The pursuit of financial success begins with a plan

The Decision Making Process

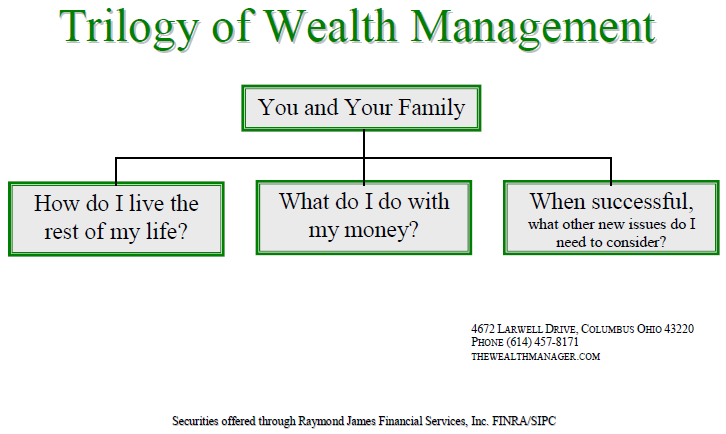

We use the GSIM model when looking at the decision making process from a MACRO (the entire wealth management process), and from a MICRO (implementation) point of view. We begin the review process on the MACRO level, which can begin with the question as basic as: “How do I live the rest of my life?” This question is quite simply your qualitative and quantitative GOALS. Whether your question or issue is basic or something much more complex, the decision making process starts here!

Once you have determined your goals, how will you go about achieving those goals? That is the STRATEGY quadrant. For younger individuals, strategy is typically a function of savings rate, while as wealth assets increase, the issue of rate of return and risk management can become focal points. As wealth increases the issues become more numerous and usually more complex. We have found wealth building and management an evolutionary process and as such tend to become more complex as it evolves. A decision making process allows one to better address complexity.

After the strategy is determined, it is time to IMPLEMENT. This simply means working the plan that best suits the goals and strategy of each individual, family or organization and their set of issues.

Although it may appear so, implementation is not the last step of the process. The only thing that we can guarantee is that things are going to change. The MANAGE FOR CHANGE quadrant of the GSIM model is to illustrate that Wealth Management is a process, not an event. When things change, we are able to go back to the strategy and make the next decision to address or counter the change. Whether things go right, go wrong, or just plain change a discipline is in place to manage more effectively.

Simply put, implementation is going back to meet the specific goals of the individual. It is based upon strategy, and when things change it reverts back to strategy. The GSIM model as a whole is a circular but interactive process, which enables the individual to manage their personal wealth like a business.