Investor Sentiment is at Historic Lows - What Does That Mean for Markets?

This year has been full of uncertainty for investors. Government spending cuts are leading to job losses, tariffs are creating economic uncertainty, and market sentiment is shaky.

Many investors are wondering what’s next.

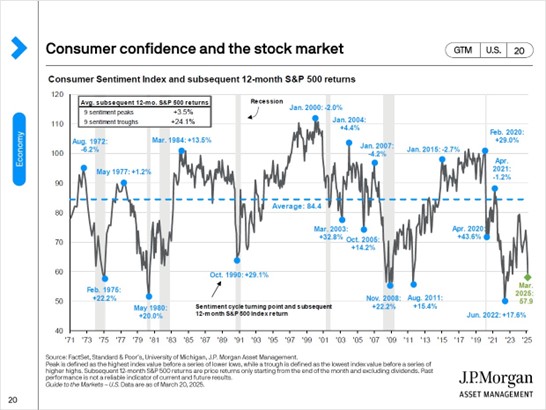

One way to gauge consumer sentiment is the University of Michigan Consumer Sentiment Index, which surveys households on their financial outlook, business conditions, and overall confidence in the economy. Historically, extreme highs and lows in consumer sentiment have been valuable contrarian indicators for the stock market.

The most recent reading of 57.9 is in line with periods like 2008 and 2011—even at the height of COVID in April 2020, investors felt more confident than they do today. I think it’s important to take a step back and think about that. Consumers felt better when we were dealing with a once every hundred-year pandemic that we had no immediate solution for. I remember going to the grocery store when the pandemic just started, it felt like I was in a movie showing the beginning of an apocalypse. People felt better then, than they do now!

What’s interesting is that historically, markets tend to underperform when sentiment is high (average return: +3.5% over the next 12 months). But when consumers are most pessimistic, markets have historically delivered strong returns (average: +24.1%).

While past performance is never a guarantee, this pattern suggests that when investors feel the most uncertain, we may actually be approaching a turning point for the better.

How are you feeling about the market right now? Drop your thoughts in the comments!

Every investor's situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Michael Fitzgerald and not necessarily those of Raymond James. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market.