SUCCESSFUL EQUITY INVESTING MAY REQUIRE A FAIR AMOUNT OF TIME AND EVEN MORE PATIENCE - PAUL METCALFE

April began with significant volatility as the S&P 500 experienced one of its sharpest 3-day drawdowns, followed by a strong rally upon news that President Trump would pause tariffs. Since then, the market has attempted to digest the potential impacts of the proposed tariffs and the effects they could have on the economy which has led to increased volatility. While extreme market movements can be unsettling, it is important to remember that the best days and the worst days in the market tend to cluster together. According to Bloomberg, the time between the worst day in a drawdown and the best day of subsequent trading is often as little as 2-8 days.

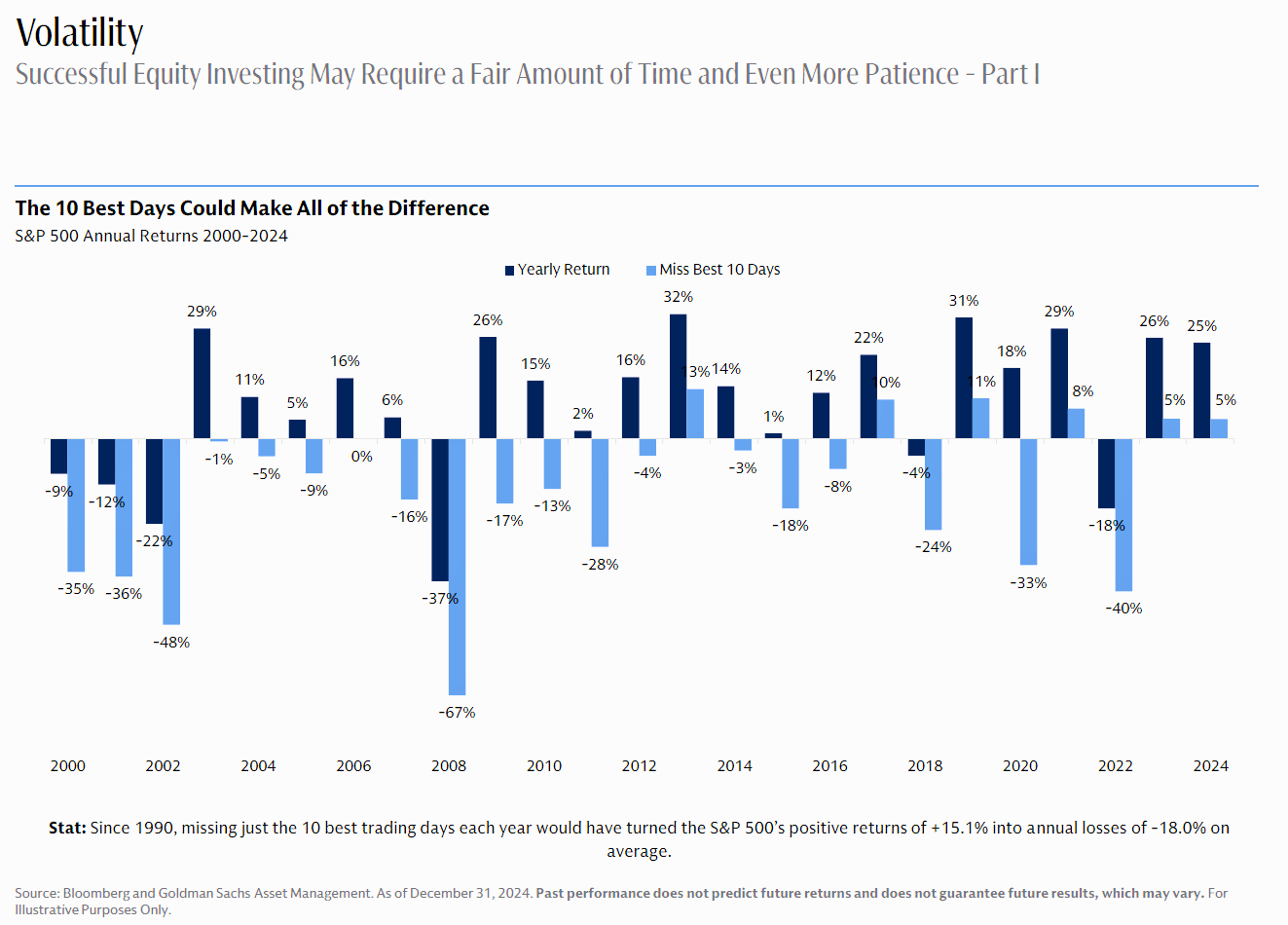

Establishing and following through with a well-thought-out financial plan is one the most important things we do with our clients as it creates a “roadmap” to your financial future and prepares us for not just the good times but also the challenging ones. This plan, paired with a customized portfolio is designed to help minimize volatility and weather market turbulence. As illustrated in the chart below, missing just the ten best days in the market going back to the year 2000 would significantly reduce your overall return.

Now, to address the big question…what should you expect moving forward? We anticipate volatility to continue until the market gains more clarity regarding tariffs and their potential implications. As negotiations continue between the United States and various countries, many existing tariffs have been postponed for 90 days, which has helped stabilize some of the recent market fluctuations. The good news is that we believe this turbulence is self-inflicted and not indicative of a structural issue within the markets.

As always, Lisa and I are happy to help and discuss any questions you may have.

Any opinions are those of Paul Metcalfe and not necessarily those of Raymond James. All opinions as of this date are subject to change without notice. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. Past performance is not a guarantee for future results.