As we continue through 2023, our reflection on our ROOTs philosophy remains relevant. If you remember, Retire On Own Terms (ROOTs) focuses on you as an individual, not a walking number working within a cookie cutter framework. You do not need to use the same approach as your parents, neighbors or friends to reach the retirement setup for you. We want to partner with you to create a plan to balance your personal goals and create the financial confidence required to live your life, and later your retirement, on your terms. As we move into the heart of the summer season, the need for balance comes into sharp focus. Balancing work with play, screen time with sunshine, commuter time with boat time.

Your financial life is no different. Finding that balance between your “needs” versus your “wants” and your short-term goals against your long-term goals is a lifelong project. Not every penny needs to be maximized on the spreadsheet. “If you would just invest that $4 instead of buying that coffee….” can be a problematic mindset if you don’t seek the balance with days where you just need that hit of caffeination. How you invest your money requires this same balanced approach. Life is not lived inside a spreadsheet. There is not a spreadsheet in the world that would generate a formula result of “buying this fantastic boat is a better return than the S&P 500 over the next decade.”

You don’t buy a boat for the return on investment. You buy a boat to create memories of sunset cruises disconnected from the noise, of kids and grandkids jumping off the back and of laughter and lake spray with your friends. The concept of ROOTs revolves around creating a financial plan allowing you and your family to live the life you want now and in the future. Growing your pot of gold now without waiting for the end of the rainbow to enjoy it.

How do we help ensure you can take that trip of a lifetime, support your grandkids through college or buy that boat? You take the right steps today to put yourself in a position to do those things when the time is right. You do not take on excess risk in the stock market, lying awake at night sweating your risky future position. Your investments should reflect your goals, your values. Your neighbor’s goals and values have little bearing on your own. For all you know, your neighbor suffers from naviphobia (fear of boats). If life was all about beating a benchmark, you wouldn’t pay a lawn care company to mow your lawn. There would be no boat industry. Coffee shops? Forget about it.

Take a moment to reflect. Do your assets and financial decisions mirror your family values? Are you taking the right steps and allocating to the right investments so you can continue to live the life you desire? If your answer is yes, put your blinders on and ignore the noise around you. If your answer is no, it is time for us to sit down together and revisit your financial picture so we can get you to R.O.O.T.s.

If you’re in your 70s, you’re likely familiar with having to take annual RMDs from your IRA accounts. You can steer a portion of those distributions (up to $100,000) directly to a qualified charity, taking a pass on the income taxes that would normally be due on that portion of your RMD. This is what’s called a qualified charitable distribution. These can be done now, you do not have to wait until the end of the year!

Do you have Power of Attorney documents created in conjunction with your estate planning attorney? Have you updated your trust documents in the past few years? Send us a copy! Having these documents in your file allows us to timely and smoothly transition to working with your representative or trustee if events so dictate. You can drop them off, mail them in OR utilize our secure, digital storage platform: VAULT (accessed through your online account profile).

As interest rates quickly increased this past year, they rippled over to money market accounts and short-term individual bonds. If you are looking for some alternatives for your cash, give us a call. We are helping clients find 4-5% rates for their short-term needs.

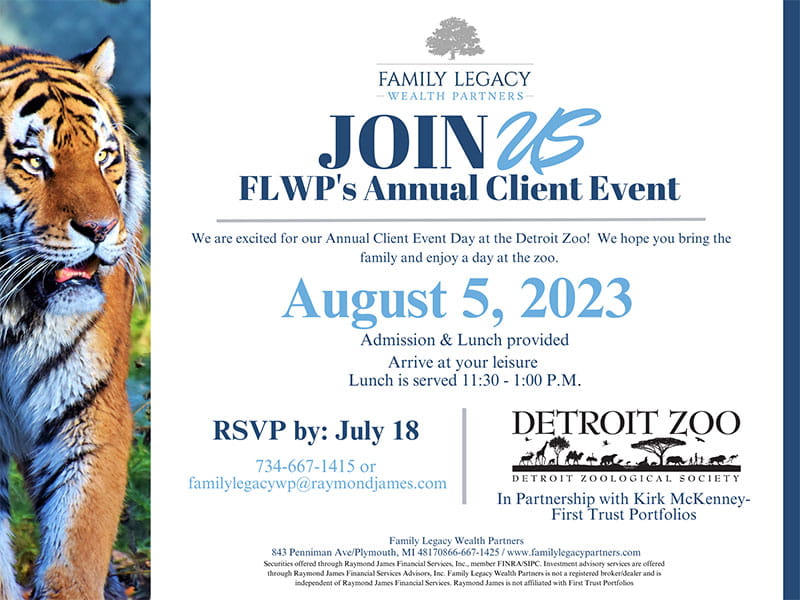

Mark your calendars - Client Appreciation Week is just around the corner (July 31- Aug5)! It's that special time of year when we wholeheartedly honor and celebrate the wonderful relationships, we have with you and your family. We have exciting plans lined up and we can't wait to show our appreciation. To wrap up the week, we are returning to the Detroit Zoo on August 5th. We hope you can join us!

In our continued efforts of being curious this year, we have been wanting to ask even more questions and need your help! We need to hear from you! You are our R.O.O.T.s and your input matters, you help us shape who we are and the direction we go in (we nurture and water this tree with you in mind and based on your needs and requests). In the coming weeks you will be receiving a survey from us. We would greatly appreciate your time to fill this out. It will only take 5 minutes and can easily be accessed from your phone or computer. If you have any questions don't hesitate to call the office.

Last quarter, our team joined forces with Jeff Horton from Horton Plumbing to undertake a collective effort in beautifying Smith Park. Together, we mulched flower beds, cleared away tree debris and removed weeds (ALOT OF THEM!) all with the aim of enhancing the park's appearance for the upcoming spring season.

Have a volunteer experience we might be able to help with? Let us know, we always looking for ways to get involved with our community.

Colin and his wife, Ali recently celebrated the arrival of their precious baby girl, Kendall, in May. We're thrilled for their growing family and excited to witness their beautiful journey as loving parents.