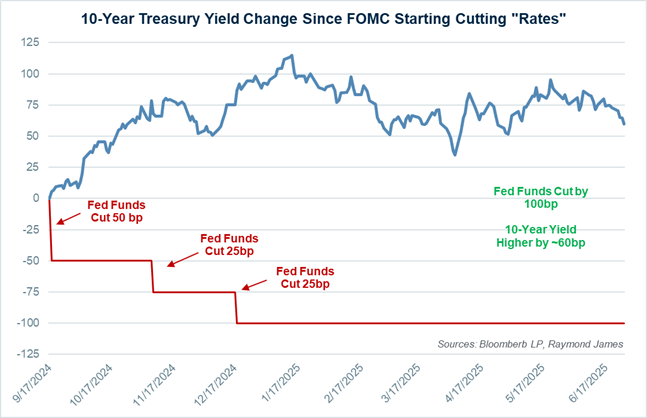

The chart below shows the yield changes for the Fed Funds rate versus the 10-year Treasury since September 17, 2024. The Fed Funds rate has been lowered by a total of 100 basis points since then. Over that same timeframe, the yield of the 10-year Treasury has moved in the opposite direction. Four months after the initial FOMC rate cut, the Fed Funds rate was 100 basis points lower and the 10-year Treasury was ~115 basis points higher, resulting in the two rates being 215 basis points further apart than at the start of the timeframe. Things don’t always play out how you think they will.

What is the takeaway for fixed income investors? As much as we try to predict the future, there are numerous factors influencing the markets that will affect how things eventually play out. While the FOMC is a powerful force in the market, it isn’t the only force. Whether it is predictions about where Fed Funds will be six months from now, where the 10-year Treasury will be in a year, or what the relative value of municipal bonds compared to taxable bonds will be next month; at the end of the day these are all just predictions that may or may not play out as expected. What we do know is that right now, yields across the fixed income space are at some of the most attractive levels that we have experienced over the past 15+ years. These yields can be locked in today, meaning that returns for years into the future do not depend on accurate market predictions. Contact your financial advisor today to inquire about the current opportunities available in fixed income.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.