In good times and in bad, you have always put your family first. But what happens when you’re gone? Although choosing life insurance can be a daunting task, selecting the right policy is critical to your family’s financial well-being.

Having insufficient coverage, or worse, having no coverage at all, may be detrimental to your loved ones during a time when they need support the most.

Raymond James understands the importance of your family. And because you are our first priority, we want to help ensure the financial well-being of those you love most. In fact, we were one of the first firms to understand and emphasize the role insurance plays in a comprehensive financial plan.

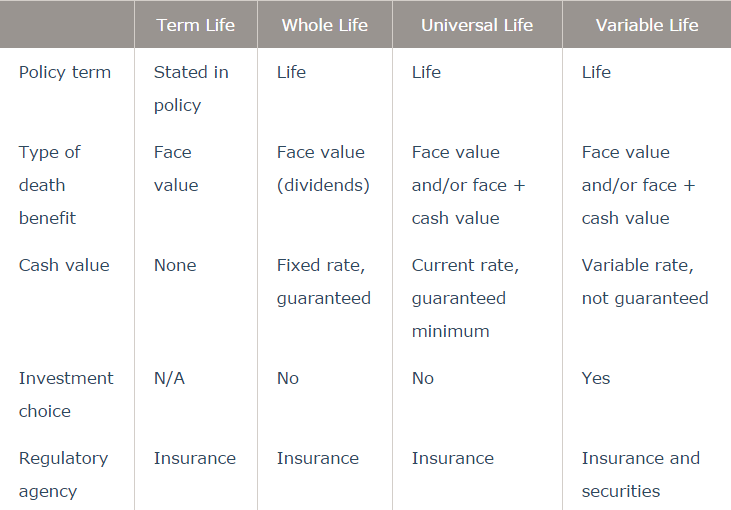

There are fees and charges associated with variable life insurance policies. Charges vary based on the circumstances of the insured life. Surrender charges vary by issue age, risk class and gender. Loans and partial withdrawals will decrease the death benefit and cash value and may be subject to policy limitations and income tax. A 10% federal tax penalty may also apply if the loan or withdrawal is taken prior to age 59½. All guarantees, including death benefits, are subject to the claims-paying ability of the issuing insurance company. An investment in variable life insurance involves risk, including possible loss of principal. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than the original investment.