Not If But When

Since we have had more questions lately about the market and our “take” on the market, we thought that a little visual might help.

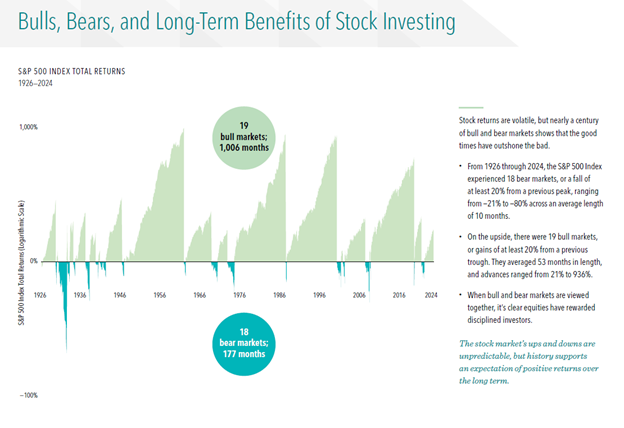

When we are asked about what we expect the market to do, we can only answer honestly with two answers. 1- We have no earthly idea what it will do tomorrow, next month, or next year. 2- For investors who expect to have a portion of their assets invested in the stock market for most of their lives, then the odds are very high that they will be rewarded for their temperament and discipline. And that means staying disciplined when, not if, bear markets occur.

Because bear markets, corrections etc. are part and parcel of the experience which long-term investors face, we thought the chart below may help put them in perspective.

Source: Dimensional Advisors

As you can see, they have happened with regularity. Also, the average drops the stock market experiences annually is 17%. That is the norm.

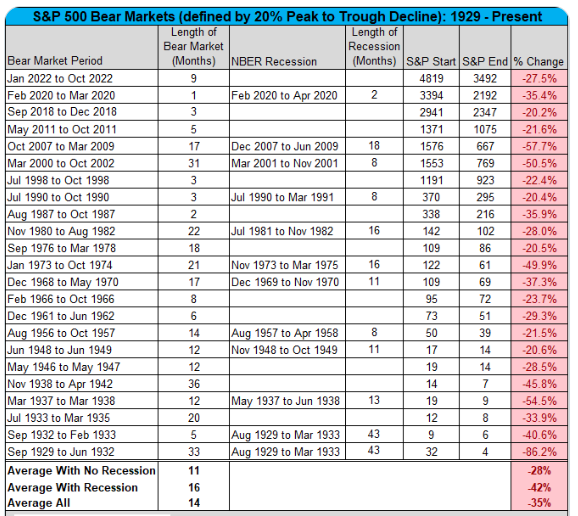

The chart below is almost scary. I started in the investment business in 1983, so I have been through 9 bear markets, with two drawdowns of over 50%. They were not fun and seemed to last forever, but to provide some perspective, the Dow Jones closed at 1190 at the end of 1983.Today it closed at 41,583. But as the chart below makes clear, it was not a carefree ride.

Source: Creative Planning

When these inevitable events in the chart above occur, this can remind us that these events are the price of admission to earn the positive returns of owning many great companies around the world.

Thank you as always for your trust and confidence in us and don’t hesitate to call with any thoughts or questions you have.

Disclosure: The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of John Foster and not necessarily those of Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Prior to making an investment decision, please consult with your financial advisor about your individual situation. If you no longer wish to receive these emails, please reply “unsubscribe.