If you’re seeking to secure your financial future beyond your working years, you have many options for saving and investing your money. But when it comes to long-term planning, certain investments let you save on a tax-deferred basis.

Combine tax deferral with the long-term growth potential inherent in stock and bond investments and you have an alternative that can help you build the retirement assets you’ll need – a variable annuity.

Variable annuities offer a remarkable combination of tax-advantaged growth opportunities and protection including:

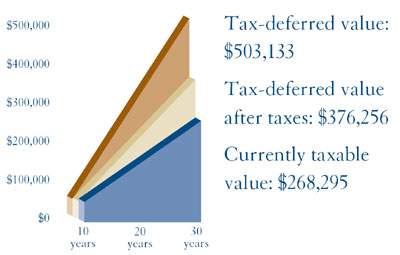

- Tax deferral. You pay no current income tax on earnings or other taxable amounts until you make a withdrawal. At that time, it’s important to be aware that withdrawals of taxable amounts are subject to income tax and, if taken prior to age 59 ½, a 10% federal tax penalty may apply.1

- Potential for long-term growth of your money. You’re able to invest in professionally managed investment portfolios.

- Valuable guarantees. These include protection for beneficiaries and choices for income you cannot outlive.

The questions and answers that follow will help you understand more about the valuable role variable annuities can play in your retirement planning.

1Tax-qualified contracts such as IRAs, 401(k)s and others are tax-deferred regardless of whether they are funded with an annuity. However, annuities do provide other features and benefits including, but not limited to, a guaranteed death benefit (based on the claims-paying ability of the issuer) and income choices, for which a mortality and expense risk is charged.