Our Flexible Strategy Method (FPM), as described in "The Evergreen Portfolio," by H. Ron Miller and Martin Truax, is a three-pronged approach designed to help manage risk in a volatile financial marketplace.

FPM begins with a flexible overall strategic asset allocation that represents our secular, big-picture view of financial conditions. This allocation could potentially have a bias towards inflation, deflation, or any environment in between.

The next phase of the process is to build out the core of the strategy, typically comprised of individual stocks, bonds, ETFs and mutual funds that invest in our secular themes.

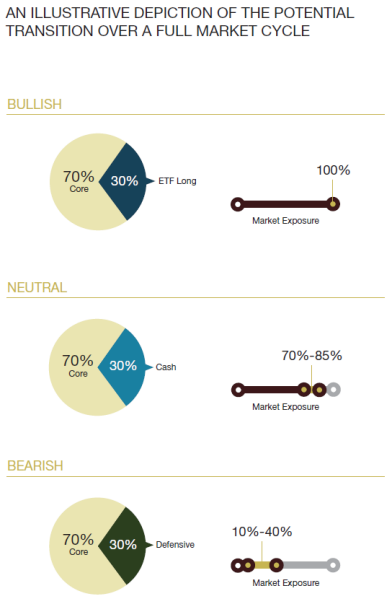

This core approximately represents 70% of the overall strategy and is designed to be a longer-term hold of our highest conviction investments, chosen through careful selection after quantitative and qualitative screening. Fundamental and technical analyses are applied to fill in the core of the strategy, as well as help to identify weak positions for potential replacement over time.

The remaining approximately 30% exposure represents the final phase in our process – our swing allocation. This allocation is actively managed for risk using a disciplined process driven by our proprietary technical analysis. The swing allocations can be bullish, bearish, or flat, and typically use index ETFs, long and/or short, or money market vehicles.

The information contained in this book does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions of the chapter authors are those of the chapter author and not necessarily those of Raymond James. Expressions of opinion are as of the initial book publishing date and are subject to change without notice.

Raymond James & Associates, Inc. is not responsible for the consequences of any particular transaction or investment decision based on the content of this book. All financial, retirement and estate planning should be individualized as each.

The result of this investment approach is that market exposure can range from a net long 100% all the way down to 10%:*

- 100%, when our strategies are bullish, the swing allocation contains ETFs correlated to the market or stocks

- A range of 70% to 85% when our strategies are neutral, the swing allocation contains cash or money markets

- A range of 10% to 40% when our models are bearish, swing allocation contains holdings that range from 1 x 1 to 2 x 1 inverse to the indexes we feel best hedge the underlying core of the strategies. These holdings are designed to increase in value as the market declines. However, there is no assurance that these holdings will properly hedge your portfolio.

We build a series of defensive hedges and strive to manage risk in every market environment.

*The above represents target allocation of the advertised strategies. Individual clients accounts may vary from the allocation over time based on various factors, including the client's unique circumstances.

IPMG reserves the right to target an overall net short position in extreme negative environments.

Stock and Bond ETF investors are subject to risks similar to those of holders of other stock and bond portfolios. A primary consideration is that the general level of stock or bond prices may decline, thus affecting the value of an equity or fixed income ETF, respectively. This is because an equity (or bond) ETF represents interest in a portfolio of stocks (or bonds). An exchange traded sector fund may also be adversely affected by the performance of that specific sector or group of industries on which it is based.

Leveraged ETFs seek returns that are either, 2x, -1x or -2x the return of an index or other benchmark (target) for a single day, as measured from one NAV calculation to the next. Due to the compounding of daily returns, leveraged ETF returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. Investors should monitor their holdings consistent with their strategies, as frequently as daily. While leveraged ETFs can be useful in some situations, they can be more expensive and can result in losses to investors and non-correlation to the index for those who hold them for longer than a day. For more information on correlation, leverage and other risks, please read the prospectus carefully.

Although exchange traded funds are designed to provide investment results that generally correspond to the price and yield performance of their respective underlying indexes, the trusts may not be able to exactly replicate the performance of the indexes because of trust expenses and other factors.

Investing in small- and mid-cap stocks generally involves greater risks and, therefore, may not be appropriate for every investor. International investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Asset allocation and diversification do not ensure a profit or protect against a loss.

Investors should carefully consider the investment objectives, risks, charges and expenses of mutual funds and exchange traded funds before investing. The prospectus contains this and other information about the funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Any opinions are those of the Investment Manager(s) and their team and not necessarily those of Raymond James. Opinions are subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security outside of a managed account. This should not be considered forward looking, and does not guarantee the future performance of any investment.

All investments are subject to risk, including loss. There is no assurance that any investment strategy will be successful. Asset allocation and diversification does not ensure a profit or protect against a loss. It is important to review the investment objectives, risk tolerance, tax objectives and liquidity needs before choosing an investment style or manager.

This Fact Sheet is not intended to be a client-specific suitability analysis or recommendation. Do not use this as the sole basis for investment decisions. Do not select an investment strategy based on performance alone.

The individual(s) mentioned as the Investment Manager(s) are Financial Advisors with Raymond James participating in a Raymond James fee-based advisory program. This is an investment advisory program in which the client's Financial Advisor invests the client's assets on a discretionary basis in a range of securities. Raymond James investment advisory programs may require a minimum asset level and, depending on your specific investment objectives and financial position, may not be suitable for you.

In a fee-based account, clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory relationship. In deciding to pay a fee rather than commissions, clients should understand that the fee may be higher than a commission alternative during periods of lower trading. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm's Form ADV Part 2 as well as the client agreement.

ASSET CLASS RISK CONSIDERATIONS

Equities: Investors should be willing and able to assume the risks of equity investing. The value of a client's portfolio changes daily and can be affected by changes in interest rates, general market conditions and other political, social and economic developments, as well as specific matters relating to the companies in which the strategy has invested. Companies paying dividends can reduce or cut payouts at any time.

Fixed Income: All fixed income securities are subject to market risk and interest rate risk. If fixed income securities are sold in the secondary market before maturity, an investor may experience a gain or loss depending on the level of interest rates, market conditions and the credit quality of the issuer. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Please note these strategies may be subject to state, local, and/or alternative minimum taxes. You should discuss any tax or legal matters with the appropriate professional.

Sectors: Strategies that invest primarily in securities of companies in one industry or sector are subject to greater price fluctuations and volatility than strategies that invest in a more broadly diversified strategies. The Strategy may have over-weighted sector and issuer positions and may result in greater volatility and risk.