Economic Monitor – Weekly Commentary

by Eugenio Alemán

Higher oil prices complicate monetary policy

June 13, 2025

Chief Economist Eugenio J. Alemán discusses current economic conditions.

If there is something the Federal Reserve (Fed) does not want to see today, as it approaches next week’s Federal Open Market Committee (FOMC) meeting, it is a shock to oil prices. The reason for this is that it brings back memories of the 1970s and 1980s, when oil prices surged and contributed to higher inflation during those decades. But the similarities don’t end there. Some of the actors of the events that triggered the shocks to oil prices are also familiar and involve Israel and Iran.

However, we have come a long way from the 1970s and the 1980s, especially when it comes to the consumption of petroleum. The global economy does not depend as much on oil today as it did back in the 70s and 80s, and thus, a petroleum shock is not as impactful as it was during those decades. Of course, the total impact on petroleum prices is difficult to predict because it will depend on the evolution of the conflict between these two countries.

But the truth is that one of the most important contributors to lower inflation over the last year or so has been a decline in petroleum prices, and the current conflict will probably disrupt this trend. Thus, there is a high probability that Fed officials will be spooked and their risk aversion will increase, which means that monetary policy will probably remain restrictive for a longer period of time. That is, tariff as well as petroleum price uncertainty will definitely keep the Fed on the sidelines for next week’s meeting and could potentially reduce the probability that they will lower interest rates later in the year.

Under this scenario, the core PCE price index and the core CPI price index will be of utmost importance for the Fed. If headline inflation accelerates but core inflation remains contained, then the monetary policy path could remain intact. However, if we see both headline and core inflation moving up, then the prospects for lower interest rates are probably less likely.

Little inflation impact from tariffs, so far

This was a good week for inflation as well as for the Trump administration, as tariff-related impacts are still not popping up in the headline inflation numbers. We have seen marginal impact in some goods prices, but the emerging weakness in the service side of the economy is showing up in pricing power weakness, which is keeping overall inflation numbers contained—at least for now.

However, we have to add US dollar weakness to the threat of higher inflation from tariffs, as this weakness will make imports even more expensive and could add another layer of potentially higher prices going forward. On the flip side, this week’s attacks between Israel and Iran are showing up as an appreciation of the dollar, as investors seek less risk from current uncertainty, which could lessen the impact of the dollar on import prices.

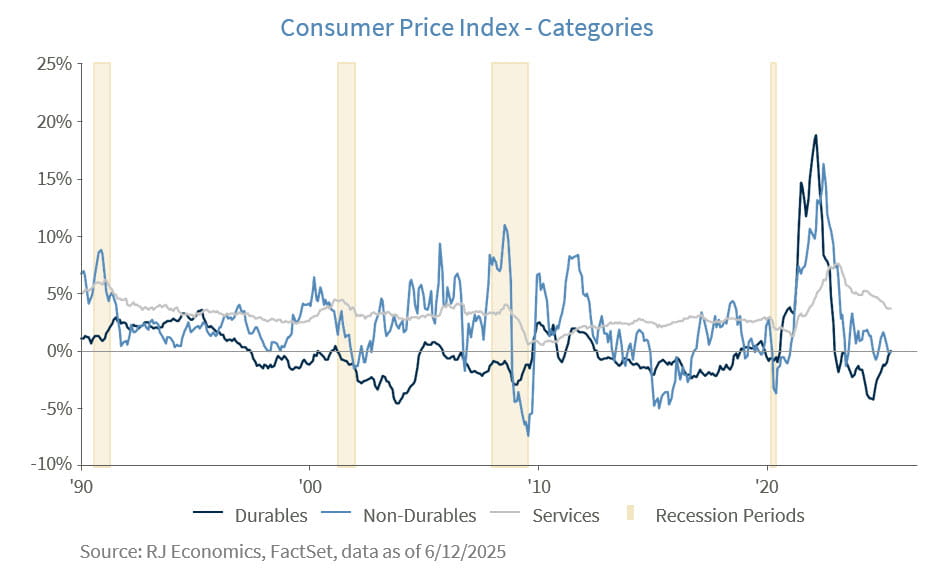

Perhaps the biggest unknown remaining has to do with the state of economic activity. Last week, we saw the first sign of potential weakness in the service side of the economy, with the ISM Services PMI dropping into contraction in May, the first such reading since June of 2024. Furthermore, while both durable and nondurable goods prices were almost flat on a year-over-year basis in May, services prices continued to slow down, hitting 3.7%. That is, the underlying disinflationary environment continued, so far undisturbed from increases in tariffs.

It is still not clear if the lack of tariff-induced price hikes are the result of President Trump’s “eat tariff price increases” comments, the overall weakness in economic activity—which makes it difficult for firms to pass larger price increases to customers—still high levels of uncertainty regarding the future levels of tariffs which make it difficult for firms to know by how much they should be increasing prices, or a combination of all of the above.

What we do know is that whatever the reason is for the reduced impact from tariffs on the rate of increase in prices, this is going to cost firms considerably, as earnings will reflect these effects at some point during the year.

If these effects push firms to adjust their employment levels in order to reduce the impact on profits, then we can see some further economic weakness ahead. This is the reason why we are not changing our recession probability (50/50) as many shops have been doing lately. That is, we still believe that uncertainty about the future is problematic and has the potential to derail economic activity during the second half of the year.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It provides a indication of the health of small businesses in the U.S., which account of roughly 50% of the nation's private workforce.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.