While I never watched the early 2000s soap opera, “As the World Turns”, sometimes daily world news seems like another episode of a soap opera. The talking heads on CNBC might like to think that “as the news cycle turns”…so does the stock market. However, although daily news cycles certainly effect the short-term volatility of the stock market, history has shown it does very little to effect the long-term trend.

What’s interesting but never seems to be brought up by the media is the fact that there is over $17 trillion in sovereign government debt that has a negative yield.2 Much of that money is moving and will continue to move to the United States, and is one of the main reasons the yield on U.S. Treasury bonds has dropped this year (10-year U.S. Treasury 1.70%). This money should continue to move to the U.S., perhaps even more so into blue chip dividend paying stocks. The dividend yield on the S&P 500 is 1.90% and is also taxed at a much more favorable rate than the interest income on Treasury bonds.2

The stock market has only yielded more than the 10-year Treasury eight times in the past decade.5 Each time, it has been a positive leading indicator for the market. Investors are not likely to leave the stock market when it yields more than bonds or CDs. So, we think the flow of funds back into the stock market is healthy and will continue to accelerate.5

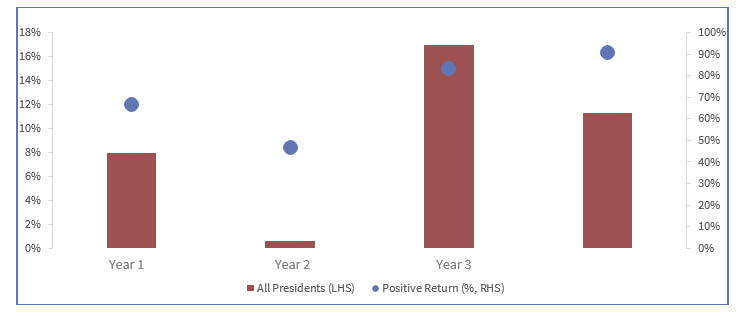

We believe the impeachment / conviction of President Trump to be unlikely. However, it is important to note that the stock market was actually up over 30% the year following the Clinton impeachment.3 So, even if such an event were to occur, we believe it would have a limited short-term impact on the primary uptrend of the stock market. In addition, as you can see in the chart below, the 4th year of a president’s term has historically proven strong. The “dots” show the S&P 500 has been positive 91% of the time in the fourth year of a Presidential term.

As you know, the Fed decided to cut key interest rates for the third time this year. The Fed will continue to monitor inflation as well as global economic news.

Since inflation remains below the Fed’s 2% target, we believe it likely they will continue an expansionary policy.4

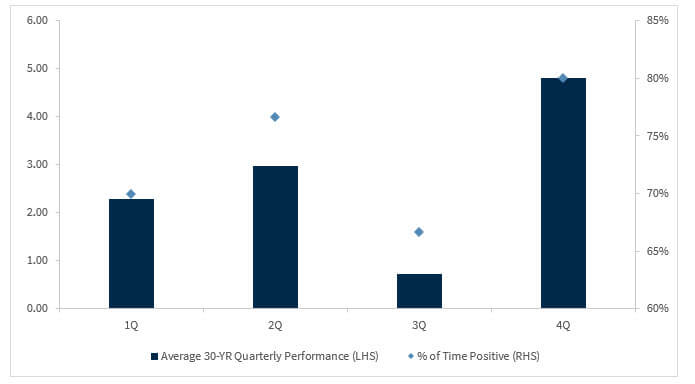

The fourth quarter has historically been the best quarter of the year (last year excepted) for the S&P 500. As you can see in the chart below, it has been up an average of 4.8% over the last 30 years and has been positive 81% of the time. With the holiday shopping season approaching, we expect the U.S. consumer will continue to fuel economic expansion.6

One of the main causes of continuing market volatility has been trade tensions between the U.S. and its major trading partners, namely China and the European Union. President Trump and Japan’s Prime Minister Abe were able to “come together” on a limited trade pact involving agricultural products.

Thank you for reading our “episode” of “As the World Turns”. We trust that by the time you receive this you will be enjoying some crisp air and some good football games.

If you are over 70-1/2 you can take up to $100,000 tax free out of your IRA each year as long as it is given to a qualified church or charity. It’s called a Qualified Charitable Deduction (QCD).

If you would like more information on QCD’s please call or email us.

770-673-2187