This past quarter has been a trying one for our country, with devastating hurricanes, earthquakes and wildfires, mass shootings, as well as provocative weapons tests and rhetoric from North Korea. However, the market has been unsympathetic as it continues to climb. We have also seen a clear breakout in the Energy sector.

As we hear stories of greedy opportunists charging exorbitant prices for a simple bottle of water, we are grateful to work for a company like Raymond James who cares about people more than profits. Raymond James’ St. Petersburg headquarters was thought to be in the eye of Hurricane Irma. In preparation, Raymond James chartered its own flights, footing the bill to evacuate all 4,200 of its home office employees, as well as their families and pets to other cities. Raymond James also covered their room and board in their destination cities. Thankfully, Raymond James headquarters was not hit as badly as first feared. However, we continue to pray for the many victims who have lost their homes and even their loved ones in Florida, Texas, and much of the Caribbean.

As you know, we recently moved from the Overton Park building near the Galleria to the NorthPark building in Dunwoody. We are glad to have the move behind us. Malcolm is enjoying his new office and the view from the 18th floor. The whole team enjoys the new office and new friends.

North Korea created quite a stir with its sixth and most powerful weapons test September 3rd. The following war of words between President Trump and Kim Jong Un leaves observers asking, “Did North Korea declare war on the United States?” and “Did the United States declare war on North Korea?”

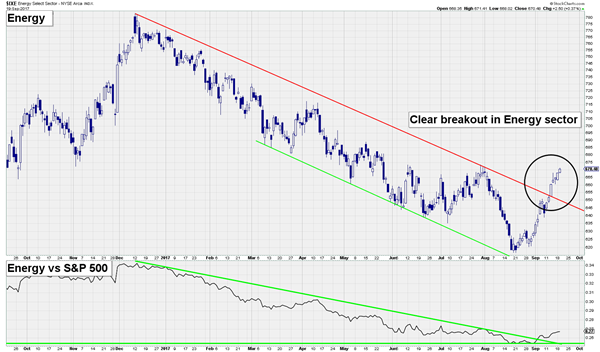

Interestingly, the market (particularly the Energy sector) did not seem to care, as the S&P 500 continued to climb throughout this news. The Energy sector broke out above the upper limit of its downtrend since last December. The chart below shows the breakout, as well as the relative strength of the energy sector compared with the S&P 500.1

Although a short-term “pause” in the market would not be surprising from a technical standpoint, our Chief Investment Strategist, Jeff Saut, writes:

Long-term, the primary trend remains powerfully bullish and the end is nowhere near in sight as the six major factors (monetary, economic, valuation, sentiment, supply/demand, and internal/momentum/technical) continue to give bullish readings. One of the most amazing aspects of this great bull market is sentiment. Although the bull market is in its ninth year…investors remain skeptical and pessimistic. Note that many hedge fund managers are bearish. In terms of asset allocation, funds are sitting on a mountain of cash and very low in equities. In fact, funds are the most underweight in U.S. equities in ten years.2

Also worth noting is the shrinkage in the supply of stocks. In 1996, over 8,000 stocks traded in the U.S. Today, that number has been halved. This supply/demand imbalance creates an explosive situation for the market.2

We trust this letter finds you doing well. We hope you will come visit us at our new location soon.

Most sincerely,

Malcolm C. Tarver, III

Senior Vice President, Investments

Certified Investment Management Analyst ®

1 Investment Strategy, Jeff Saut, September 25, 2017

2 Charts of the Week, Andrew Adams, September 20, 2017.

Past performance does not guarantee future results and there is no assurance that the objectives will be met. Investing involves risk and you may incur a profit or a loss. The information and opinions provided have been obtained from sources believed to be reliable but no independent verification has been made, nor is its accuracy or completeness guaranteed. Expressions of opinion are as of this date and are subject to change without notice. The opinions expressed are provided solely for informational purposes and not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Long-term investing does not insure a profitable outcome. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There are additional risks associated with investing in an individual sector, including limited diversification. The S&P 500 is an unmanaged index of 500 widely held stocks and is generally considered representative of the US equity market. It is not possible to invest directly in an index. Investment Management Consultants Association (IMCA®) is the owner of the certification marks "CIMA®" and "Certified Investment Management Analyst®". Use of CIMA® or Certified Investment Management Analyst® signifies that the user has successfully completed IMCA’s initial and ongoing credentialing requirements for investment management consultants. Investments in the energy sector are not suitable for all investors. Further information regarding these investments is available from your financial advisor.