Here we stand at that unique time, another year behind us and a new one ahead. This year will have plenty in store for the markets, our practice and your experience with FLWP. We have been brainstorming ideas and potential enhancements to expand on the deep roots which you have planted with FLWP. We wish to continue to nurture our relationships with you and see them continue to flourish.

We spent time in 2023 getting curious with you, aiming to better understand your expectations of us, by using a survey. Through the conversations initiated, we dove into exploring your hopes and fears connected to your wealth, while encouraging you to further define the “why” behind your actions.

We appreciate your continued openness and willingness to connect and share with us. These deeper relationships and connections assure we understand your needs and connect with your priorities. Based on your feedback, we will continue to focus on team development in 2024 to ensure we stay sharp and keep our communication with you top notch.

Many of you have enjoyed this newsletter as we have shared more of the behind-the-scenes happenings with you. We will continue to shape this into a resource on industry updates, legislative changes, market

We look forward to continuing to walk alongside you your wealth journey in 2024. We would not be here without you, and as Lindsay reminds us, “We do not take this responsibility lightly.” We know you have choices; and are grateful and proud you have chosen us.

The markets saw some relief and rallied late last year with the Federal Reserve’s announcement that interest rates will stay level or potentially decline in 2024. Could we continue to see additional upside as we enter the new year? The answer is very similar to the possibility of the Detroit Lions winning the Super Bowl: Yes. But there are plenty of challenges ahead including, higher interest rates, inflation, and an election year. While individuals and businesses have been rather resilient, the question becomes how much more pain can be tolerated?

Historically, election years have provided relatively stable returns in the market and while we don’t anticipate that changing, playing politics with your portfolio is not something that proves to be successful over the long term. We have seen contentious election cycles in the past and this year appears to be another fiery one. We aim to construct portfolios and make recommendations based on fact rather than news headlines.

While we are cautiously optimistic for this year, there are a few areas of opportunity that we plan to position for. In the bond market, taking advantage of the rise in interest rates and being more active in longer term fixed income gives us the opportunity to lock in attractive rates that we have not seen in many years. In the equity markets, we expect the market performance to broaden away from just a few technology names outperforming to a market that has more participation as companies now seem to have better earnings potential and clearer outlooks with interest rates stabilizing.

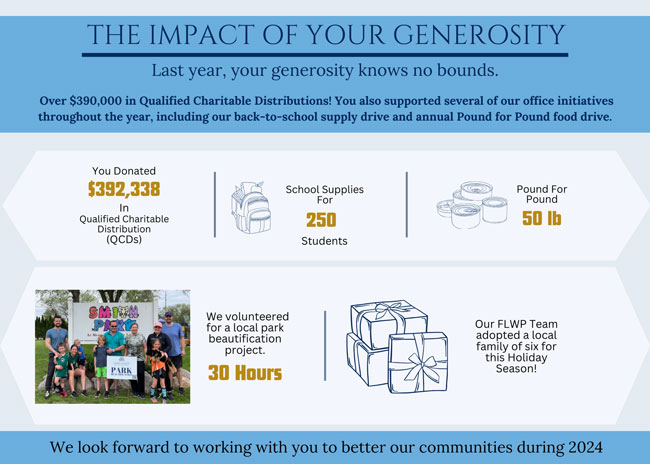

It continues to warm our hearts to see the generous and community-focused nature of our clients. Thanks to you, many local charities, churches, and global organization are in a better position to impact their communities. You sent out over $390,000 in Qualified Charitable Distributions last year! You also supported several of our office initiatives throughout the year, including our back-to-school supply drive and the annual Pound for Pound food drive. Below is a recap of the amazing efforts you and the FLWP team supported in 2023!

We look forward to working with you to better our communities during 2024

2024 Contribution Changes

Employer Retirement Plans Contribution

401 (K), 403 (B) & 457 plans

Traditional & Roth IRA Contribution Limit

Must have earned income to qualify

Annual Gifting Limit

Annual Gift tax exclusion:

In December, we hosted a Winter Wonderland in the office! We had such a great time connecting with families and our community. The kids made some wonderful holiday crafts at Santa’s Workshop and there was even a surprise visit from the big guy in red!

This quarter one of our own, Bill Hartsock, will be navigating his own retirement. Bill has been a part of our team since 2010, and has found cherished relationships with many of you. He has determined it is time to step away and focus on this next stage with his family. We will miss Bill’s storytelling and thoughtful approach to shaping the direction of both our business and our client relationships. We have spent months working to assure his clients feel supported as they transition to working with a new advisor. For those of you impacted, we hope you observe us practicing what we preach by creating a succession plan to support you as Bill made the decision to step away from this portion of his life’s work.