BENEFITING YOUR FUTURE and your benefits plan

Employers have a renewed focus on benefits as they seek to attract and retain talent in a competitive labor market. Removing the heavy burden of retirement plan management ensures quality and service – and prioritizes your employees. You have many responsibilities. Let us take care of this one for you.

Our mission is to help your employees make progress toward their financial goals while improving your fiduciary protection* and helping you reclaim your time. You can feel confident in the sound advice and quality service from a partner that puts your business and its employees first. Explore your options with SHRM401(k) Solutions by Raymond James.

Our Team

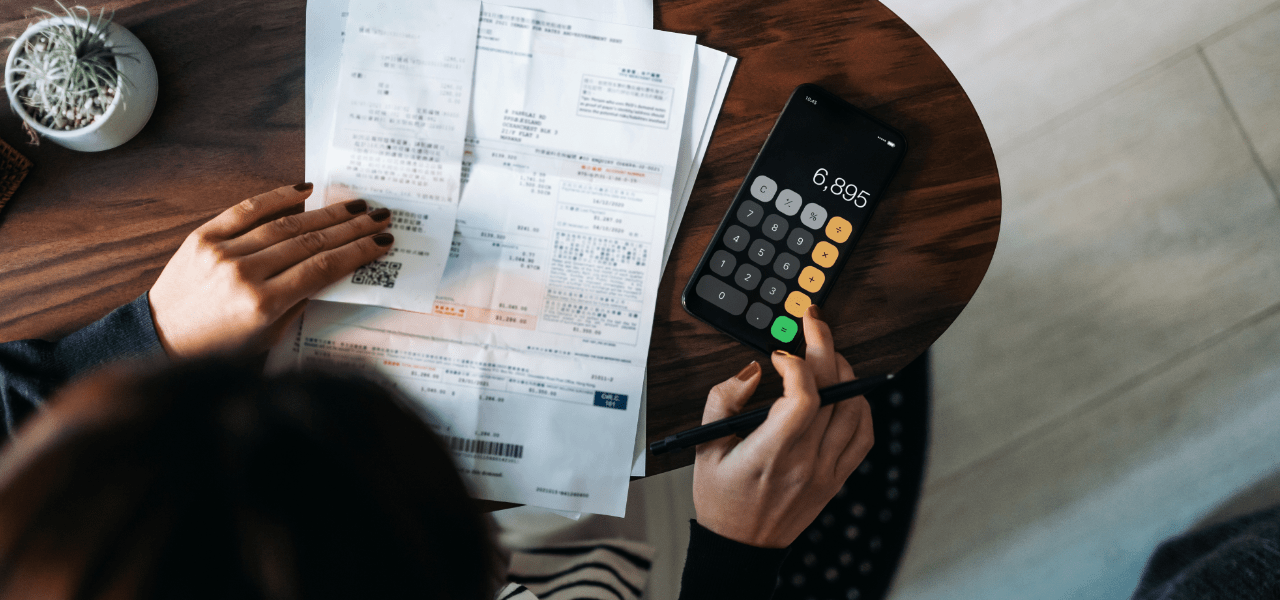

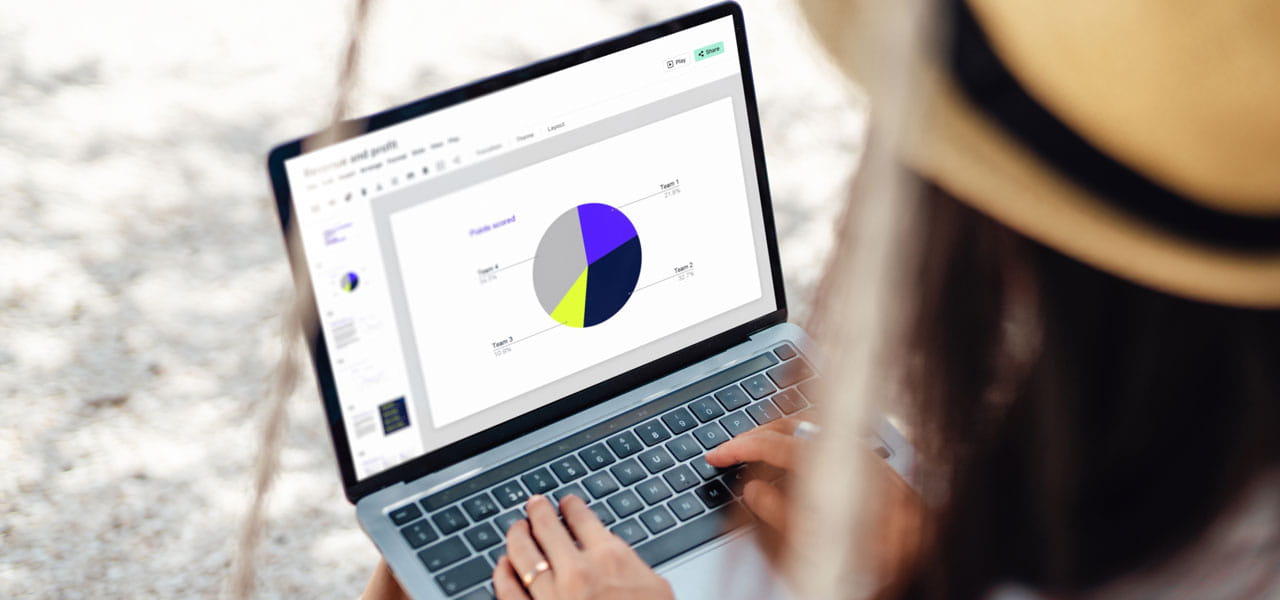

Investment selection and management

Through this partnership, Raymond James will work as your investment manager to manage, select and monitor investment offerings for your employees.* This reduces your responsibility and risks related to menu selection, enabling you to focus on the higher-level strategy for your retirement benefit plan.

*As set forth in, and subject to, applicable agreements

Fiduciary responsibility

While employers always hold a fiduciary/stewardship role as the 401(k) plan sponsor, through this partnership you can outsource the investment management and plan administration roles, relieving you of these time-consuming, complicated and day-to-day duties.

Employee Financial Progress

Empower your employees to make financial progress through your 401(k) plan. Our approach to employee education aims to boost financial wellness through customized tools that meet employees where they are today. Your employees will benefit from programs and guidance informed by 60 years of wealth management experience from a firm that puts people first.

4 OF THE BEST PRACTICES FOR STARTING A 401(K)

The ins and outs of nonqualified deferred compensation

SECURE Act 2.0: Changes to employer-sponsored retirement plans

A winning benefits package can set your business apart

Understanding New Retirement Plan Tax Credits

Five Reasons To Start A 401(K) Plan

Five habits of 401(k) Millionaires

Raising Smart Spenders And Savers

Not All Stable Funds Are Created Equally

Help Improve Employees Retirement Outcomes

Good Plan Design Can Help Lead To Financial Wellness

Buzzing about employee wellness

![Who can I turn to for help? [VIDEO]](/-/media/rj/advisor-sites/sites/c/o/corporateadvisorsgroup/images/blog/blog-4-group-of-business-persons-1365436734.jpg)