Summer Client Appreciation Event

I am writing to invite you to our Summer Client Appreciation event, with details below:

Tuesday, July 22nd

5:00 – 7:00PM

Thunder Bay Grille Canoe Room

N14W24130 Tower Place

Pewaukee, WI 53072

Food and beverages will be provided and will begin to be served at 5:00PM. Again, this year Ryan Dooyema from Russell Investments will be speaking briefly. There are many of our clients who have accounts that are managed by Russell Investments, and we look forward to hearing from Ryan! We’ll welcome everyone to the event at 5:30PM with some brief remarks, after which Ryan will speak, and the remainder of our time will be spent making our rounds throughout the room to enjoy conversation with as many attendees as possible.

Please give us a call at 262-691-4000 to RSVP by Thursday, July 10th so that we are prepared with proper quantities of food. Friends and family of clients are certainly welcome to attend, so feel free to bring them along if you would like!

We’ve enjoyed the opportunity to have a casual evening of socializing and good food at these events the past few years and we look forward to it again. We consider these client appreciation events to be a great opportunity for us to show appreciation to you for the relationship that we’ve had.

Lastly, I’ve included an insert with some thoughts of mine on the economy in 2025. We will be hosting a webinar via Zoom at 12:00PM on Wednesday, June 4th where I’ll get into these economic topics in greater detail. You’re welcome to join us for the webinar and we’ll be emailing invitations to register for it on Wednesday, May 28th.

As always, I’ll remind you that it is an honor and a privilege to serve you. We hope to see you on July 22nd!

Chart Source: Joel Merritt, with data from https://fred.stlouisfed.org/ and https://www.federalreserve.gov/DataDownload

Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Merritt Wealth & Retirement Advisors, Inc is not a registered broker/dealer and is independent of Raymond James Financial Services. Any opinions are those of Joel Merritt and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing

The Economy in 2025

There is a whole lot of chatter in the news these days about the economy, and, as is the case with most things, some of the information being presented is important and a lot isn't! A lot of the economic commentary that makes the news has to do with current events and speculation about how they'll play out and what impact they'll have on the economy.

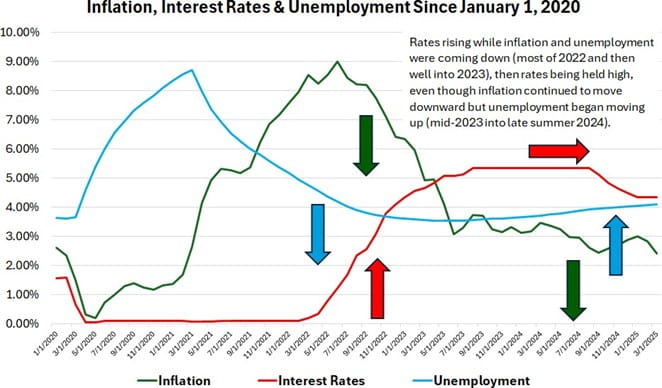

Oftentimes, however, things don't play out as speculated. Rather than dabble in speculation about things that might happen, I'd like to share with you some things that are going on behind the scenes that I think are important. The first chart on the previous page shows what inflation, interest rates and unemployment have been doing since the beginning of 2020. In my opinion, these three things, along with the yields on T-Bills, which are short-term obligations (under one year) of the US Government are the most important things to pay attention to when it comes to where the economy is headed.

The Federal Reserve has a dual-mandate to keep both inflation and unemployment from getting too high. Their primary tool for accomplishing this is to raise or lower interest rates by moving the Federal Funds Rate. The Federal Reserve began raising interest rates in early 2022 and they have said that the reason they were doing so was to fight inflation. Their messaging has created confusion, because unfortunately the Federal Reserve waited until inflation had nearly peaked before beginning to raise interest rates and they continued to raise rates across 2022 and throughout most of 2023 while inflation was in decline. Then, the Federal Reserve maintained peak interest rates throughout much of last year while unemployment, which had been in decline since roughly the end of 2020, began to modestly rise. If what I just said sounded backward to you, then you're reading this correctly!

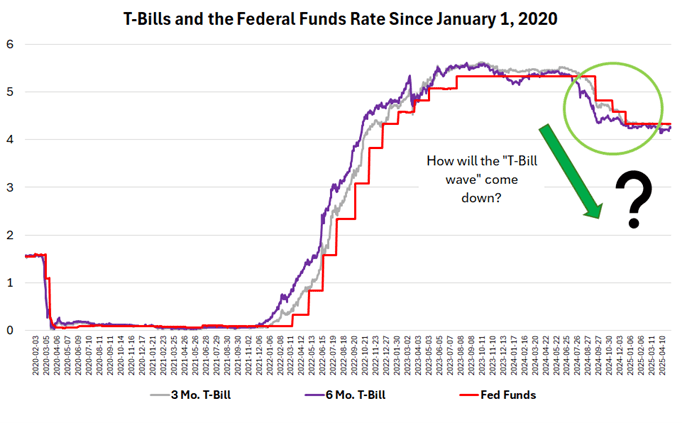

Throughout these past few years, it has seemed that the Federal Reserve has been doing the opposite of what the data shows and the opposite of what they have said they've been trying to accomplish! So what gives? What is the Federal Reserve doing with interest rates and why are they doing it? The second chart shows what the Federal Reserve has actually been doing, which is to match the Federal Funds Rate to the yields on T-Bills, which is essentially the interest that interest that the US Government is obligated to pay to those who hold T-Bills. Their insistence on matching the Federal Funds Rate to the yields on T-Bills has created a complicated economic picture, because higher interest rates put pressure on the economy. The pressure that higher interest rates put on the economy has become a bit concerning, seeing as unemployment has begun trending upward. There have been 12 recessions since 1948 and each time unemployment began trending upward before them. The wave-like pattern in T-Bill yields, shown in the second chart, has also been typical prior to recessions in recent decades and recessions have tended to begin while the T-Bill wave is coming down.

This current T-Bill wave began coming down late last summer, but has flattened out since the beginning of 2025.

Things like tariffs and the fact that over 5 million delinquent student loan borrowers are likely to have their wages garnished beginning this summer also matter when it comes to the direction that the economy is headed. Though these things are important, it remains to be seen how they'll play out and what impact they'll have. For my part, I prefer to put my focus on things that have a long historical track record of mattering and have real data to support them. For these reasons, I am paying close attention to the direction that unemployment is heading and to what's happening to T-Bill yields in the months to come. Having said all of that, it continues to remain important to maintain a prudent and diversified approach to investing and to stay the course.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. Merritt Wealth & Retirement Advisors, Inc is not a registered broker/dealer and is independent of Raymond James Financial Services. Any opinions are those of Joel Merritt and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.