Key Concepts

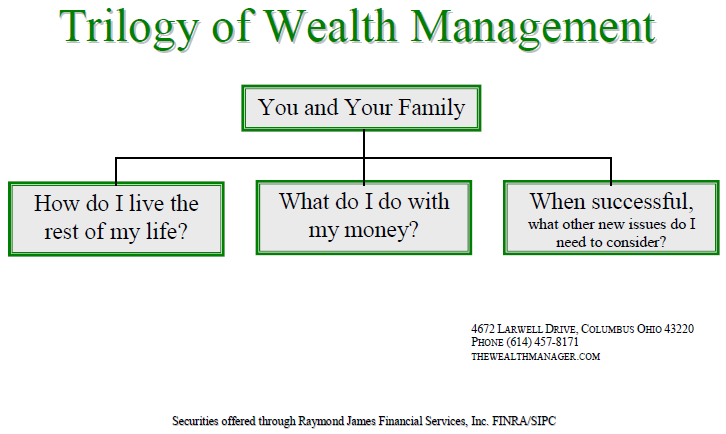

We developed the trilogy by trying to make things as simple as possible within the framework of personal wealth management. What we have found is that every question we have encountered with regard to financial planning is embedded in one of the three questions of the trilogy.

How do I live the rest of my life?

This is a starting point in a discussion about personal wealth management, and it has both qualitative and quantitative aspects. While financial planning eventually gets to the numbers it is the qualitative issues we find equally important to the quantitative topics. While this can represent a starting point we also understand that a client’s world will change and the world around them will also change. This is the part of personal wealth management and financial planning where we find everybody different as they evolve through lifecycles. Unless you know you have more resources than you need a common concern is the concern about making your money last the rest your life and often beyond to the next generation(s).

What do I do with my money?

While conventional wisdom often generates questionnaires that asked subjective questions that beget subjective answers we take a somewhat different approach to asset management. Everybody’s capital and money is invested in the same markets as everyone else’s. While the goals and needs of the first question can always be different for different clients, their money is subject to the same markets the same risk in the same possible returns. We believe that a default return objective can be an, after-tax rate of return greater than inflation when possible. This is the rate of return that is required by everyone if one’s objective is to preserve or enhance the value of their wealth. This is not to say this has to be your objective but it is the thought process that does deserve your consideration. While rates of return are critically important in attaining this return, risk management is equally important and requires a definitive conversation and understanding as you go forward with your personal wealth management.

What other issues do I need to consider?

Another realization everyone needs to recognize; as your wealth level increases the greater the complexity becomes in solving the issues that higher levels of wealth create. These issues involve such items as 1) tax planning 2) estate planning 3) multiple generational planning, 4) and philanthropic planning. It comes down to the issue: Once you have wealth, how can you keep it? This by no means is a complete list but each of these subjects can involve an in-depth conversation and analysis when applied to your individual situation.

Functions of Personal Wealth Management

Within the entirety of personal wealth management there are several separate but somewhat related functions, they are;

- The planning for the individual circumstance

- Study and understanding of the macro/micro financial world we live in

- Portfolio design – asset allocation – risk management –diversification

- Tax efficiency – Return efficiency

- Portfolio management – manager selection and monitoring

- Retirement income planning

- Estate and legacy planning

- Insurance and long term care

- Qualified plan/IRA distributions

- Stock options

- Business Succession

- Charitable Giving

- Asset Preservation

- Find the best thinkers who go beyond conventional wisdom

- Ongoing review and analysis of the above (See GSIM Chart)

Asset allocation and diversification do not assure a profit or protect against loss.