The Week In Review 8/7/2023

Some people grumble that roses have thorns; I am grateful that thorns have roses. ~ Alphonse Karr

Good Morning ,

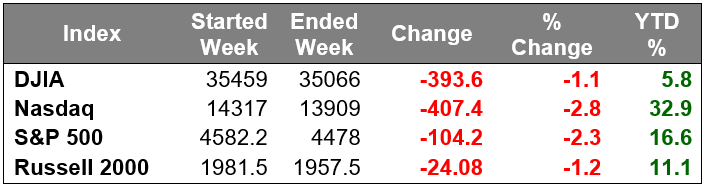

We had a large list of earnings announcements last week, and reactions were mixed… stocks were sold even though the earnings were on average impressive, especially in technology.

Apple and Amazon were the earnings reports that carried the most market-moving weight. Even though the numbers were equally impressive, Amazon jumped 8.3% higher on Friday while Apple fell 4.8%.

A rather substantial sell off was driven by a big jump in long-term rates that provided an excuse for participants to take some money off the table in a short-term overbought market.

The factors that drove the move in rates included supply concerns and the continuation of relatively strong data that support the view that the Fed might keep rates higher for longer and find a reason to raise the Fed Funds rate again.

To add to the interest rate pessimism, Fitch Ratings service downgraded U.S. Treasury credit to AA+ from AAA, which didn’t go over well at all. The downgrade reflected the expected fiscal deterioration over the next three years, growing government debt, and erosion of governance related to peers. We see this as a warning to policy makers.

S&P and Moody’s had lowered their ratings years ago.

Market rates declined following the downgrade but shot higher immediately following the much larger-than-expected increase in ADP private-sector payrolls.

Treasuries started to widen their losses after the release of a better-than-expected report on productivity and unit labor costs on Thursday. Weekly initial jobless claims increased slightly, but still reflect a strong labor market. Meanwhile, the ISM Non-Manufacturing Index showed that services sector growth decelerated in July.

On Thursday, the 10-yr note yield settled just 14 basis points shy of its high from October while the 30-yr yield was just 12 basis points below last year's high.

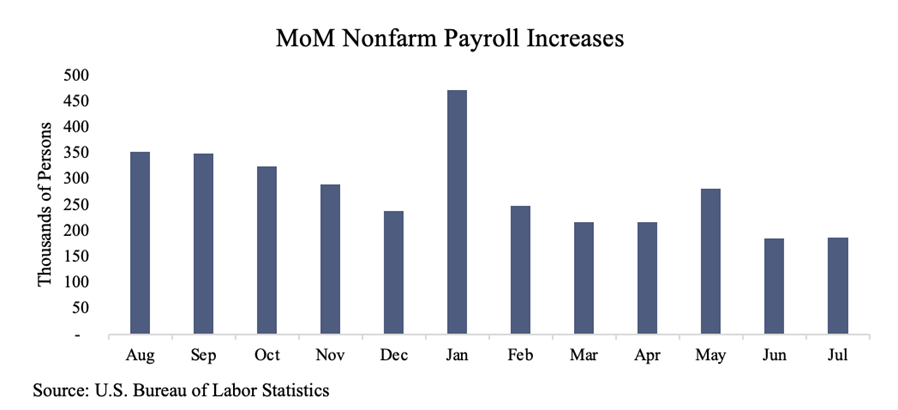

Yields ultimately retreated from their highs in response to the July Employment Situation Report, which showed a slowdown in nonfarm payroll growth that had the market considering the idea that it may be enough to keep the Fed on hold.

The 10-yr yield closed nine basis points higher on the week to 4.06%. The 30-yr yield jumped 18 basis points to 4.21%. The highest probability that the market is assigning for another Fed rate hike at any of the remaining meetings this year is only 27.7% for the November FOMC meeting, according to the CME FedWatch Tool.

On a central bank related note, the Bank of England announced a 25 basis points rate hike to 5.25%.

Only one of the S&P 500 sectors logged a gain -- energy (+1.2%) -- while the utilities (-4.7%), information technology (-4.1%), and communication services (-2.9%) sectors saw the largest declines.

Market Snapshot…

- Oil Prices – Oil prices rose as global supplies tightened. West Texas Intermediate crude (WTI) gained $1.27, or 1.6%, to close at $82.82 a barrel. Brent crude futures rose $1.10, or 1.3%, to settle at $86.24 a barrel.

- Gold– Gold prices rose on Friday after a slightly weaker-than-expected U.S. jobs report pushed the dollar and Treasury yields lower. Spot Gold was up 0.3% to $1,938.69 per ounce. U.S. gold futures gained 0.3% to $1,974.10. Silver finished the week at $22.934.

- S. Dollar– The dollar fell, paring almost all the week’s gains, after slowing U.S. jobs growth in July. The dollar index fell 0.459% after climbing on Thursday to 102.84, the highest since July 7. The decline was poised to be the dollar’s biggest single-day loss in three weeks. The Euro/US$ exchange rate is now 1.103.

- S. Treasury Rates– The yield on the 10-year Treasury pulled back Friday, after briefly hitting a multi-month high. The 10-year Treasury yield touched a high of 4.206%, the highest level since Nov. 8, 2022, before dropping nearly 15 basis points to 4.042%.

- Asian shares were down in overnight trading.

- European markets are trading lower.

- Domestic markets are trading higher this morning.

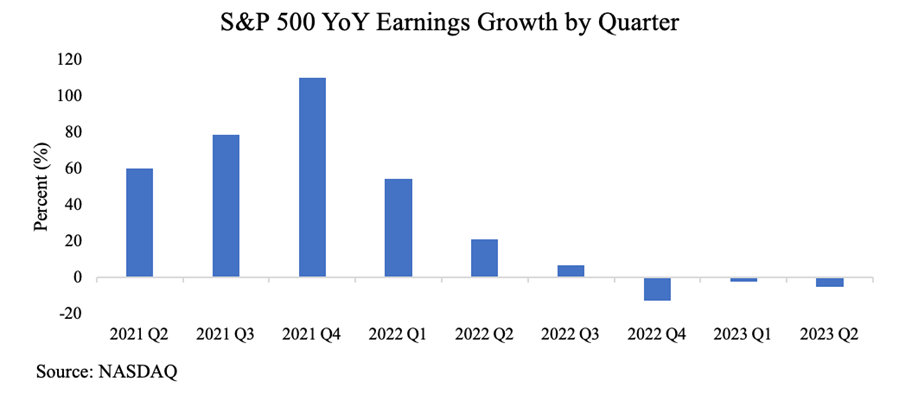

Earnings season has been in full swing with 84% of S&P 500 companies reporting.

According to Factset, of the companies that have reported, the blended earnings growth rate for the quarter is -5.2%. With only 16% of companies remaining, it leads us to believe that this will be the third straight quarter of negative earnings growth.

This week will be a double feature with both the CPI and PPI inflation reports for July. On top of that, we will hear from several FOMC members who will likely be commenting on the latest job numbers and potential policy actions for the remainder of 2023.

Have a great week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.