Changing of the Guard

To watch/listen to this week’s article please click here.

Nope not the election. I’m sure like all of you…I’m over it. I’m referring to both the leadership of the stock market and investing styles. I know from some of the conversations I’ve had with you, that there is some understanding of what I’m talking about, however I want to reiterate my main point of the past few weeks.

All the major indexes (Dow Jones, S&P 500 and Nasdaq) are all Market Capitalization Weighted Indexes. Meaning, the biggest stocks, have the biggest weighting. So, when one of the largest stocks moves higher, it has the ability to drag the index higher, even if the majority of the other components are going lower.

For the past few years, just buying a passive investment that tracks the index has worked well. Aside from feeling the volatility of the Powell gaff in Q4 of 2018 and Covid in 2020, you participated in 40% return through that time, thanks mainly to the biggest three stocks in the index, who were each up over 150% during that time. According to Standard & Poor’s those three stocks made up 17% of the index, and if you add in the next 3 biggest stocks, it takes you to a weighting of over 25%.

The S&P 500 actually has 505 stocks in the index (for reasons I can’t explain in the time you have to read this), so simple math tells you that 499 stocks make up the remaining 75% of the index. Academics have debated the merit of this system for years, however there is no argument that this methodology has certainly helped the average investor over time, exacerbated recently. But in my mind, the good times are over for the easy money investors.

By easy money investors I mean the do it yourselfers, who buy the major indexes through ETFs, and the financial advisors who do the same on behalf of their clients. It’s time to do the research. For those of us that have been buying the individual stocks and bonds all this time, it’s our time to shine.

I wrote it in the note last week and I’ll reiterate it again this week…I think it’s entirely possible that we could see the major indexes be flat or eke out slight gains over the next market cycle, all while seeing 80% of the constituents of the S&P 500 book double digit returns each year.

Now for those of you in the Ambassador portfolios, I have been, and will continue to make shifts to position the portfolios from the mega caps to smaller cap names. That does not mean a wholesale shift, rather trimming around the edges to raise some capital to enable a reposition.

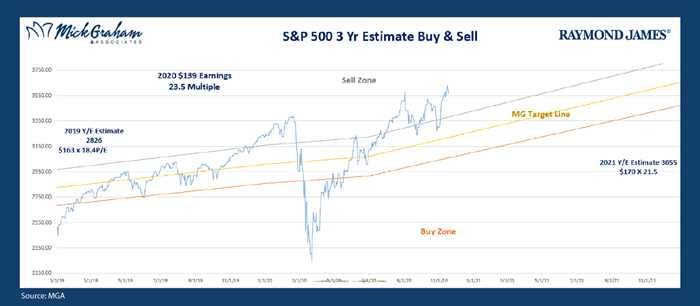

Just to ensure no confusion, I am bullish for the next 12-24 months. I fully expect Earnings Per Share growth of 20% plus through next year. This along with the MASSIVE amount of stimulus that is already in the market, along with another couple of trillion in the next round, as well as the low rate environment, and yes, a return to normalcy with a vaccine, not to mention a divided congress, is enough to keep me overweight to equities in general. Oh yeah, don’t forget about TINA (There Is No Alternative, to get a decent return).

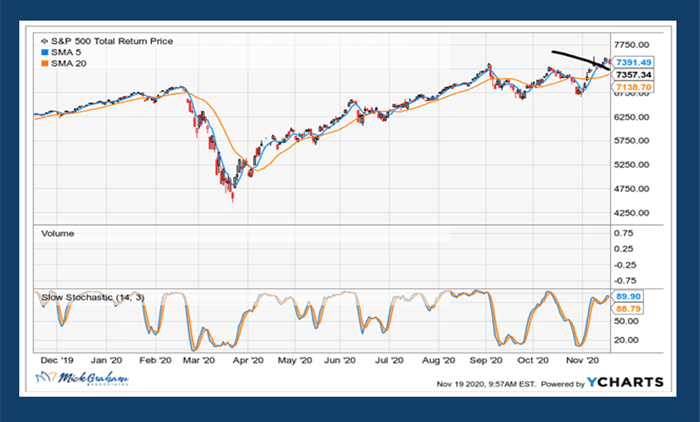

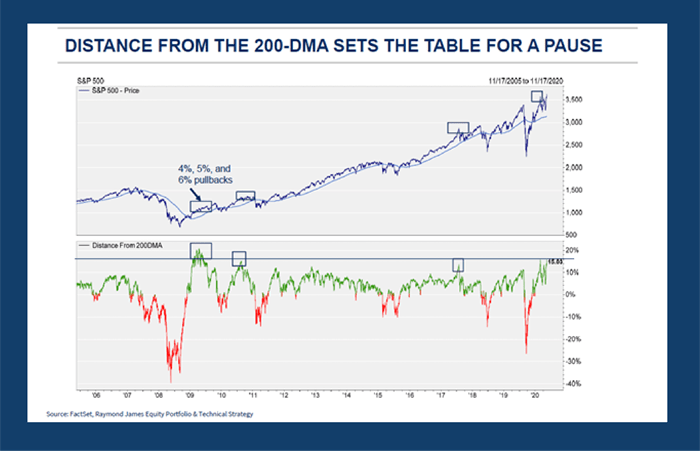

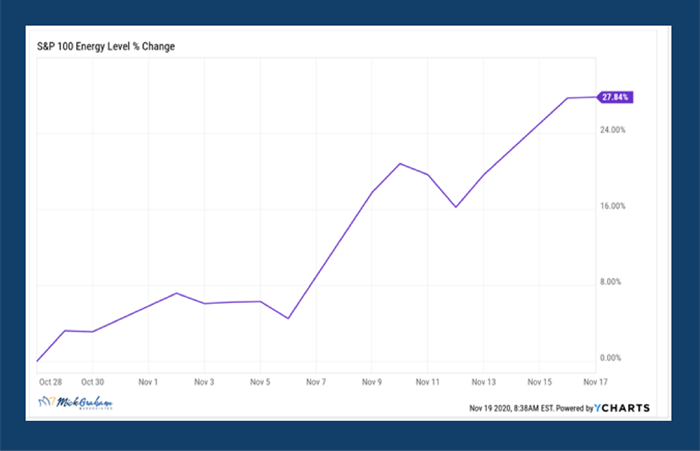

Let’s look at a shorter time frame. News of the two vaccines have sent the market racing back through all time highs. The distance between the 5-day moving average and the 20-day moving average is as high as it’s been in the past 12 months. We have seen run ups in some of the sectors that have been hit the most. The energy sector has seen a near 30% return in the past 15 trading days.

This leads me to believe that a stall or a pull back would not be shocking. Therefore, this is the time to take a little off the table (as I mentioned earlier), by trimming from those names that have done very well through this recent rally. All the while examining those fundamentally strong names that have not participated as much over a 6, 12- & 24-month time-period.

Sector allocation will remain highly important. Despite the fifteen day rally in Energy, the sector is plagued with supply/demand issues, financials although I would argue are historically cheap need to see the longer term rates move higher, and real estate beyond residential is full of landmines. The majority of consumer has pent up savings, as shown in the U.S. Savings Deposit amount, which now topples $11.8 Trillion. This highlights the opportunity for discretionary spending when things are open back up fully.