In a recent survey of Raymond James employees, 80% said their number one priority this year was to go on vacation. The other 20%...may be dreaming of the beach, but are working hard. We at Tarver Asset Management Group have been working hard to transition many of Carrie’s responsibilities over to my wife, Judy. As some of you already know, Carrie’s heart never quite left the Middle East where she taught in 2013-2014. Although she recently completed her financial planning designation, she realized her passion was still for her students in the Middle East. She will be working at Raymond James through the end of July and plans to leave for the Kurdish region of Iraq mid-August.

Judy was part of our team last time Carrie was in the Middle East, has a degree in Accounting, and is far better than me (Malcolm) with details and troubleshooting. We are grateful to have her.

Not only has our team been working hard…but growth-oriented stocks in particular have been working hard for investors.6 As discussed in our previous newsletter, the market experienced a brief rotation from growth to value mid-February to mid-May.5 However, as you may have already noticed, growth stocks continue to make a strong comeback.1

As many growth investments are near all-time highs, some investors fear we are overvalued. We have viewed the past twelve years since March of 2009 as one long-term secular bull market. However, our Chief Investment Officer at Raymond James views the Coronavirus Crash of last year as the shortest bear market in history and this to be the beginning of a new long-term secular bull market.3 Whether it is a “young bull” or an “old bull”, we would like to share five reasons why we believe it will continue to run.

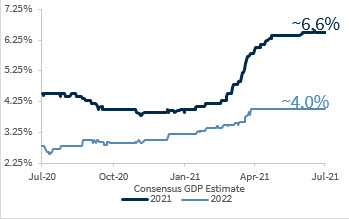

1. A Still-Improving Economy

The U.S. economy grew at an 8.6% annual pace in the 2nd quarter, and the Labor Department announced that 850,000 jobs were added during the month of June.1 The economy is on track to post the best year of economic growth since 1984, with the potential to have the best year since the 1950s.3

Consensus GDP Estimates Moving Higher

Source: Raymond James Investment Strategy

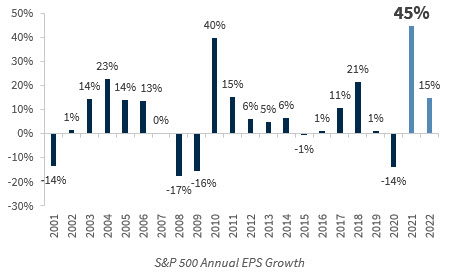

2. Strong Earnings Expectations

Preliminary estimates anticipate the S&P 500 achieving second-quarter earnings growth of 63.6%. Analysts have also raised earnings estimates by 7.3% since the end of March, which could bring an earnings season full of positive surprises.2

As you can see in the chart on the next page, 2021 is on track to have record earnings per share growth, which is the primary reason we do not believe stocks are overvalued. In contrast to the “Tech Bubble” of the early 2000s, this bull market has solid earnings to back it up.

Strongest EPS Growth in 20 Years

Source: Raymond James Investment Strategy

While we never enjoy seeing our taxes raised, the strength of not only current earnings…but also forward earnings should keep the market strong in spite of a possible increase in corporate taxes.

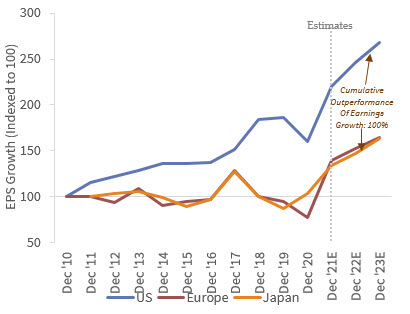

In addition, we continue to favor U.S. companies, as their earnings growth and profitability ratios still far outpace the rest of the world.3

US Economic Growth Leading To Stronger EPS Revisions

Source: Raymond James Investment Strategy

3. Market Tailwind of Low Interest Rates

Treasury yields are declining and inflation is rising. The 10-year Treasury is now around 1.35%.2 The continuing decline came as the European Central Bank (ECB) announced it would tolerate up to 2% annual inflation. So, just like the Federal Reserve, the ECB seems to be throwing its inflation targets out the window…at least for now.2 Both high yield bonds and treasury bonds now have a negative yield relative to inflation.2

We believe this is very bullish for stocks, as they will likely continue to yield substantially more than Treasuries.2 So, low interest rates will likely continue to drive investors to the equity markets. Raymond James analysts do not expect the Fed to begin raising interest rates until at least the middle of 2023.3

While longer-term concerns remain about the explosion in our national debt, low interest rates have constrained the cost of servicing that debt. To put things in perspective, while the national debt has increased by over 900% since 1985, the amount of interest required to service that debt has only increased approximately 170% due to lower interest rates.3 This is one of the major reasons why we do not believe the Fed will aggressively raise rates.

4. Defaltionary Forces Tempering Inflation

We do not consider the rising inflation we have experienced as bad news for the market either, as growth stocks can be a hedge against inflation. Some investors believe higher inflation slows positive equity market returns. However, history has shown the S&P 500 has grown an average of 13% annually when inflation was between 2-4%.3

We also reiterate our opinion on inflation from our previous communications. We believe inflation to be transitory and actually see deflationary forces at work. Commodity prices are already coming down in areas such as lumber and copper and most commodities with the exception of oil.5 Longer-term, innovation should cause productivity to increase and temper any inflation tendencies. Some cyclical companies whose products will become obsolete and have not invested in innovation, but have leveraged their balance sheets by borrowing money to pay dividends and buy back shares may experience cyclical deflation.

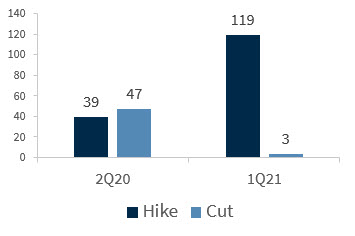

5. Strong Corporate Balance Sheets

Near record levels of cash on other growth company balance sheets should continue to drive positive shareholder-friendly activities.3 As a result, we expect both buybacks and dividends to increase from current levels. As you can see from the chart below, the number of dividend increases have already increased dramatically.

Dividend Hikes Increasing

Source: Raymond James Investment Strategy

For all these reasons, we believe this bull has much life left. We hope you and your family enjoy a nice summer vacation, as your investments are busy working for you. As always, we appreciate your friendship and trust.

1Louis Navellier, Weekly Update, July 2, 2021

2Louis Navellier, Weekly Update, July 9, 2021

3Larry Adam, Raymond James, July 12, 2021

4Larry Adam, Investment Strategy Quarterly, July 2021

5Cathie Wood, Ark Investments, July 13, 2021

6MarketSmith Charts, July 14, 2021

Any opinions are those of Malcolm Tarver and not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Dividends are not guaranteed and must be authorized by the company's board of directors.