2022 Summary

For most investors, 2022 will be a year to forget. Broad stock and bond market indexes declined sharply as the air finally started to leak from the “Superbubble,” a term Jeremy Grantham used to describe the capital markets craziness in his Let the Wild Rumpus Begin, published January 20th, 2022 [https://www.gmo.com/americas/research-library/let-the-wild-rumpus-begin/]. In that report and others, Grantham described the madness of growth stocks, crypto currencies, SPACs and NFTs but also highlighted the highly elevated overall valuations of stocks, bonds and real estate. He compared then current market conditions to the roaring 20’s, to Japan in the late 80s and the US tech bubble of the late 90s. He reminded investors that historically all bubbles eventually burst, ultimately returning back to trend and that current prices were unhinged.

In my opinion, the bubble was a result of a number of compounding factors. Interest rates were kept incredibly low for the past decade-plus, following the 2008 financial crisis, and punctuated by a new record low in real rates, or interest rates after inflation during Covid. Massive covid related stimulus on the order of $2 to $3 trillion annually and deficits not seen since World War II further distorted the capital markets.

The bizarrely low interest rates and rampant investor speculation pushed asset prices higher and higher while the economy sputtered. High asset prices accompanied by low borrowing costs ultimately created a giant disconnect between purchasing power and the real goods and services that the economy could produce. Said another way, valuations, asset prices or claims on future cash flows, became deeply disconnected from the goods and services the real economy could produce, GDP. Higher and higher inflation ensued to balance or ration the buying power vs. economic production imbalance.

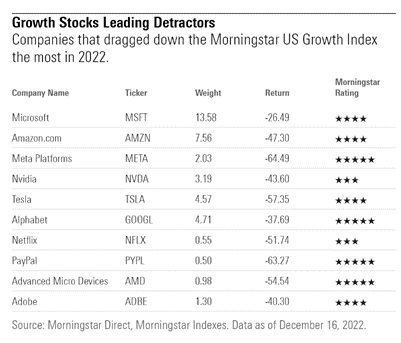

A Morningstar article, What investors can learn from a Terrible Year highlighted that valuations ultimately always matter. [https://www.morningstar.com/articles/1130318/what-investors-can-learn-from-a-terrible-year] Per the article, a virtual yacht in an online game sold for $650,000, virtual real estate transactions totaled more than $500 million and a digital Gucci handbag sold for $4,000, all in the metaverse. Elevated asset prices were then hit with additional challenges, including a war and supply shortages. The 40 year high in inflation was followed by rising interest rates at an unprecedented size and speed. Higher rates led to lower asset values as the discount rate rose and investor sentiment swiftly shifted. The damage was widespread, but concentrated on the most speculative assets, see below:

- S&P 500 - 19%

- Nasdaq -33%

- Cryptocurrency failures, FTX, Celsius, Terra-Luna, bitcoin -65%, Coinbase -86%

- Bonds -11%

“Valuation was key for 2022,” says David Sekera, chief U.S. market strategist at Morningstar, investors needed to know what they were paying. Indeed, value stocks delivered returns in 2022 that far outpaced their growth counterparts. The Morningstar US Market Broad Value Index was off approximately 8% for the year compared with the Morningstar US Market Broad Growth Index, which fell more than 30%.

While stocks and bonds declined sharply some investments held up well in 2022. Perceived inflation hedges including gold and natural resource stocks were mostly unchanged. Widely owned funds GMO-Allspring global absolute return and the BlackRock event credit were down slightly.

Looking Ahead

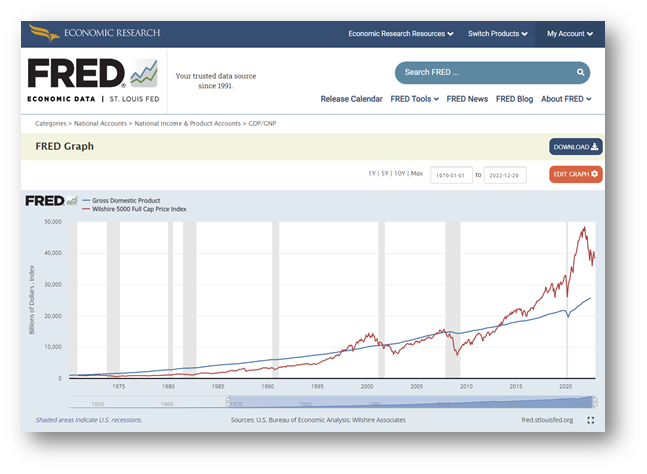

As to where we go from here, Grantham pointed out that all previous historical bubbles eventually came back to trend, that valuations ultimately fully mean revert. The chart below would appear to suggest that US markets may have a bit more to go in this reset; US equities (red line) still appear to trade at a meaningful premium to US GDP (blue line). Warren Buffett has highlighted this ratio, market cap to GDP, as one of the best, simplest ways to assess broad stock market valuation.

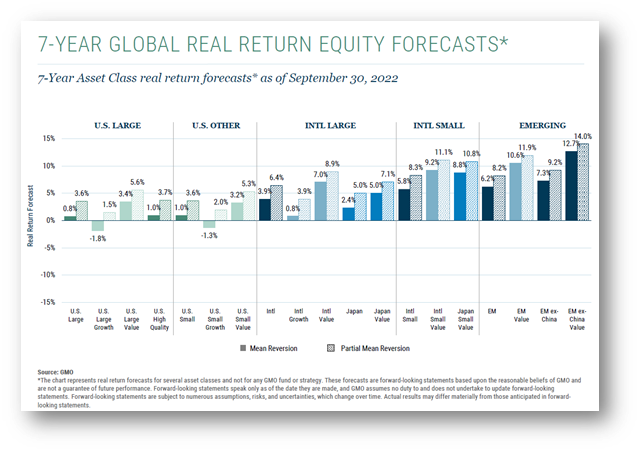

Timing the markets, outmaneuvering the day-to-day wiggles, gyrations and inflection points is nearly impossible. That said, starting valuations have been pretty reliably correlated to ending returns over longer periods …5, 7, 10 years. GMO makes an estimate, a 7 year return forecast for broad asset classes. According to GMO foreign, small and value offer the most attractive returns looking forward.

As the Danish physicist Neils Bohr once remarked, “Prediction is very difficult, especially about the future.” Admittedly, that sounds like a Yogi Berra quote, but think aptly describes the challenges of forecasting the economy and capital markets. Acknowledging those difficulties, there are some signs that 2023 may be economically challenging.

The yield curve is deeply inverted, meaning short interest rates are above long rates. That suggests the bond market believes interest rates will go down, as the Fed will be forced to cut rates, likely due to economic weakness or a recession. There is an old joke but one that holds some truth: the yield curve has forecasted 9 of the last 7 recessions. So while the yield curve is not perfect, an inverted yield curve has tended to precede economic weakness.

In my opinion, the capital markets do not appear to be pricing in a recession, a modest slow down or a soft landing perhaps. Earnings estimates have come down some but do not reflect the likely steep drop one would expect to see in a recession. Profit margins are still quite high vs. historical averages. Stock prices are a function of earnings and the multiples applied to those earnings. I believe this current stock market decline is mostly a function of higher interest rates reducing equity valuations via a higher discount rate.

In my opinion, corporate profit margins are likely to drift lower over time as most key components of the profit & loss statement come under pressure, including higher interest expense, higher cost of goods, labor force inflation and higher corporate taxes. This is not the end of the world, but a significant tailwind is likely to be a headwind over the next 5 to 10 years.

A review of the current capital markets would not be complete without some discussion of inflation. There are lots of theories on inflation and I will offer no special new deep insights on that front. As I alluded to earlier, I think inflation’s resurgence was in large part a function of recent extreme monetary and fiscal policies. This resulted in a massive disconnect between purchasing power (low rates & inflated asset prices) and real economic production, GDP etc.

Looking out, it appears there are a number of headwinds on the inflation front, namely demographics, geopolitics and deglobalization. The labor force in the developed world appears to be in decline as total fertility rates drop well below the 2.1 replacement rate, e.g. France 1.9, US 1.7, China 1.7, Germany 1.6, Japan 1.4, South Korea 0.9, Singapore 1.1. As the ratio of dependents to workers increases, it tends to be inflationary.

On top of that, the long trend of globalization looks set to reverse on the margin. There seems to be a marginal preference for safety and security in supply chains vs. price. There seems to be less of an emphasis on outsourcing to lower cost labor regions, like Asia, Mexico etc., and more towards reshoring in perceived economically critical sectors, i.e. semi conductors.

Summary

I believe the current backdrop may have more risk than usual given still elevated US valuations and a likely slowing economy. The Fed in the past has tended to raise rates until something breaks…Long term capital management, tech media telecom bubble, housing bubble & mortgage backed securities, Bear Stearns, Lehman…and now crypto, UK pension funds etc. We shall likely find out the next weak link(s) as the Fed’s rate hikes trickle thru the economy.

It seems particularly prudent now to be well diversified, to invest for resilience vs. highest return, to be prepared for high inflation, or deflation, a strong economy, a recession or depression, for a strong or weak dollar, for geopolitical risks, climate change, etc. As always, control what you can control: risk, taxes, fees and, importantly, the valuations of the investments you own.

I would like to leave on an optimistic note. Eventually the war in Europe will end, commodity and geopolitical challenges tend to be cyclical. Prices or valuations tend to be the lowest at peak fear and one would think current events in Europe - war, acute energy shortage, looming recession - might suggest we are close to peak fear. GMO, Research Affiliates and others have highlighted the opportunities in foreign value stocks. Europe, Japan, Emerging markets may offer …10-12% + real returns. Add inflation and likely some currency appreciation as the US Dollar declines from 35 year highs and it is not hard to envision very attractive returns from here.

References

- https://acquirersmultiple.com/category/jeremy-grantham/

- https://www.gmo.com/americas/research-library/

- https://acquirersmultiple.com/blog/

- https://podcasts.apple.com/us/podcast/rwh014-the-resilient-investor-w-matthew-mclennan/id928933489?i=1000581264062

- https://podcasts.apple.com/us/podcast/jeremy-grantham-a-historic-market-bubble/id1154105909?i=1000510301236

- https://mebfaber.com/2022/09/19/biwv6-ben-inker/

- https://www.grantspub.com/podcasts.cfm

- https://mebfaber.com/2022/12/07/bob-elliott/

- https://podcasts.apple.com/us/podcast/252-ian-bremmer-pandemics-climate-change-and/id1474687988?i=1000565484201

- https://www.researchaffiliates.com/home

- https://mebfaber.com/2022/10/12/e449-jim-rogers/

- https://podcasts.apple.com/gb/podcast/tim-steffen-tax-saving-strategies-for-a-falling-market/id1462214964?i=1000580092247

- https://mebfaber.com/2022/09/21/e444-steve-romick/

- https://www.youtube.com/watch?v=EI_M4o2mrs8

- https://mebfaber.com/2022/12/14/e459-louis-vincent-gave/

- https://podcasts.apple.com/gb/podcast/67-diego-parrilla-anti-bubbles-golds-perfect-storm/id1504694129?i=1000524920539

- https://www.bloomberg.com/news/audio/2022-10-11/investing-in-the-era-of-climate-change-podcast

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Ben Clauss and not necessarily those of Raymond James.