Holding Steady during Late Nights & Market Conditions

SWFG: Holding Steady during Late Nights and Market Conditions

Originally written 11/23/22

Updated 11/14/23

“…I feel strongly…that it’s not the things you buy and sell that make you money; it’s the things you hold.”

Howard Marks, Chairman, Oaktree Capital

"Hank"

This piece was originally written late one night in 2022; however, reviewing it with 2022 data brought back great memories with insightful information pertinent during trying markets, as we experienced from August through October. Next year we may have 2023 dates to include. Enjoy the below!

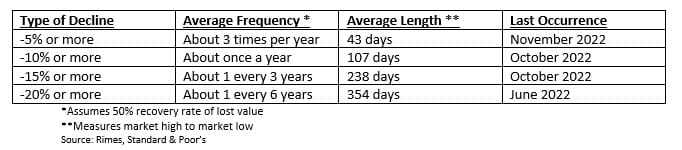

Over the course of this year and many years in the past, Warren, Brian, and I have communicated that downward market movements can be referred to as "normal, necessary, and natural” and to “hold steady” to your plan. Some of you would disagree with this description, but the statistics below tell the tale.

As I lay in bed this morning, with two extra bodies and a couple of stuffed animals making our bed feel fuller, I couldn’t stop taking in my surroundings. Baylor (2 years old) is under the weather and was awake around 1 am, eventually joining us in our bed. Collins (2 months old) was up around 3 am for her bottle. However, Baylor's stuffed animal “Hank” kept staring at me, almost as if to say, “hold steady.”

Hold steady in moments when we are tired. Hold steady in keeping the bottle stable or fear an upset baby. Hold steady in raising two kids to the best of our abilities. Hold steady in cherishing these moments, even though they can be challenging.

As all was calm again, everyone fell back asleep, but I couldn't. Thoughts of work, family, and my to-do lists ran rampant through my brain. These two thoughts crept to mind as I scrolled through the internet, trying to put my brain to rest, and they aligned similarly to Hank’s “hold steady” message:

- How often do market declines occur, and if we reacted to them, how frequently would we be reacting?

A History of Market Declines (1952 – December 2022)

This piece was created in January 2023. Below is what the history of the S&P 500 index tells us:

What would happen if we missed some of the best days when markets recover?

What would happen if we missed some of the best days when markets recover?

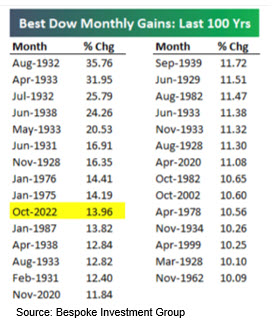

If you sold in September 2022 due to being exhausted, frustrated, or certain we were going down the wrong path. What did it cost you? The chart to the right shows the best month of returns for the Dow since 1976.

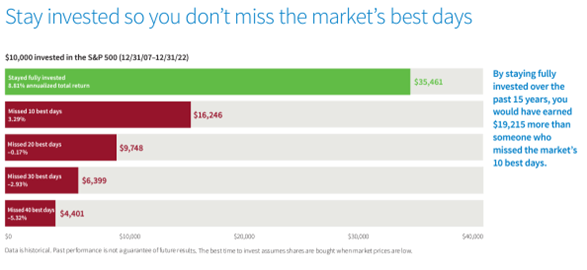

Taking this further, you can find below what would’ve happened if you missed just the 10 best individual market days over a 15-year time period.

While “holding steady” is not always the easiest thing to do, we believe that looking at historical data can prove that it is often the prudent thing to do. It is entirely possible that the broader markets could go down another 10%. That could be normal, perhaps necessary, and very natural.

Source: Putnam Investments

In due time, I will recover the sleep I missed last night. In time, we believe the markets will do the same; history says so, at least. I won’t wish for more nights like last night, just like we won't wish for market downturns. However, I will "hold steady" when those nights come, just as we will hold steady as your trusted advisor doing what we believe is best for you and your financial plan in challenging market conditions like now.

“The best service we can provide the retail investor is to provide education. To make them understand what we’re doing and why and thus what they should do about it.”

Sources:

https://www.putnam.com/literature/pdf/II508-ec7166a52bb89b4621f3d2525199b64b.pdf

https://www.capitalgroup.com/individual/planning/market-fluctuations/past-market-declines.html

Disclosure:

Any opinions are those of the author and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Past performance is not a guarantee of future results. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification.

The S&P500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary.