Catherine and Carrie have chosen their spring vacations on opposite ends of the spectrum. Carrie went snow-skiing in Colorado following the most snowfall they had seen in years. Catherine is spending her spring vacation soaking up the sun on a Caribbean island. While many places in the U.S. reached all-time records of snowfall this winter, the “meltdown” has begun and spring is on its way. However, as you are well aware, the market already had its “meltdown” in December and has been steadily “melting up” ever since.

Though brief “pauses” and corrections along the way are to be expected, we believe the overall trend will continue to be up and not down.

You have likely heard much ado about the “inverted yield curve” being an ominous omen of impending doom. However, we believe the REAL yield curve to watch is the 3-month Treasury bill to the 30-year Treasury bond…and it is nowhere near inversion. So, if you hear the “yield curve” is “inverted”, then they are referring to the wrong yield curve.1

The second myth regarding the yield curve is that when it does invert, a recession always follows. While it is true that every recession since 1962 has been preceded by an inversion…it’s important to remember that not every inversion has been followed by a recession.1

The pundits would also have you believe earnings are going to fall farther than Tacko Fall when he loses his balance. We do not believe this to be the case either. Certainly earnings growth has slowed, however not at an alarming rate. In fact, approximately 70% of companies reporting earnings this past quarter have beat analysts’ expectations.2

In the many years I’ve been in this business, I do not ever recall the Fed announcing ahead of time that it would not be raising interest rates the rest of the year. We have often observed the market hates uncertainty…and the Fed gave us a rare dose of certainty with their recent announcement. In fact, Larry Kudlow as well as Steve Moore (recently nominated as a Fed Governor) are even talking about actually cutting interest rates fifty basis points.3

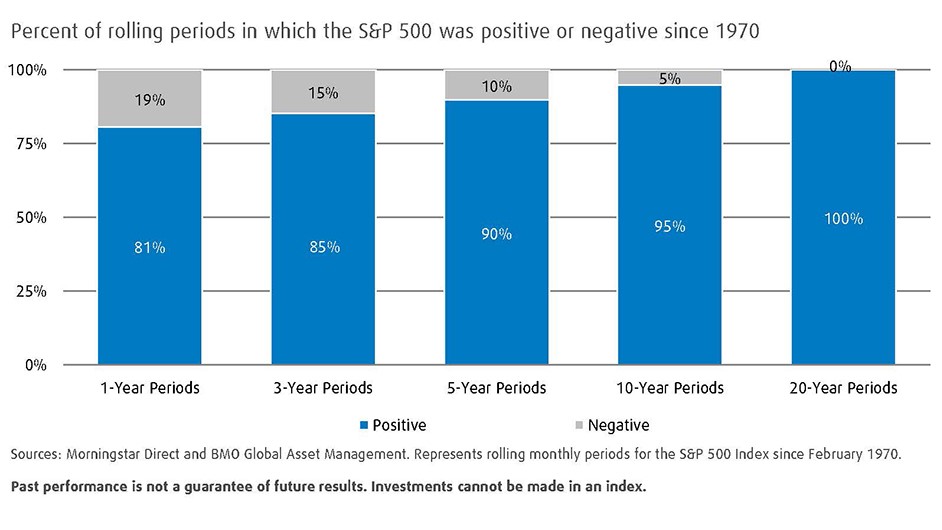

We realize our encouragements to “stay the course” and keep a long-term perspective are mostly “preaching to the choir”, as most of you are experienced long-term investors. However, the graph below just reiterates the importance and rewards of long-term investing. While 81% of 1-year periods since 1970 were positive on the S&P 500, 95% of 10-year periods and 100% of 20-year periods were positive.

Chart Source: BMO Global Asset Management, December 2018

In summary, while noting that short-term pullbacks, like breathing in and breathing out, are a normal part of a secular bull market, we continue to believe we are in a healthy bull market.

We hope you have a wonderful Easter. As always, we greatly value your trust and friendship.

1Jeff Saut, March 25, 2019

2MarketWatch, February 22, 2019

3CNBC.com, March 27, 2019

4CNBC, March 28, 2019

Past performance does not guarantee future results and there is no assurance that the objectives will be met. Investing involves risk and you may incur a profit or a loss. The information and opinions provided have been obtained from sources believed to be reliable but no independent verification has been made, nor is its accuracy or completeness guaranteed. Expressions of opinion may not necessarily be those of Raymond James & Associates and are as of this date and are subject to change without notice. The opinions expressed are provided solely for informational purposes and not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Long-term investing does not insure a profitable outcome. Investment Management Consultants Association (IMCA®) is the owner of the certification marks “CIMA®,” and “Certified Investment Management Analyst®.” Use of CIMA® or Certified Investment Management Analyst® signifies that the user has successfully completed IMCA’s initial and ongoing credentialing requirements for investment management consultants. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. BMO Global Asset Management is the brand name for various affiliated entities of BMO Financial Group that provide investment management and trust and custody services. Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO). BMO Asset Management U.S. consists of BMO Asset Management Corp., BMO Asset Management (Canada)® includes BMO Asset Management Inc., and LGM consists of the subsidiaries of LGM (Bermuda) Limited. BMO Taft-Hartley Services, BMO Trust and Custody Services and BMO Trust Outsourcing Services are a part of BMO Global Asset Management and a division of BMO Harris Bank N.A., offering products and services through various affiliated entities of BMO Financial Group. This is not intended to serve as a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. Information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. This publication is prepared for general information only. This material does not constitute investment advice and is not intended as an endorsement of any specific investment. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investment involves risk. Market conditions and trends will fluctuate. The value of an investment as well as income associated with investments may rise or fall. Accordingly, investors may receive back less than originally invested. Investments cannot be made in an index. Past performance is not necessarily a guide to future performance. BMO Global Asset Management is the brand name for BMO Investment Distributors, LLC. BMO Asset Management Corp. is the investment adviser to the BMO Funds. BMO Fund platform services are offered by BMO Investment Distributors, LLC, the distributor for the BMO Funds. Member FINRA/SIPC. All investments involve risk, including the loss of principal. Investors should carefully consider the investment objectives, risks, charges and expenses of the BMO Funds. This and other important information is contained in the prospectuses and/or summary prospectuses, which can be obtained by calling 1-800-236-3863. Please read carefully before investing. Investment advisory services in the United States are provided by BMO Asset Management Corp., LGM Investments Limited, BMO Global Asset Management (Asia) Limited, Pyrford International Limited and Taplin, Canida & Habacht, LLC. Investment advisory services in Canada are provided by BMO Asset Management Inc., BMO Asset Management Corp., LGM Investments Limited, BMO Global Asset Management (Asia) Limited and Pyrford International Limited. Financial promotions in the United Kingdom are provided by LGM Investments Limited and Pyrford International Limited. LGM Investments Limited and Pyrford International Limited are authorized and regulated by the Financial Conduct Authority in the United Kingdom. Asset management services in Hong Kong are provided by BMO Global Asset Management (Asia) Limited, licensed by the Securities and Futures Commission to conduct regulated activity Type 9 - asset management under the Securities and Futures Ordinance. This website is for informational purposes only and is not intended to provide a complete description of BMO Global Asset Management's products or services. Past performance is not indicative of future results. It should not be construed as investment advice or relied upon in making an investment decision. Information on this website does not constitute an offer for products or services, or a solicitation of an offer in any jurisdiction in which such solicitation or offer would be unlawful. Products and services can only be offered by appropriate representatives of the respective manager. Notice to residents of the United Kingdom: For the avoidance of any doubt, the information on this website does not constitute an offer for products or services to persons in the United Kingdom. Please read the Privacy Policy and Legal Disclosures reached through links above for important information. Investment products are: Not a Deposit — Not FDIC Insured — No Bank Guarantee — May Lose Value. Copyright 2018. BMO Financial Corp. All Rights Reserved. TM/® Trade-marks/registered trade-marks of Bank of Montreal, used under license.