As you know, a “black swan” is an unexpected negative event so called because black swans are characterized by their extreme rarity and unpredictability. Examples would be the financial crisis of 2008, the September 11th terrorist attacks, and the recent Covid-19 pandemic. While we hope this pandemic is “singing its swan song”, the market obviously recovered long before the economy or pandemic improved. That’s the thing about “black swans”…they create quite a commotion when they first land, but the market as a leading indicator often quickly recovers from the shock.

As an illustration of how far we have climbed from the lows of last March, we added the “Last 12 Months” (March 2020 – March 2021) to your Performance Monitor. This emphasizes the dramatic importance of “staying the course”…whether through rapid market recoveries like 2020 or longer term recoveries such as from the declines in 2007-2008 or 2000-2002. If one had gotten out of the market in March 2020, they would have given up most, if not all, the gains from the previous several years. Congratulations for staying the course through those months of declines in order to be rewarded later in the year.

While we certainly expect corrections and bumps along the way, here are some of the reasons we remain positive long-term…

We believe pent-up consumer spending, corporate revenues, earnings, capital expenditures, and investment in innovative technology could unleash the strongest period of American growth since the late 1980s, and possibly the post-World War II period.3

However, the observation is that very few investors believe it. Many are still scared to death believing a recession or even depression is just around the corner. Therefore, they are sitting on way too much cash as they watch the equity market move higher.4

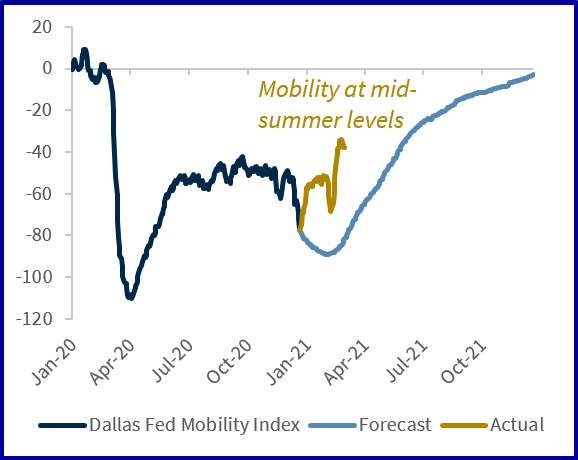

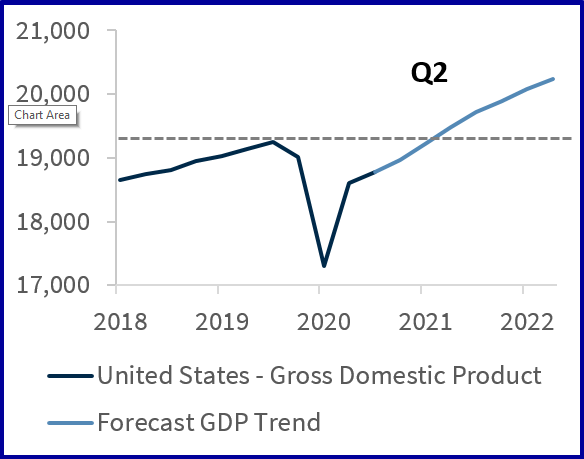

As a result of improving consumer activity, we expect U.S. GDP to be approximately 5.6% in 2021 with economic activity reaching pre-COVID levels in the second quarter of this year (see charts below).2

Mobility Far Exceeding Expectations

Source: Raymond James Investment Strategy

US Economy to Regain Lost Activity in 2Q

Source: Raymond James Investment Strategy

We anticipate the best year of earnings growth since 2010 estimated at approximately 38% for 2021.2 Multiple expansion due to optimism surrounding the economic recovery has led most major indices to record levels. Moving forward, we believe a substantially better earnings environment will lead the equity market higher over the next twelve months.

Fundamental analysis remains critical, and our favored sectors – Information Tech, Communication Services, Financials, Industrials, and Consumer Discretionary remain attractive due to visible earnings growth and attractive valuations.2 Beyond the short term recovery run, these sectors have long-term secular growth trends intact as well.

There are several fearful narratives we’d like to address that we believe are more myth than reality.

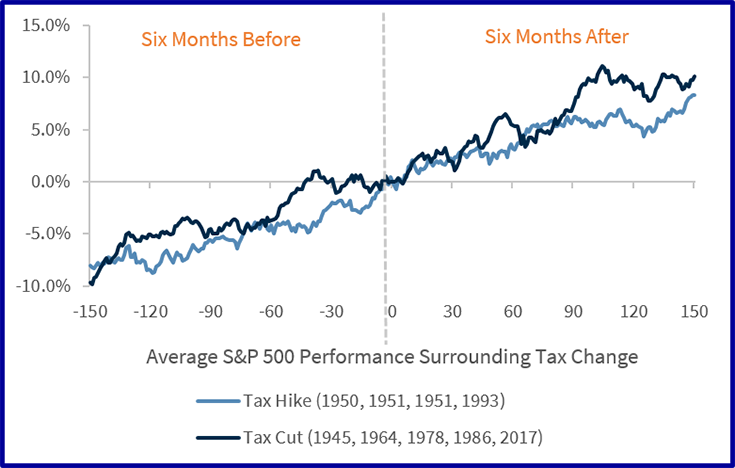

Myth #1: The Market Will Crash if Taxes are Raised: Many fear tax hikes and believe they could be the death knell to this bull market. While we don’t enjoy seeing corporate or individual taxes raised, the market has proven much less political than most of us. The chart below shows the market has historically risen in spite of corporate tax hikes. The axis is the date of the tax increase / decrease, the horizontal scale is the number of days prior to and after the tax cut / increase, and the vertical scale is the percent increase in the S&P 500. The key is the strength of the economy to absorb those higher tax rates.2

Equities Rally Amidst Rising Corporate Tax Hikes

Source: Raymond James Investment Strategy

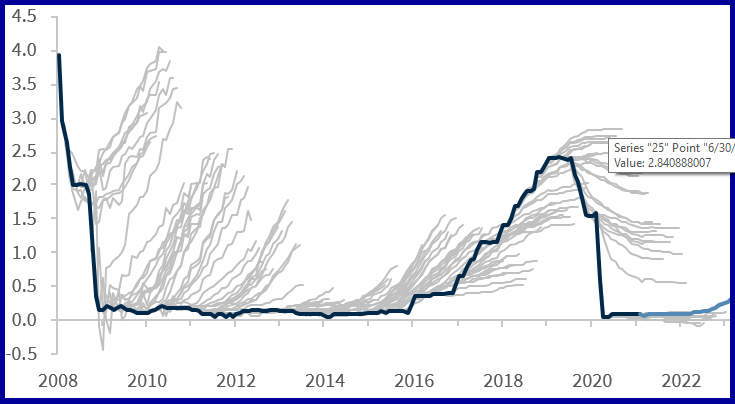

Myth #2: The Fed Will Dramatically Raise Interest Rates: We think the Fed will remain on hold keeping interest rates low. Following the last three recessions, they waited approximately four years on average to raise rates for the first time.2 While the market seems to be pricing in 2-3 Fed rate hikes through 2023, as the chart below shows, it is not unusual for the market to overestimate rate hikes.2 The dark line represents actual interest rates vs. the grey lines, expectations.2

Market Historically Overestimates Fed Rate Hikes

Source: Raymond James Investment Strategy

Myth #3 Value will Outperform Growth: Although value stocks have recently rallied and outperformed growth for several months, in my experience, shifts to value are typically short-lived. I do not believe the economy has shifted away from growth long-term and expect to see that reflected as 1st quarter earnings are reported.

While value (reopening) stocks may be perceived as a good “value” because they underperformed for a long period of time, they actually are “expensive”…even at depressed levels. While Technology has outperformed the typical reopening areas (airlines, restaurants, hotels, resorts and cruises) since the start of 2020, this is not without fundamental basis. In fact, Technology’s 2022 earnings / share have been revised approximately 20% higher over that time period, whereas the reopening areas’ 2022 earnings / share have been revised approximately 40% lower and have not improved in recent months.2

Companies that have leveraged their balance sheets due to pressure from shareholders to buy back shares and pay dividends rather than invest in innovative research may suffer in coming years. However, those companies that have invested in innovative technology opportunities such as electronic vehicles, robotics, artificial intelligence, next generation internet, genomic revolution, DNA sequencing, cyber security, space exploration, and remote home offices, should benefit.

We appreciate your friendship and trust through “black swans” and “the best of times.” It’s a privilege to serve you and your family.

1Raymond James Performance Analysis, March 31, 2021

2Larry Adam, Raymond James, April 12, 2021

3Louis Navellier, April 2021

4Jeff Saut, Saut Strategy, April 12, 2021

Any opinions are those of Malcolm Tarver and not necessarily those of Raymond James. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is not indicative of future results. There is no assurance these trends will continue or that forecasts mentioned will occur. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Dividends are not guaranteed and must be authorized by the company's board of directors. Sector investments are companies engaged in business related to a specific sector. There are additional risks associated with investing in an individual sector, including limited diversification. The companies engaged in the technology industry are subject to fierce competition and their products and services may be subject to rapid obsolescence.