They tell us that fall is here…and with it comes crisp air, football, The Ryder Cup (a great victory for the U.S.A.), an increasingly intense election season, apple pie, pumpkin spice, and for many students, fall break. The market has been in a "trading range" for the past month, and we could be poised for our own fall break…up and out of this range.

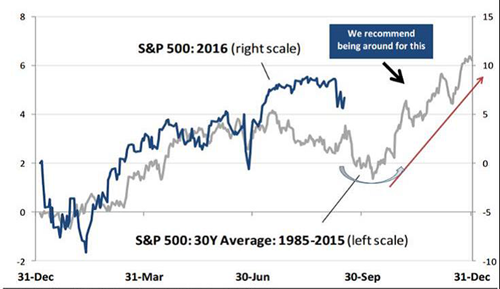

Yearly Market Cycle

As you can see in the graph below, fall is typically a strong season for the stock market...especially in election years.1Therefore, we continue to believe any pullbacks to be buying opportunities.

Low Interest Rates

The Fed’s decision not to raise rates in their September meeting brought a positive jump in the S&P 500. While the decision was not a surprise, it removed any remaining uncertainty until at least December, and leaves us in a bullish low interest rate environment.2

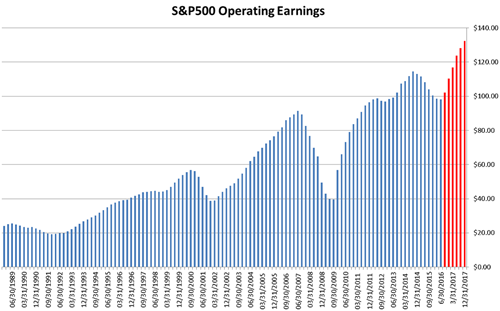

Improving Earnings

The S&P 500 has now had seven straight quarters of declining earnings, but the market has “held its own” in spite of it. However, the red lines in the graph below show projected 2017 earnings estimates. If earnings reports come in anywhere close to these estimates, the so-called “earnings recession” will be over. This would also support our continued belief that we are in a secular bull market that has six to seven years left.2

In view of the historic yearly election cycle, low interest rates, and improving earnings estimates, we hope to see a continued long-term bull market. While students around the country are enjoying their fall break, we hope to be enjoying a break-out in the market. Thank you for the privilege of working with you, and if there is anything additional we can do to serve you, please let us know.

MCT: cat

1Investment Strategy, Jeff Saut, September 20, 2016

2Gleanings, Jeff Saut, September 26, 2016

Past performance does not guarantee future results and there is no assurance that the objectives will be met. Investing involves risk and you may incur a profit or a loss. The information and opinions provided have been obtained from sources believed to be reliable but no independent verification has been made, nor is its accuracy or completeness guaranteed. Expressions of opinion are as of this date and are subject to change without notice. The opinions expressed are provided solely for informational purposes and not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Long-term investing does not insure a profitable outcome. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There are additional risks associated with investing in an individual sector, including limited diversification. The S&P 500 is an unmanaged index of 500 widely held stocks and is generally considered representative of the US equity market. It is not possible to invest directly in an index. Investment Management Consultants Association (IMCA®) is the owner of the certification marks "CIMA®" and "Certified Investment Management Analyst®". Use of CIMA® or Certified Investment Management Analyst® signifies that the user has successfully completed IMCA’s initial and ongoing credentialing requirements for investment management consultants.