Remain Calm, All is Well

‘Living in the moment’ is not a great approach to investing

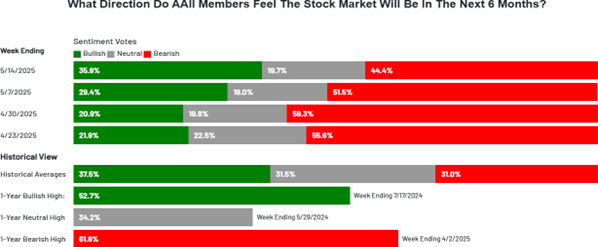

In several prior letters, I have shared data from the American Association for Individual Investors (AAII) weekly sentiment survey. Each week members of AAII can answer whether they hold a bearish, bullish or neutral view on the U.S. stock market over the next 6 months. It’s clear that many survey respondents become increasing bullish when the S&P 500 is performing well and bearish when recent moves and news stories are concerning. Below is a recent summary of the AAII sentiment survey. The chart below it shows the S&P 500 for the same period.

Source AAII.com

Source: finance.yahoo.com

Driving using only the rearview mirror can be fraught with risk

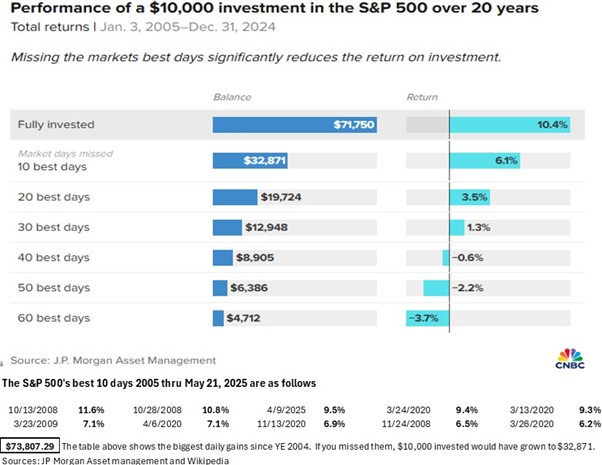

We all would like to get ahead of the market. We like the idea of reducing our equity exposure before significant declines and then adding back into stocks before advances. However, research shows that investors who have poor timing (e.g. they are out of the market on what prove to be the best days) can miss out on a substantial amount of the upside compared to if they just remain invested through thick and thin environments. This is before consideration of tax impacts which can constitute a huge cost in taxable portfolios, especially for investors in the highest marginal tax brackets. In an endnote, you will see an analysis by JP Morgan Asset Management that shows the impact of missing out on the best days.i Sobering stuff.

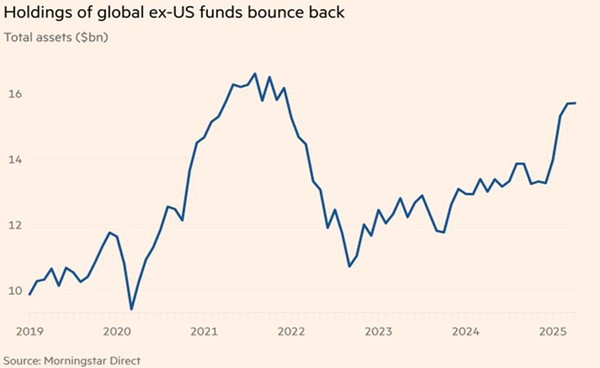

It’s not just U.S. individual investors who tend to reduce or add exposure to non-U.S. markets at inopportune times. Non-U.S. investors also tend to add when markets rise significantly and to sell on weakness. This too can mean they have little ownership of segments that perform surprisingly well. Of course, their buying and selling activity also tends to affect prices. As the chart below shows, investors including European and Asian have recently added to global funds that exclude U.S. companies.ii If these flows continue, it could translate into higher security prices in these markets.

Source: Financial Times 5/21/2025

Because it is inherently difficult to allocate into and out of equity markets in favor of holding things like cash, we prefer to adhere to strategic allocations that we believe make sense for each of you. Furthermore, it is nearly impossible to know which segments will perform particularly well or poorly along the way. Therefore, we prefer to allocate capital broadly. Doing so helps ensure we are not out of segments that perform relatively well or highly concentrated in segments that perform particularly poorly. This also means that we can avoid incurring capital gain taxes along the way. Once you send money to Uncle Sam, it never comes back. We intentionally try to invest in a tax-efficient manner.

As you will see in the endnote, some individual days yield price gains that rival the annual long-term average for the S&P 500. Missing a few of these days can adversely impact long-term portfolio performance. Indeed, these sharp increases often account for a disproportionate share of gains in many years. Of course, diversified, buy and hold investors experience the best and worst days. However, over long periods, gains tend to overwhelm losses.

Patient investors tend to fare well as generally speaking major stock indexes rise over time. That said, periods of declines or sideways movements of 10 or more years do occur. The good news is bear markets provide opportunity for investors who are net-savers to add to their portfolios during their ‘accumulation years.’ Indeed, dollar cost averaging is very helpful whenever possible because more shares are acquired at what prove to be good entry points. Conversely, for investors who are not adding new contributions because they are taking distributions, holding rainy day reserves is important. That’s because investors can draw down on reserves instead of selling securities that have lost significant value in a market downturn. Investors need to survive the lean times while remaining constructively invested in equities throughout time.

Lastly, we want to share some observations about emerging markets. First and foremost, they have trailed the returns for U.S. stock indexes like the S&P 500 by a wide margin since the GFC.

U.S. stocks have fared very well due to the powerful combination of healthy earnings growth and a significant increase in valuation. This favorable performance has enticed large investment flows from U.S. and foreign based investors alike. However, the tide may be changing. If investment flows into emerging market and developed ex U.S. international continue, these segments could lead returns over U.S. markets

It has been a long time since EM equities have provided strong returns let alone led returns. That said, we believe things may be different in the years ahead. First, EM valuations are deeply discounted relative to the U.S. stock market and their own valuation metrics. Investors have reduced allocations in EM and other international equity markets over many years. Therefore, investor positioning is low but could increase as better returns would likely attract attention and investment flows which could lead to a sustained increase in prices. In summary, the timing of sustained reversals is unknown. Nevertheless, we believe changes in leadership across equity market segments are just a question of time. We will continue to be patient.

As always, we welcome any comments and questions you may have about these and other topics.

W. Richard Jones, CFA

Partner, Harmony Wealth Partners

i

ii

Any opinions are those of the author, are subject to change without notice and are not necessarily those of Raymond James. This material is being provided for information purposes only and does not purport to be a complete description of the securities, markets, or developments referred to in this material and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected, including asset allocation and diversification. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign market. Raymond James is not affiliated with nor endorses the opinions or services of any of the above-named organization.