Building a plan designed for you

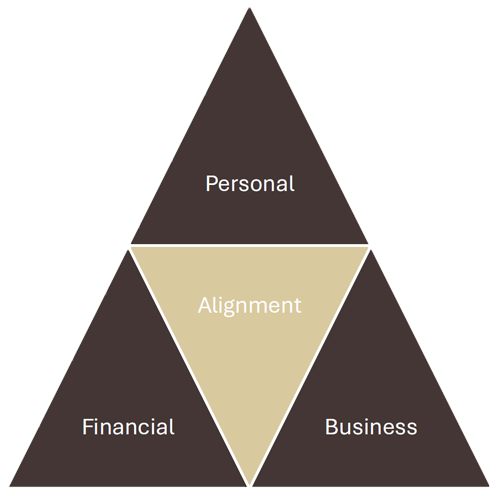

We begin by engaging in a discovery process designed specifically for business owners that allows us to learn more about you and your business – because the better we know you and what you want to accomplish, the more we can help. This enables us to create a personalized financial plan that fits your life and your business by aligning your personal, business, and financial goals. By taking an all-inclusive approach, you can achieve a balanced and fulfilling life both during and after your business ownership.

-

Successful business owners must focus on building companies that are not only profitable but also significant. This involves creating a business that is valuable, transferable, and aligned with your personal and financial goals. It’s vital to understand the difference between income generation and value creation to ensure a successful transition.

-

Personal planning is key to a fulfilling post-exit life. Owners need to identify their personal purpose and goals beyond their business. This involves creating a detailed lifestyle plan that includes personal ambitions, family considerations, and non-financial aspects of retirement. By integrating personal planning with business and financial strategies, owners can achieve a regret-free exit and a meaningful next step.

-

The value of your business often constitutes the majority of an owner's net worth, making personal financial planning crucial. Owners should maintain updated financial, estate, and tax plans to mitigate risks and ensure a smooth transition. Understanding one's wealth gap - the difference between current wealth and the amount needed for life after the business- is essential for effective planning.

Once business owners have identified and aligned their goals, we consider other areas of planning that are vital to achieving long term financial stability while bridging the gap between the personal plan and business plan.

We design, implement, and monitor detailed plans that consider your current and future goals, touching on everything from insurance needs, college funding, and philanthropic planning, to employee retirement plans and debt management.

*Banking and Lending Services provided by Raymond James, member FDIC, affiliated with Raymond James Financial Services and Raymond James & Associates, Inc.

Raymond James and its advisors do not offer tax advice. You should discuss any tax matters with the appropriate professional.