If the stock market could sing, it would probably sing, “All I want for Christmas is a tax bill signed.” The odds of some form of a tax bill signed into law is “extremely high,” according to our Washington Policy analyst, Ed Mills. The question is, how will the final terms be negotiated? 1 We believe investment decisions should be based on much more than just the amount of taxes a company pays. However, one of the economic sectors with the highest effective tax rates, and therefore the most potential to benefit from a tax cut, is energy. The market seems poised to benefit from a potential combination of tax relief, less regulation, and a growing economy.1

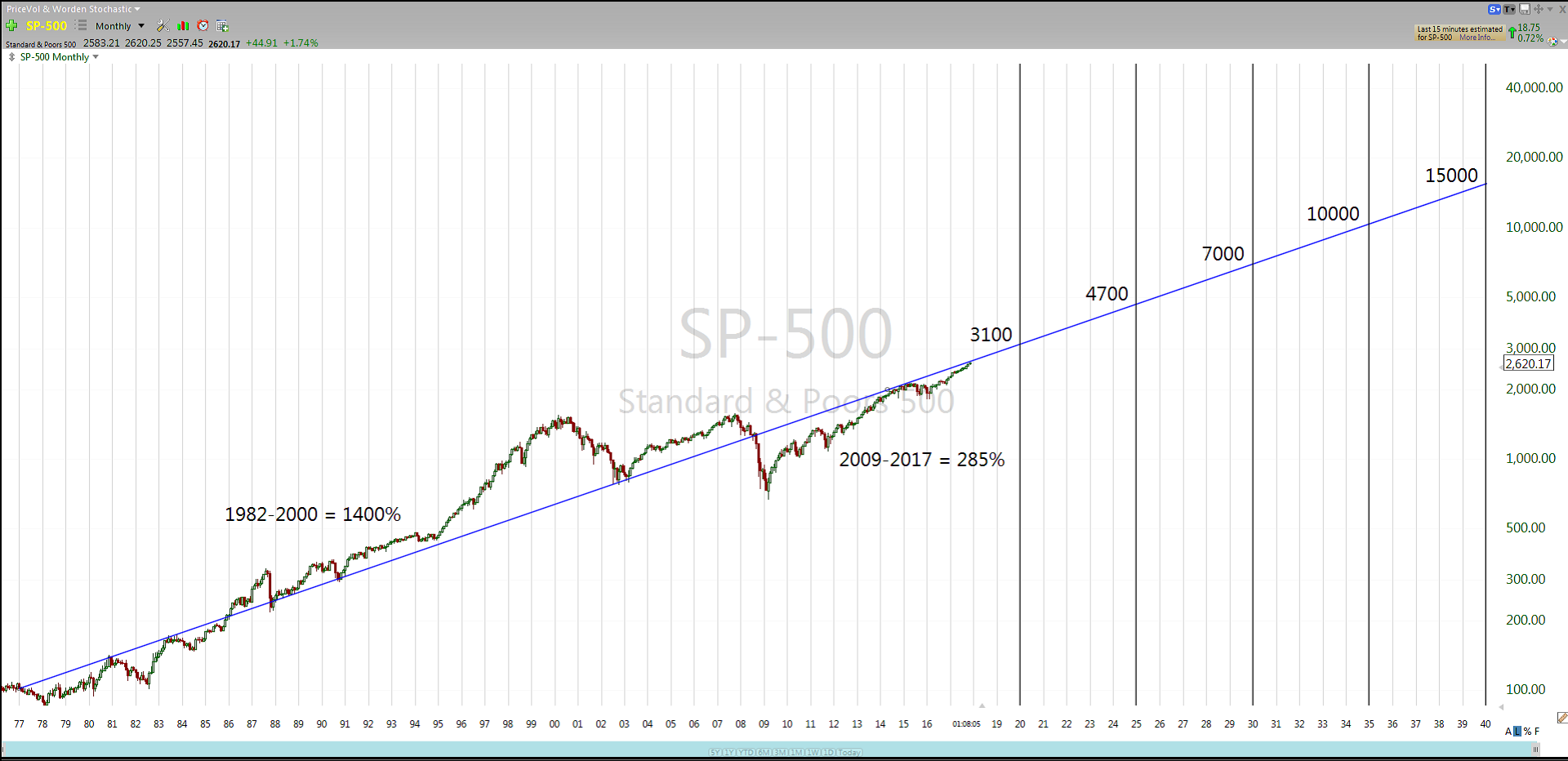

As our Market Strategist, Andrew Adams, points out: “Considering the S&P 500 is generally shown to be at the top of most charts these days, it can almost appear that ‘it can’t possibly go any higher.’ However, when we remove this psychological barrier and leave plenty of space on the upside (see chart below), the current level of the index doesn’t look quite as extended. In fact, all the index has done to this point is return to the general midpoint line of the last 40+ years, and if the index maintains a similar trajectory over the next 20 years or so, hitting milestones like 5,000, 10,000, and 15,000 doesn’t seem that ridiculous.”2

Gleanings, November 22, 2017

As “chestnuts roast on open fires and Jack Frost nips at our nose”, the ebullient month of Christmas is underway. We have learned that it’s tough to get markets “down” when spirits are so “high”. That doesn’t mean it can’t happen, but historically it is rare. And so…”although it’s been said many times, many ways…Merry Christmas…to you.”

Most sincerely,

Malcolm C. Tarver, III

Senior Vice President, Investments

Certified Investment Management Analyst ®

1Investment Strategy, Andrew Adams, December 5, 2017

2Andrew Adams November 29, 2017

Past performance does not guarantee future results and there is no assurance that the objectives will be met. Investing involves risk and you may incur a profit or a loss. The information and opinions provided have been obtained from sources believed to be reliable but no independent verification has been made, nor is its accuracy or completeness guaranteed. Expressions of opinion are as of this date and are subject to change without notice. The opinions expressed are provided solely for informational purposes and not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Long-term investing does not insure a profitable outcome. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. There are additional risks associated with investing in an individual sector, including limited diversification. The S&P 500 is an unmanaged index of 500 widely held stocks and is generally considered representative of the US equity market. It is not possible to invest directly in an index. Investment Management Consultants Association (IMCA®) is the owner of the certification marks “CIMA®,” and “Certified Investment Management Analyst®.” Use of CIMA® or Certified Investment Management Analyst® signifies that the user has successfully completed IMCA’s initial and ongoing credentialing requirements for investment management consultants.