A few years ago, my family attended the Frontier Days Rodeo in Cheyenne, Wyoming. It was a cold rainy day…and though the conditions were not ideal, I noticed several things about this rodeo: 1) The rain and cold did not discourage the bulls…they were as wild as ever, 2) No rider was ever hurt by hanging onto the bull and 3) Though no bull looked exactly the same or ran in quite the same way, all the bulls had two things in common: they were all rough and unpredictable.

So it has been with this bull market the past quarter. The conditions have not been ideal. There has been a pandemic, civil unrest and global tensions…but it has not discouraged the bulls. There has certainly been great benefit to “hanging on” through this rough and unpredictable ride…and we are thankful you have done just that.

To illustrate just how much we were rewarded for holding on, if you had been invested in the S&P 500, you would be down approximately 2% year to date. However, if you had missed only the five best days this year, you would be down approximately 33% year to date.1

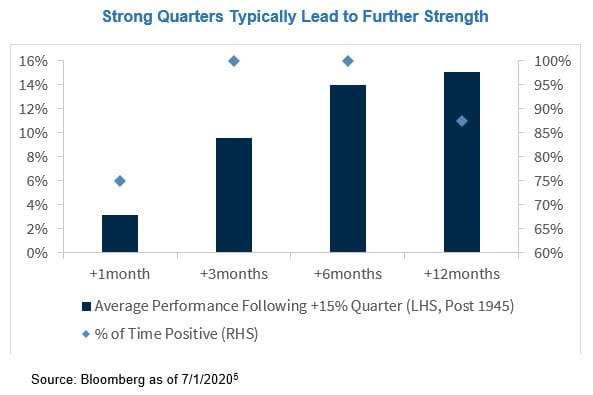

The market has made an impressive double-digit comeback since the end of March. In fact, we have just experienced the strongest one hundred days in the S&P 500 in over 80 years.3 This leads some to fear it is overbought. However, following the eight quarters of +15% returns dating back to 1945, the S&P 500 continued to climb higher by an average of another 15% in the following 12 months.1 You can see this illustrated in the chart below:

While a short-term pullback would be normal and healthy, there are a myriad of reasons why we believe this bull has a much longer course to run:

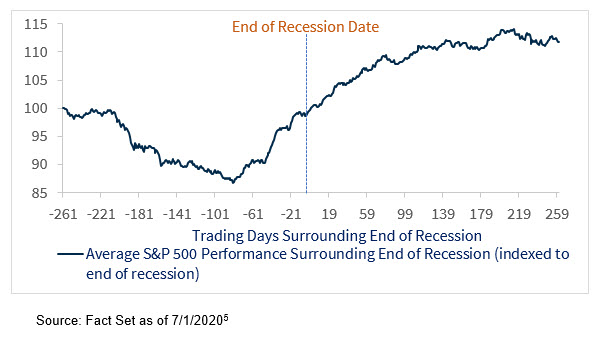

The nature of the lockdowns resulted in the shortest, deepest recession in post-World War II history.1 We believe economic growth will accelerate into the second half of 2020 and on into 2021, as TSA screenings, restaurant bookings, and gasoline demand (to name a few) are already up significantly from their lows.1

The U.S. fiscal stimulus packages passed since March have been the most significant fiscal boost since World War II, and it looks likely Congress will pass yet another wave of stimulus.4

Though the pandemic is still very much with us, the U.S. consumer appears to be in much better spirits. Consumer spending soared a record 8.2% in May, more than doubling the previous monthly record. This is significant, as consumer spending accounts for nearly 70% of U.S. GDP growth. Household incomes were also 3.8% higher in May than they were back in February before the pandemic began.3

The third quarter kicked off on a positive note, ignited by a much-better-than-expected jobs report. The Department of Labor reported that 4.8 million jobs were added during June, beating analysts’ forecasts of 3.23 million jobs. The unemployment rate also dropped to 11.1%. While still at historic levels, it was lower than May’s figure and beat economists’ forecasts of 12.5%.3

The Fed and other central banks are flooding the system with liquidity in historic proportions, and Fed Chairman Jerome Powell announced interest rates will stay low through the end of 2022. As someone recently said, he is “better than Santa Claus” as he is actually real and lives here year round.2 In spite of the Fed’s low interest rate policy and flooding the system with liquidity, inflation continues to actually move lower, and is now at its lowest level since 2011.1

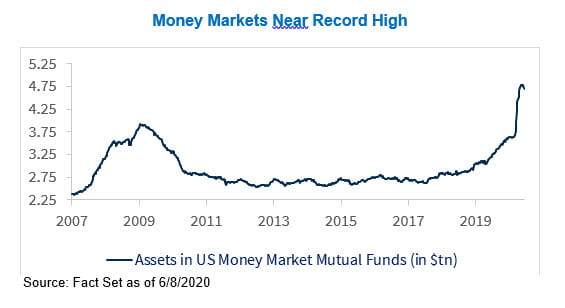

Meanwhile, many investors remain scared to death. The amount of cash on the sidelines is still near record highs at $4.8 trillion (as you can see in the chart below). Moreover, a recent survey showed that 33% of those who are over 65 have sold all their stocks!2 If the saying is true that bull markets “are born on pessimism, grow on skepticism, mature in optimism and die in euphoria”, this is a very positive sign for equities. Such elevated levels of cash on the sidelines should be very supportive of equity markets when fear begins to subside.1

“Irrational exuberance” was the phrase used by Fed Chairman Alan Greenspan in a speech given at the American Enterprise Institute on December 5, 1996 to describe his feeling that the stock market was extremely overvalued. The market did not peak until March 10, 2000…over 39 months after his irrational exuberance speech. Stocks typically do not just go from undervalued to fully valued, but often go far beyond…not to imply they are fully valued now…it depends on the individual company’s earnings growth.

Raymond James healthcare analysts say there is an 80-90% probability of a vaccine being available in 2020 to priority recipients, i.e. healthcare workers, age 65+ and those with preexisting conditions with more widespread availability anticipated beginning in 2021.1 As you know, there are also new treatments being discovered and doctors and hospitals are becoming more successful at treating those who have the virus.

A “rising tide” has not however “lifted all boats” in this 100-day bull run. Active portfolio management and overweighting economic sectors with the best potential to outperform has proved more important than ever. Amazingly, the best performing industry has outperformed the worst performing industry by approximately 70% this year.1 We are currently overweight in Information Technology, Communication Services, Healthcare and Consumer Discretionary. As you know, these sectors are continuing to outperform.

Information Technology

Communication Services

Healthcare

Consumer Discretionary

We commend you again for “hanging on” through this wild ride. Though we expect volatility to continue throughout election season, for all the reasons mentioned above, we are optimistic for the long run. Stay safe and enjoy the rest of your summer.

Malcolm C. Tarver, III

Senior Vice President, Investments

Certified Investment Management Analyst ®

1Larry Adam, Raymond James, July 6, 2020

2Jeff Saut, Saut Strategy, July 6, 2020

3Louis Navellier, Emerging Growth, July 3, 2020

4Russell Investments, Andrew Pease, June 30, 2020

5Raymond James, Investment Strategy, July 6, 2020

Any opinions are those of Malcolm Tarver and not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Dividends are not guaranteed and must be authorized by the company's board of directors.