Growing U.S. debt – trouble ahead?

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

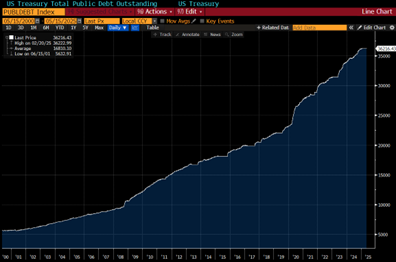

Last week I talked about the upward sloping Treasury yield curve, a welcome change from the inverted yield curve that lingered for years. The upward sloping curve means that investors are rewarded more for taking on duration. Today I am shifting to the mounting concerns for an upward sloping history of growing debt. The U.S. total public debt outstanding has reached over $36 trillion. The national debt could be compared to your personal debt held on a credit card. It is borrowed money that is accruing interest. Each of the 340 million people in the population would have to pay $106,486 to pay the debt off. Afterall, we are the nation, and it is our debt. A household of four would have to come up with nearly $426,000, an improbable resolution for most Americans.

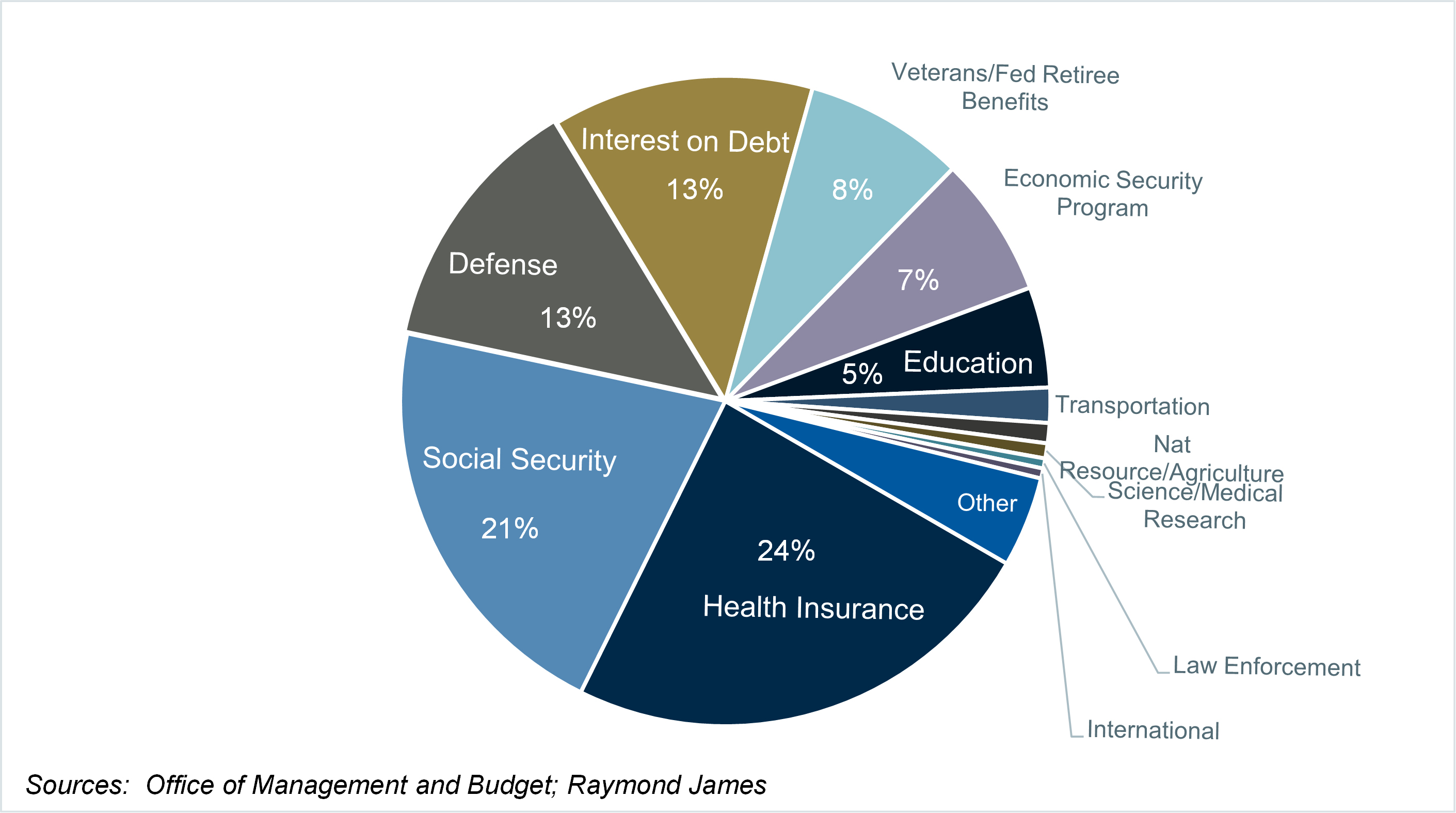

The US government now spends ~13% of its budget on interest for this debt. If this were your household’s credit card debt, spending 13% of your paycheck just for interest seems disproportionately high. Receiving a raise at work would help to remedy the situation by giving you the ability to pay down some of the debt. In the same way, the nation’s gross production could increase and help pay off some of the national debt. However, you can’t always count on a raise, nor can the nation rely on growing its way out of the problem.

By cutting back on household expenses, you can slowly lower your credit card debt. The US government can likewise reduce its spending. This is likely a little trickier for the government though because finding ways to reduce spending may involve reduction of entitlements which would be politically unpopular. The three largest sectors of US spending are health insurance (including Medicare and Medicaid), Social Security, and defense. Cutting defense is not a viable option and cutting entitlements of healthcare and supplemental retirement income would be grossly ill-received.

Another solution would be to increase US government revenue by raising taxes. Although the political mantra is often a decree to “tax the rich,” there simply are not enough rich people to tax and impact the national debt. Even though the middle class is shrinking, it still represents about 51% of American households and taxing this group would be highly unpopular.

Inflation can also help a nation pay down debt although this could have negative and positive effects. In essence, inflation decreases the spending power of a dollar so although the nominal dollars of debt remain constant, the real value of the debt decreases. Since the value of money is decreasing, the government is effectively repaying debt using currency that is worth less than when the debt was initially incurred.

None of these: deep spending cuts (including entitlements), taxing the middle class, or inflation are popular or coveted solutions to our debt problem. Substantial economic growth is welcome but certainly not a guarantee. Although the government has more options than a household with debt, there is a level of debt where there is no point of return. In other words, once the interest on debt becomes too big of a burden to manage based on the nation’s revenue, the nation is in trouble.

Moody’s is one of the major credit rating companies along with S&P and Fitch. Friday, Moody’s downgraded the U.S. government’s rating from Aaa to Aa1 bringing it in line with like ratings from S&P and Fitch. The growing nation’s debt is the primary reason. This rating change could push benchmark yields higher as investors typically demand higher return when risk increases or is perceived to increase. It also has the potential to dampen market sentiment. Given that the U.S. is a consumer-driven economy, consumer sentiment is of utmost importance.

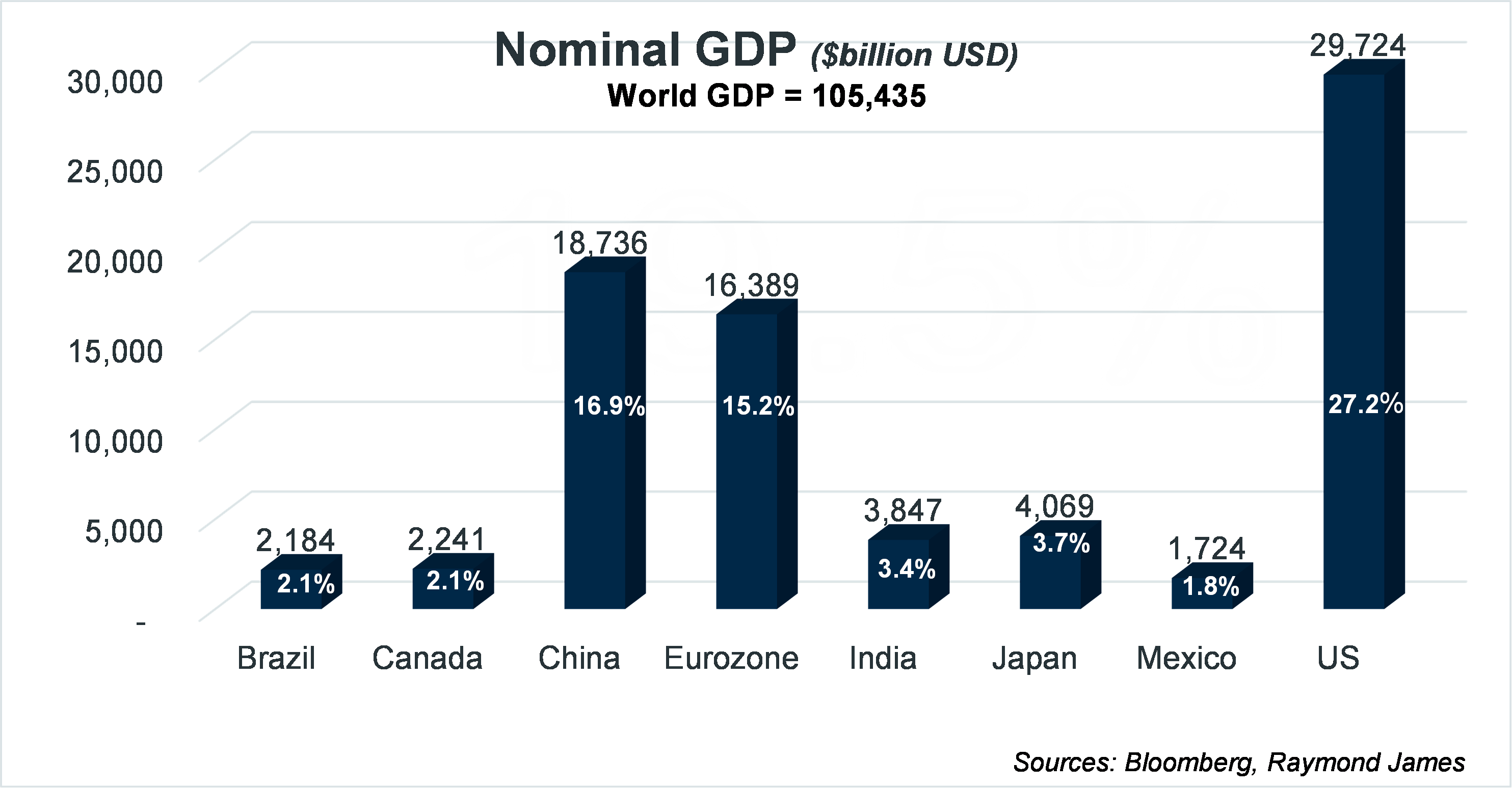

The positive side is that the U.S. remains the largest economy in the world, producing 27% of the world’s gross domestic product. By comparison, the U.S. produces 61% more GDP than the next highest nation which is China. China produces 16.9% of the world’s GDP. The U.S. remains the most powerful economic force, military force, and its dollar is the world’s currency. The red flags are raised though, and it is time to address the debt issue before it reaches a point of no return.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.

Those who keep learning, will keep rising in life.